2024 Public Chain RWA Annual Research Report: Market Deconstruction and Paradigm Change

Reprinted from panewslab

03/13/2025·1MIn 2024, public chain RWA ushered in explosive growth, indicating the rise of a new financial paradigm. Driven by the triple engine with institutions rushing to enter the market, continuous breakthroughs in technology, and gradually clear supervision, RWA is accelerating its move from proof of concept to large-scale applications. Innovation models such as asset tokenization, cross-chain interoperability, and smart contract automation are constantly emerging, reshaping the financial ecosystem. However, structural issues such as liquidity stratification, income risk mismatch, and legal challenges in asset control cannot be ignored. Looking ahead to 2025, the innovation of asset classes, the evolution of technical paradigms, and the reconstruction of regulatory frameworks will become the three main themes of RWA market development, injecting new impetus into the healthy development of RWA.

This article was contributed by Sanqing, a contributor to RealtyX DAO community.

Ⅰ Data Panorama: From scale explosion to structural transformation

1.1 Total breakout and growth rate differentiation

(From [rwa.xyz](https://www.rwa.xyz/) )

-

Total on-chain RWA size: approximately US$15.4 billion at the end of 2024 (excluding stablecoins), an increase of approximately 80% year-on-year (2023 data: approximately 8.6 billion)

-

Characteristics of growth rate differentiation:

-

* US Treasury bonds: year-on-year growth of about 415% (769 million → 3.96 billion)-

Private credit: year-on-year growth of about 48% (6.656 billion → 9.828 billion)

-

Commodity and other assets: year-on-year growth of about 32.6% (1.16 billion → 1.537 billion)

-

Real estate tokenization:

-

mechanism

|

Base year market value

|

Target year market value

|

CAGR

---|---|---|---

|

USD 2.81 billion (2023)

|

$11.8 billion (2031)

|

19.9%

|

USD 2.78 billion (2023)

|

$16.51 billion (2033)

|

19.5%

|

USD 3.8 billion (2024)

|

$26 billion (2034)

|

21.2%

While the overall market has expanded significantly, different asset classes have shown obvious growth rates and different growth rates: US Treasury bonds have achieved ultra-high growth rates due to their safe-haven attributes and institutional adoption, and private credit and commodities reflect the differentiated attention of market participants in risk, returns and liquidity. Institutions are optimistic about the long-term prospects of real estate tokenization, and expect their compound annual growth rate to be close to 20%, which implies that digital transformation and the improvement of asset circulation efficiency will promote the large-scale implementation of this field.

1.2 Market structure evolution

In 2024, the RWA market will present a "dual-core drive, diversified expansion" pattern

-

Dual-core drivers: US Treasury bonds (annual growth of 415%) and private credit (annual growth of 48%) account for more than 85% of the market. The former benefits from macro-help demand and institutional entry, while the latter relies on high-yield characteristics to attract allocations.

-

Diversified expansion: Traditional categories such as real estate and commodities are growing steadily, and emerging fields such as ESG assets, artworks, and supply chain finance are accelerating their penetration to jointly support market diversification.

Behind this stratified expansion is the synergy between the triple driving force of technology, capital and regulation. The three major trends -liquidity reconstruction, large-scale implementation, and asset innovation -constitute the core context of market evolution.

Three major trends: from liquidity reconstruction to ecological prosperity

-

Liquidity premium release: Blockchain reshapes pricing logic

-

Technology empowerment: All-weather trading and smart contracts reduce transaction costs by 30–90%, compress liquidity premium, and increase RWA assets valuation.

-

Positive cycle: Improve liquidity → Attract more issuers and investors → Further reduce premiums to form a market expansion flywheel.

-

-

Large-scale application: a double breakthrough between institutions and infrastructure

-

Traditional finance entry: BlackRock (BUIDL Fund), Franklin and others launch compliant tokenized products to verify the RWA business model.

-

The rise of dedicated public chains: Layer1 such as Plume and Mantra provide compliant and efficient tokenized infrastructure.

-

Pricing infrastructure: Chainlink oracle covers over 70% of on-chain RWA assets, solving the problem of real price anchoring.

-

-

Asset Diversification: “Core-Border” Stratified Evolution

-

* Core dominance: Treasury bonds and credit remain dominant, but the growth rate differentiation (415% vs 48%) reflects the difference in risk preferences.-

Boundary expansion:

-

Digitalization of traditional assets: real estate (19–21% CAGR), commodities improve liquidity through tokenization.

-

Emerging categories emerge: long-tail assets such as ESG, luxury goods, and IP are accelerating their launch, and supply chain finance (such as accounts receivable tokenization) releases the financing potential of SMEs.

-

-

-

The above three major trends - liquidity reconstruction reduces trading friction, institutional-level infrastructure improves credibility, and asset expansion releases long-tail value - jointly promotes RWA to penetrate deeper. Among them, real estate tokenization has become the most representative paradigm breakthrough due to its comprehensive integration of three types of trends.

Focus Area: Paradigm Breakthrough in Real Estate Tokenization

At the same time, although other sub-sectors are relatively small in size, they still show continuous rising market vitality, providing support for the diversified development of the RWA ecosystem.

-

Growth Trajectory: According to the optimistic forecast of ScienceSoft research team, by 2030, the global tokenized real estate market will even reach a huge US$3 trillion, accounting for 15% of real estate management assets. They said that although the market is still in its early stages in 2024, the rationality of issuing real estate tokens has been further verified with the increasing adoption of tokenization technology by property holders and the growing demand for investors.

-

Strategic Value: Through the integration of liquidity improvement, institutional compliance and multi-scenario applications, real estate tokenization has become a typical representative of RWA's transformation potential, consolidating its core position in the broader RWA ecosystem.

The main application scenarios of real estate tokenization include

Scene

|

model

|

Representative cases

---|---|---

Residential Real Estate Division Tokenization

|

Split residential real estate into affordable shares and lower the threshold for retail investors' investment

|

RealT, Estate Protocol

DeFi liquidity integration

|

Combined with lending and pledge agreements to release liquidity of mortgaged assets

|

Residential Mortgage Innovation

|

Tokenized mortgage certificates to enhance financing flexibility

|

PropCap

Value logic: Break physical restrictions through blockchain, achieve 7×24-hour global liquidity, and release the value of existing assets.

Ⅱ Industry driving factors: Analysis of triple power engine

2.1 Institutional admission

Institutions not only regard RWA as a new investment track, but are also trying to use public chains as the underlying technology to optimize capital operations and improve operational efficiency. The entry of institutions will accelerate the maturity of the market, promote the improvement of industry infrastructure, and further expand the digital boundaries of real-world assets.

The strategic layout of traditional financial giants

-

BlackRock launched the tokenized fund BUIDL based on the Ethereum network in March 2024, mainly investing in cash, U.S. Treasury and repurchase agreements, providing qualified investors with opportunities to earn US dollar returns. As of July 2024, BUIDL has managed assets of more than US$500 million, becoming one of the largest tokenized Treasury bond funds.

-

In addition, Fidelity, JPMorgan Chase, Citigroup and other institutions have also made strategic layouts in the RWA field.

Institutional entry promotes the process of standardization and infrastructure improvement

-

Institutional entry not only brings funds and resources, but also promotes the standardization and infrastructure construction of the RWA market. Through collaboration with blockchain projects, traditional financial institutions are exploring best practices for tokenizing real-world assets, promoting market maturity.

-

BlackRock's BUIDL fund cooperates with blockchain projects such as Security and Maple Finance to ensure that tokenized products comply with regulatory standards, and provide an on-chain credit market, promote the creation and transaction of credit products, and cooperate with Circle to establish a USDC liquidity pool to achieve 1:1 real-time exchange between BUIDL and USDC, enhancing the liquidity of tokenized products.

-

JPMorgan Chase’s Onyx digital asset platform uses blockchain to realize tokenized ownership transfer of money market fund shares through a tokenized collateral network, allowing asset management companies and institutional investors to pledge or transfer fund shares as collateral, improving capital efficiency.

2.2 Technical breakthroughs

Compliance breakthrough

To ensure that blockchain applications comply with regulatory requirements such as Anti-money laundering (AML) and Knowledge Customer (KYC), many projects are exploring the embedding of compliance mechanisms directly inside blockchain systems. For example:

- Tokeny Solutions has developed the ERC-3643 token standard, which integrates identity management and transfer restrictions directly into token smart contracts, enabling issuers to perform investor qualification reviews, KYC/AML inspections and compliance rules on the chain. For example, BlocHome uses the ERC-3643 standard to issue tokenized real estate, through which project parties can automatically verify the identity of investors and ensure that they meet regulatory requirements. According to BlocHome, after using the ERC-3643 standard, compliance costs have been reduced by 90%.

-

Tether launched the asset tokenization platform Hadron, which provides risk control, asset issuance and destruction, KYC and AML compliance guidance, and also supports blockchain reporting and capital market management.

-

Circle’s Verite framework is an open source authentication solution designed to provide interoperable identity standards for the decentralized finance (DeFi) ecosystem. The framework allows users to prove their identity on the chain while maintaining control over personal data. It is expected to achieve dynamic binding between on-chain identity and real-world asset (RWA) holding quota.

Cross-chain interoperability

Blockchain interoperability refers to the ability to exchange information and value between different blockchain networks. Achieve cross-chain interoperability is crucial to promoting the coordinated development of the blockchain ecosystem. Currently, cross-chain communication protocols are emerging, aiming to securely connect different blockchain networks and alleviate the challenges existing in the decentralized blockchain landscape. For example:

-

Wormhole has launched the NTT framework, providing an open and flexible cross-chain solution that allows native assets to be seamlessly transferred between different blockchains without the need for a traditional packaging token model. This innovation eliminates the intermediary risk of packaging tokens and enhances the integration efficiency of multi-chain liquidity.

-

Chainlink has released the Cross-chain Interoperability Protocol (CCIP), a new open source standard designed to establish common connections between hundreds of public and private chain networks to enable cross-chain applications. CCIP solves the fragmentation problem in the blockchain field by ensuring that data and assets can be transferred safely between different blockchain networks, and promotes seamless interaction between various tokenized assets.

Public chain infrastructure

Through smart contracts, RWA public chains can automatically perform compliance inspections, transaction settlements and profit distribution, thereby reducing intermediary costs, improving operational efficiency, and providing global investors with a borderless platform to promote cross-border flow of capital. The following is a brief description of two highly-watched RWA exclusive public chains.

Plume Network

Plume is the first full-stack Layer 1 public chain built specifically for Real-World Asset Finance (RWAfi), aiming to achieve rapid tokenization and global distribution of real-world assets. Its composable EVM-compatible environment supports access and management of various real-world assets.

-

End-to-end tokenization engine: simplifies asset-on-chaining process through automated compliance inspections, KYC/AML integration and scale boards.

-

Interoperability Hub: Its SkyLink cross-chain interoperability solution connects 16+ public chains (such as Solana, Movement). This will enable users to enjoy institutional-level RWA benefits on multiple chains without permission, promoting the development of the cross-chain RWA ecosystem.

-

Ecosystem expansion: Plume has launched 180+ agreements, covering real estate tokenization, private credit, commodities and other fields. In addition, the strategic cooperation with rwa.xyz ensures the comprehensive data analysis capabilities of on-chain RWA and provides users with industry-leading tokenized asset data.

Mantra

Mantra aims to provide a licenseless, high-performance and scalable Web3 development environment, tailored for compliant RWA applications:

-

Compliance Docking: Mantra is the first platform to obtain a DeFi VASP license issued by VARA, allowing it to legally operate virtual asset exchanges, brokerage business, asset management and investment services in Dubai, further consolidating the legitimacy of DeFi under the compliance framework.

-

Real-world impact: Working with DAMAC Group to tokenize $1 billion in Dubai real estate to improve liquidity of high-value properties.

-

Developer-friendly: Provides SDK and API to achieve seamless integration of identity authentication, asset custody and cross-chain settlement.

2024 RWA Technology Stack Review

In short, RWA's tokenization technology stack in 2024 has achieved "three-layer decoupling", namely the separation and coordinated development of the asset layer, protocol layer and application layer.

- Asset layer

ERC-3643 Standard: Widely used to achieve compliant equity tokenization. The standard integrates identity management and transfer restrictions directly into token smart contracts, enabling issuers to perform investor qualification reviews on-chain, as well as KYC/AML inspections to ensure compliance with token transactions.

- Protocol layer

Chainlink's oracle network has made significant progress in coverage of RWA price data sources.

Cross-chain interoperability protocol (CCIP) supports seamless RWA cross-chain management, solving inter-chain fragmentation problems and improving liquidity.

- Application layer

Lending: Maple Finance was the first to launch unsecured institutional loans, which were subsequently opened to retail users through Syrup.fi (launched in June 2024). Defactor has also become a key player, providing on-chain lending solutions for RWA and retail users.

Small and medium-sized enterprise financing: Centrifuge to tokenize real-world accounts receivable and invoices, release blockchain-based liquidity, and help small and medium-sized enterprise financing.

AMM liquidity provides: IX Swap improves automated market making (AMM) technology to promote the improvement of liquidity of tokenized assets.

Secondary market transactions: Polytrade promotes the development of RWA secondary market and realizes efficient trading of tokenized assets.

This decoupling architecture enables layers to evolve independently while maintaining seamless integration, thus driving RWA to accelerate from niche trials to scalable institutional-level solutions.

2.3 Regulatory Game

In 2024, RWA made significant progress globally, but the large-scale implementation of RWA cannot be separated from clear regulatory guidance and policy environment. Governments and international regulators are actively exploring how to promote the development of this emerging field while ensuring financial stability and protecting investor rights and interests.

Differentiation and coordination of global regulatory trends

-

US SEC: The SEC clarified the regulatory framework for securities tokens and tokenized assets in 2024, emphasizing that such assets must comply with existing securities regulations. This move provides clearer guidance for RWA's compliance operations. In the face of SEC's supervision of digital assets, some RWA project parties (such as RWA Inc.) will cooperate with compliance consulting companies to analyze the nature of their RWA tokens and take corresponding compliance measures based on the analysis results.

-

EU MiCA: The EU has further supplemented the regulatory provisions on RWA based on MiCA. MiCA divides stablecoins into asset reference tokens (ART) and electronic currency tokens (EMT), and sets clear requirements for their issuance and operation. Specifically, MiCA stipulates:

-

Asset Reference Token (ART): refers to a specific reference to crypto assets that aim to maintain stable value based on the value of one or more fiat currencies, one or more commodities, or one or more crypto assets as reference. MiCA puts higher capital requirements and stricter operational requirements for ART issuers to ensure that they have sufficient asset reserves to support the value of the token.

-

Electronic currency tokens (EMT): refers to a specific reference to crypto assets that use the value of a fiat currency as a reference and aims to maintain stable value. Issuers of EMT must obtain permission from electronic currency institutions and comply with relevant regulatory regulations.

-

-

Asian Regulatory Sandbox:

-

Japan: The revised Payment Services Act clarifies the regulatory positioning of stablecoins as “electronic payment tools”

-

Hong Kong and Singapore: By issuing regulatory guidelines and sandbox plans, a clear compliance path is provided for innovative products such as RWA.

-

The balance between regulation and innovation

-

Dynamic regulation and sandbox mechanism: Multiple countries adopt the "regulatory sandbox" model, allowing companies to experiment with new technologies and business models within a limited range, while collecting data to adjust policies. For example, the sandbox program launched by the Hong Kong Monetary Authority provides a testing platform for digital asset products such as stablecoins, which can ensure compliance without hindering innovation.

-

Cross-border regulatory coordination: With the globalization of RWA and other digital asset markets, national regulators are trying to promote unified regulatory standards under the framework of international organizations (such as FATF, G20), which will help alleviate cross-border regulatory conflicts and information asymmetry.

Ⅲ Market Paradox: Structural Contradictions under Prosperity

3.1 Liquidity stratification phenomenon

The original intention of RWA tokenization is to improve the liquidity of assets through blockchain technology, so that assets can be traded in the market more quickly and transparently. However, in practice, there is a significant stratification in liquidity between different types of assets:

-

Differences in the nature of assets and market size:

-

Differences in the intrinsic attributes of assets. For example, tokenized US Treasury bonds have national credit endorsement, mature trading markets and high-standard credit ratings. The transaction activity, trading volume and price discovery mechanisms are relatively complete, so they have high liquidity. Assets such as real estate and artworks often have high holding costs and long exit cycles due to their complex valuation, small investor demand, and limited trading methods, resulting in insufficient liquidity.

-

Market size and participant structure. High liquidity assets usually attract the participation of a large number of institutions and retail investors. In addition, the market depth is sufficient, and the buyer and seller can achieve rapid matching at any time. Low liquid assets may form information islands, with few investors and sparse trading orders, resulting in low trading volume, large price fluctuations, and difficulty in executing large-scale transactions without causing significant slippage.

-

-

Market participant behavior and expectations management:

-

Prefer high liquidity assets. Investors generally tend to choose assets that are easy to cash and have low transaction costs, which is particularly obvious during periods of high market popularity. The trading activity of high-liquidity assets will further attract more participants, while low-liquidity assets may be marginalized, forming a market structure of "survival of the fittest".

-

Liquidity premium and price fluctuations. Assets with better liquidity often enjoy a certain premium, while low-liquid assets may encounter significant discounts when they are urgently needed due to the lack of sufficient counterparties, thereby aggravating price volatility and market risks.

-

To solve this problem, many RWA project parties have taken the following measures:

-

Introducing market maker mechanism : Market makers are encouraged to provide liquidity for low-liquid assets, narrow the bid and offer price spreads and increase trading activity by providing buying and selling quotations.

-

Integrate DeFi protocol: **** Combining RWA with DeFi protocols, such as using RWA as collateral to participate in lending, or including RWA into DEX pairs. Through the DeFi protocol, RWA liquidity can be improved and investors can provide more profit opportunities.

-

Incentive users to participate in transactions : Incentive users to participate in transactions of low-liquid assets through airdrops, trading competitions, etc.

3.2 Income risk mismatch crisis

Although RWA brings diverse returns opportunities to investors, behind the appeal of returns, there are often problems of mismatch between returns and risks:

- Inadequate risk disclosure and transparency

Traditional financial markets require strict information disclosure and regular risk assessment reports, but in the process of RWA tokenization, some platforms have not yet established unified and transparent risk assessment and information disclosure standards. The lack of sufficient risk warnings makes it difficult for investors to timely understand the credit status of assets, collateral quality and market volatility.

- Disconnection between asset endorsement and actual risk taking

In many tokenization projects, in order to achieve digital management of assets, SPVs (special purpose carriers), trust funds or third-party custodians are usually set up to undertake the assets. However, if these structural designs are flawed, the tokens held by investors may not really correspond to actual assets in the event of bankruptcy or default, resulting in increased mismatch in earnings risk. High-yield products often come at the expense of higher default probability and credit risk. Some products in the RWA market may underestimate potential credit risks due to opaque publicity or ratings, and thus bear huge losses when the default event occurs.

- Market sentiment and risk premium fluctuations

Traditional financial markets usually have a variety of risk mitigation tools (such as credit default swaps, guarantee mechanisms, etc.) to balance risk and return, but in many RWA tokenized products, such tools have not been fully developed and applied, making the mismatch between returns and risks more obvious. In the decentralized trading environment, the price of tokens is more affected by short-term market sentiment and liquidity fluctuations. When the market sentiment is optimistic, high-yield assets may be overly sought after and prices are far higher than their fundamental support; and once the market turns cold or sudden risk events occur, prices will fall rapidly, causing investors to enter the peak period and exit the trough period, further increasing risk mismatch.

3.3 Legal Paradox of Asset Control

In the process of RWA tokenization, the control of assets forms an internal paradox between the legal system and the technical framework. This paradox is mainly reflected in the three levels of rights confirmation dilemma, bankruptcy and isolation failure and transnational judicial conflict, which makes token holders face the dilemma of "triple right suspension".

-

Rights confirmation dilemma: Blockchain technology provides a decentralized ledger that can ensure the uniqueness and transferability of tokens in the form of encryption technology. However, real-world asset ownership depends on traditional legal rights confirmation systems, such as real estate registration, company equity structure, custody agreements, etc. Therefore, there may be a separation between the on-chain registration and off-chain confirmation.

-

Smart Contract vs. Real Law: Although the holder of the token has certificates of ownership on the chain, this right may not be able to counter third-party claims without corresponding legal confirmation. For example, in real estate tokenization projects, even if tokens are held, the token holder may not be considered as the real asset owner in the current legally.

-

Automatic execution of smart contracts vs. Judicial intervention: In judicial litigation, the court may rule to freeze or redistribute assets, and the automated execution logic of smart contracts may not be able to effectively cooperate with legal orders, resulting in a conflict between the legal system and the technical framework. This means that even if the on-chain transaction has been completed, the court may still declare the transaction invalid or revoked.

-

-

Bankruptcy Quarantine Death: Tokenized assets usually need to be managed by an entity (such as a SPV company, trust fund or custodian), and once that entity goes bankrupt, token holders may face:

-

The ownership of assets is unclear: In the traditional financial system, securities, trust assets, etc. are usually protected by bankruptcy isolation mechanisms. Even if the manager goes bankrupt, the holder's assets will not be used to repay debts. However, in the practice of tokenized RWA, token holders may face the risk that assets are seized by courts or used to pay off debts if the legal structure of the asset custodian is unclear.

-

Token interests may be considered unsecured claims: if the regulator or court determines that the token is just a "map" of assets rather than a direct certificate of ownership, token holders may not enjoy the right of priority repayment during bankruptcy liquidation and can only queue up to repay as ordinary creditors. This will seriously undermine the credit basis of RWA assets as financial instruments.

-

-

Transnational judicial conflict: RWA tokenization usually involves multiple jurisdictions, such as the location of assets, token issuance, investor location, etc. The conflict between laws of various countries may cause the rights of token holders to be in uncertain states.

-

Differences in the identification of asset ownership by different judicial systems: The laws of some countries believe that digital assets can be regarded as legal property and are protected by property laws, while in others, it may be just contractual rights or bills rights, with different legal frameworks applied. Therefore, investors may face the lack of legal protection in these i countries due to different legal interpretations.

-

Cross-border law enforcement issues: Assuming an investor holds a tokenized gold issued on a blockchain, but because the gold is escrowed in another country's bank vault, investors may not be able to effectively enforce their ownership claims if the laws of the two countries have different interpretations of gold ownership. In addition, there are also technical obstacles to the execution of court freezing and seizure orders on the blockchain.

-

Ⅳ Future Deduction: Three Major Trends of RWA in 2025

4.1 Asset Class Revolution

- Non-standard assets are on the chain:

As the RWA market continues to expand, private credit and U.S. Treasury bonds are expected to continue to dominate due to their excellent liquidity and credit ratings. However, non-standardized assets, especially real estate in developed areas or areas with rapid economic growth, will usher in a significant chain-up process in 2025.

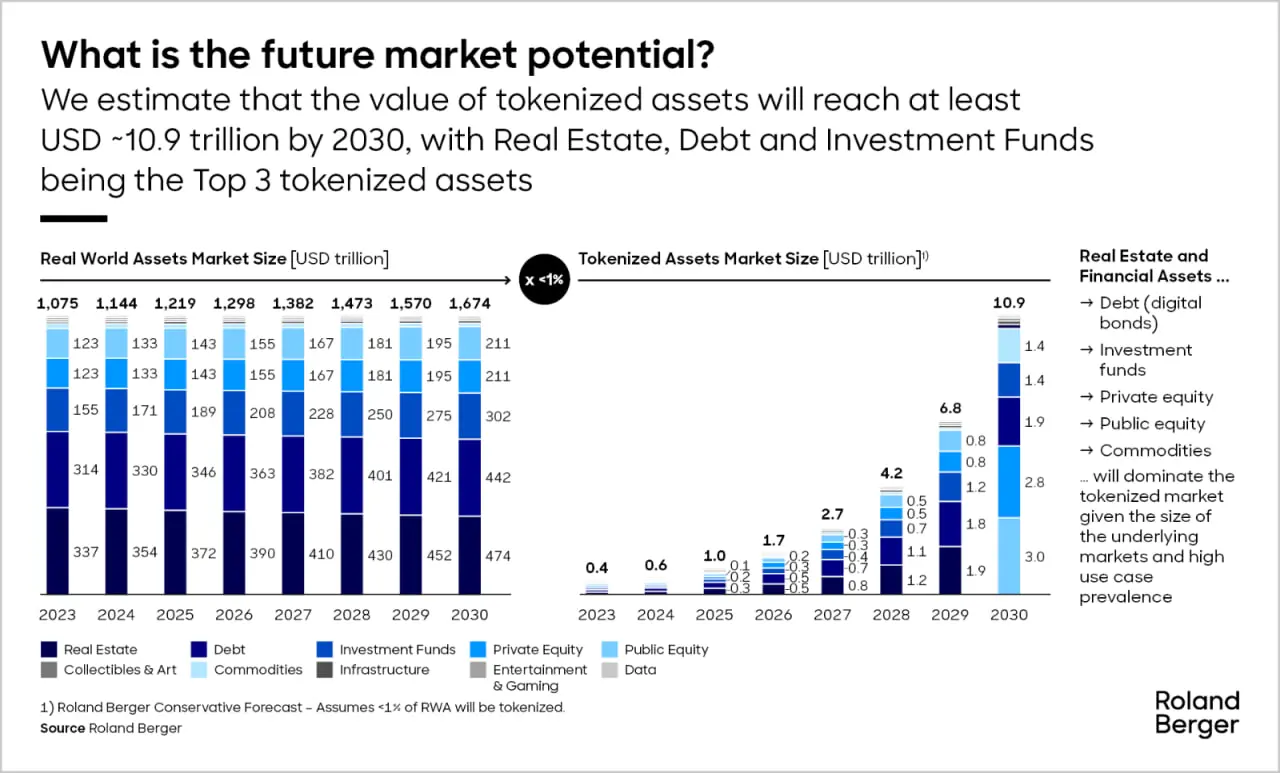

[According to Bitwise\'s forecast](https://bitwiseinvestments.com/crypto-market-insights/the-year-ahead-10-crypto-predictions-for-2025) , the RWA market size will reach US$50 billion by the end of 2025. Among them, Security Token Market predicts tokenized real estate to reach $1.4 trillion, and Roland Berger predicts that real estate will account for nearly one-third of the market share. Real estate is expected to be the largest tokenized asset type in 2030, accounting for nearly a third of the market, according to Roland Berger\'s forecast. This is mainly due to the maturity of blockchain technology and the increasing demand for RWA, which traditionally less liquid assets are expected to achieve more efficient transactions and management.  (From [Roland Berger](https://www.rolandberger.com/en/Insights/Publications/Tokenization-of-real-world-assets-unlocking-a-new-era-of-ownership-trading.html) )

2. RWAFi Massive Integration Innovation: Before the real world officially moved towards the Web3 era, RWA's development mainly stemmed from the desire for traditional financial liquidity. However, with the launch of RWA, this process is not only the digitalization of assets, but also the deep integration with blockchain finance such as DeFi. This convergence has spawned a powerful “RWA+any 'Fi'” model that drives the diversity and depth of financial innovation. The combination of real estate tokenization and DeFi is an important direction for RWAFi integration and innovation. By putting real estate assets on the chain and combining them with the DeFi protocol, the following innovative applications can be achieved:

-

Mortgage: Use tokenized real estate as collateral to obtain loans from DeFi lending platforms (for example, tokenized apartments as collateral in exchange for stablecoin loans).

-

Earning Farming: Token holders can deposit RWA tokens into the DeFi protocol to earn interest income (such as loan repayment income) or agreement rewards (such as governance tokens). Unlike passive holding, income farming can actively optimize asset returns.

-

Liquidity mining: Users can provide liquidity for RWA token trading pairs, earn transaction fees and liquidity incentives on decentralized exchanges (DEXs), and the returns are proportional to the liquidity of investment.

Case: RealtyX, Plume Network and Eco Partners

RealtyX (real estate tokenization platform) and Plume Network (L1 public chain built specifically for RWA) are promoting the implementation of RWAfi innovation framework:

Tokenization: RealtyX ensures compliance and cross-chain interoperability through Plume blockchain to tokenize real estate (such as Dubai residential properties).

Collateralized Loans: Token holders can use RealtyX tokens as collateral to obtain loans on Plume integrated lending platforms (such as Defactor and Mystic Finance).

Yield Farming: Combining RealtyX's real estate token and Pendle's income tokenization protocol, users can create tradable future rental income tokens to optimize investment returns.

Liquidity Mining: RealtyX tokens can form a liquidity pool with stablecoins for transactions in DEX (such as Rooster Protocol). Liquidity providers can obtain native token incentives for RealtyX and Plume.

4.2 Technology paradigm migration

- Adoption of zero-knowledge proof technology

Zero Knowledge Proof-of-Law (ZKP) technology has shown great potential in several areas of Web3. In the RWA field, ZKP applications can realize asset verification and transactions while ensuring data privacy. This is particularly important for on-chain transactions of assets involving sensitive information (such as real estate, private credit, etc.), which can enhance the security and credibility of transactions.

- Adoption of modular blockchain

Modular blockchain architecture has shown advantages in improving network performance and scalability in other areas of Web3. In the RWA field, the adoption of modular blockchain can realize the flexible combination of different functional modules to meet the needs of diversified assets on the chain. This will promote the standardization and interoperability of RWA, and reduce the technical barriers and costs of hanging chains. Referring to Plume Network, it attracted more than 180 RWA-related protocols, more than 3 million user addresses, and hundreds of millions of transactions were generated on the test network.

4.3 Restructuring of regulatory frameworks

- Changes in U.S. regulatory policy

Given the Trump administration’s friendly attitude towards cryptocurrencies and the accelerated entry of US institutions into the RWA field, it is foreseeable that the United States will show a more open attitude in crypto asset regulation. Policies and regulations that support RWA’s on-chain are expected to be introduced to encourage financial innovation while ensuring market stability and security. This will provide a clearer legal framework for the development of RWA, reduce compliance risks, and attract more institutions and investors to participate.

- Transnational unified supervision

Although this is not the main trend in 2025, with the continued explosion of RWA, especially the continuous outbreak of predicted non-standard assets, there may be many cross-border litigation involving RWA, especially related to non-standard assets this year. This will prompt national regulators to begin considering a unified international regulatory framework to address legal and compliance issues in cross-border transactions.

Conclusion: The pain of growth of RWA moving towards institutional

maturity

In 2024, RWA tokenization will move from concept to reality, and will gradually enter the stage of scale-based application driven by accelerated institutional investment (such as BlackRock BUIDL), regulatory breakthroughs and infrastructure upgrades (such as Plume Network's RWA exclusive L1). However, with the growth of tokenized assets such as treasury bonds, real estate, and private credit, the industry still needs to face a series of structural challenges.

Core Challenge

- Centralized dilemma: The contradiction between compliance and decentralization

-

Many RWA protocols rely on "licensed DeFi" models (such as custodians, SPVs) to meet compliance requirements, which conflicts with the blockchain's decentralization philosophy.

-

Legal ownership of assets is still subject to traditional legal frameworks, limiting the autonomy of smart contracts in dispute handling.

-

Decentralization Dividend: Access thresholds and regulatory barriers

-

There is a conflict between lowering investment thresholds and the barriers such as KYC/AML compliance, opaque information disclosure, and high technical thresholds.

-

While DAO governance has potential, it still faces challenges of low engagement and regulatory uncertainty.

-

-

Market fragmentation: uneven distribution of liquidity

-

Liquidity is concentrated on blue-chip RWA assets (such as U.S. Treasury bonds), marginalizing niche assets.

-

Cross-border legal uncertainty threatens the enforceable ownership claims of tokenized assets and increases investment risks.

-

**The way to break the deadlock: collaboration is better than

compromise**

To achieve the global development of RWA, all parties in the industry need to focus on promoting the following directions:

- Seamless interoperability

Through the integration of RWA exclusive L1 from Plume Network and DeFi from RealtyX, we can open up the traditional finance and blockchain world and reduce asset liquidity resistance.

- Compliance embedding

Embed KYC/AML mechanisms (such as zero-knowledge proof identity authentication) at the protocol level to ensure compliance while protecting user privacy. Proof of compliance should not be a barrier to innovation.

- Global Governance Alliance

Cooperate with institutions such as FATF and BIS to promote the unification of cross-border regulatory standards and ensure that tokenized assets can still be legally protected in the event of bankruptcy, judicial conflicts, etc.

- Education promotes popularization

With a more friendly user interface (such as RealtyX's retail-friendly Dapp), lower the barriers to use ordinary users and improve market transparency with Chainlink's asset-level oracle.

Draw a responsible blueprint for large-scale development

The rise of RWA is not about replicating traditional finance, but about reshaping trust:

-

For institutions: achieve 24/7 liquidity, allowing assets that were once inadequate to enter the global market.

-

For individual investors: expand market access, such as Dubai real estate, Asian private credit, etc.

-

For developers: projects such as RealtyX are being verified that decentralized and real-world financial frameworks can achieve compatible coexistence.

Infrastructure has been implemented and the industry trend is irreversible. Now, the key lies in how to execute efficiently - the industry needs to look at the future with a rigorous attitude and inclusive perspective, and promote RWA to truly achieve institutional maturity.

jinse

jinse