Stablecoin boom: Five mainstream stablecoins are driving cryptocurrencies into popularity

転載元: jinse

05/06/2025·10DAuthor: Aaron Wood, CoinTelegraph; Translated by: Tao Zhu, Golden Finance

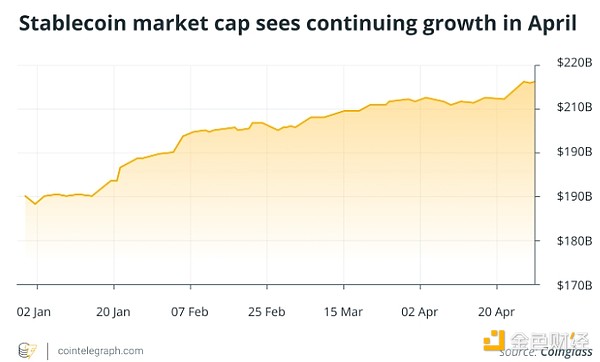

With the growing interest of institutional investors and the gradual improvement of the legal framework for stablecoins, the field is booming, and five major projects are expected to expand the market in the near future.

In the EU, the Crypto Asset Market (MiCA) regulatory scheme has been fully implemented and provides clear guidelines for stablecoin issuers to help them enter the European market. In the United States, the Stable Coin Act and the GENIUS Act, which aim to set rules for stablecoins, are under consideration by Congress.

Therefore, major payment companies such as Mastercard and Visa Card are increasing their support for the stablecoin system, and the emergence of new coins has also pushed up the overall market value of the stablecoin market.

The following five major stablecoin initiatives are expected to drive cryptocurrency popularity.

Tether will be restarted in the United States

Stablecoin giant Tether plans to restart in the United States to launch a stablecoin based on the US dollar.

USDT is already a world-renowned stablecoin, providing liquidity to cryptocurrency trading pairs on numerous exchanges.

However, Tether is in a dilemma for regulators due to its proof of reserves, other financial transparency, and anti-money laundering issues.

On April 30, Tether CEO Paolo Ardoino announced in an interview with CNBC that the company plans to launch a renamed stablecoin in the United States, which is distinguished from its ubiquitous international stablecoin. “Domestic stablecoins are different from international stablecoins,” he said.

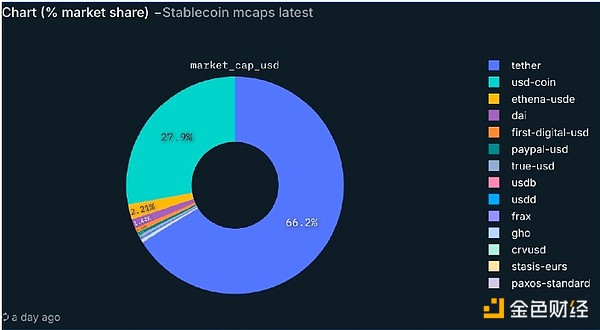

Tether accounts for the largest share of the stablecoin market. Source: Nansen

Under the pro-cryptocurrency administration of U.S. President Donald Trump, U.S. exposure to cryptocurrencies continues to expand, a move that will allow Tether to enter the U.S. financial markets.

Trump enters the dollar market and launches USD1

In early March, World Liberty Financial (WLFI), a cryptocurrency project related to the Trump family, launched its dollar-backed stablecoin USD1 on BNB Chain and Ethereum.

According to CoinMarketCap, the market value of this currency has exceeded US$2 billion as of the time of publication.

Previously, some high-profile cryptocurrency projects also used the president's personal brand as marketing tools, such as the TRUMP and WLFI meme coins launched before Trump's inauguration.

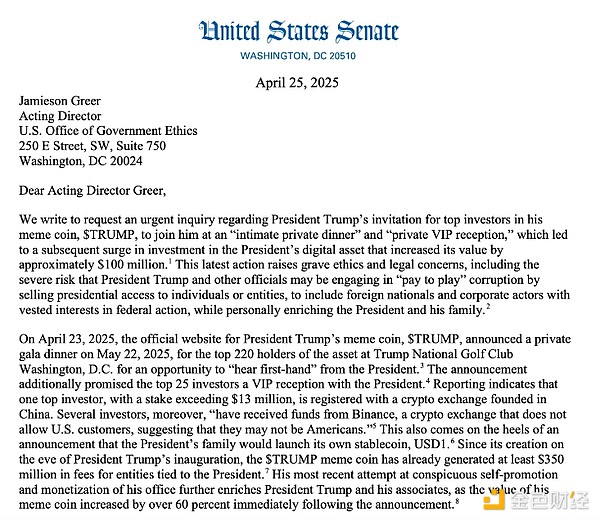

Trump's ability to influence stablecoin policy has led to a group of U.S. senators calling for an investigation into his personal interests in the project, saying it was a clear conflict of interest.

Letters requesting investigation. Source: Senator Schiff

Custodia and Vantage Bank launch stablecoins issued by bank on Ethereum

Two U.S. banks — crypto-friendly Custodia Bank and Texas-based Vantage Bank — have reached a partnership to issue their first bank-issued stablecoins in the U.S., the U.K. and Europe.

On March 25, Custodia announced that it had tokenized US dollar demand deposits into ERC-20 standard token Avit on the Ethereum blockchain.

Custodia CEO and cryptocurrency advocate Caitlin Long said Avit is “real dollar” because it tokenizes funds that customers can withdraw on demand, just like deposits in checking accounts.

Stripe is testing a stablecoin product

On April 28, Stripe CEO Patrick Collison announced that its global payment platform is developing a stablecoin product based on the US dollar for use outside the United States.

Previously, the company was approved to acquire stablecoin payment network Bridge for US$1 billion in October 2024 and completed the acquisition in February 2025.

Founded in 2022 by two former Coinbase executives Zach Abrams and Sean Yu, Bridge competes with companies using SWIFT’s global payment system.

The stablecoin program is the latest development in the company's ever- expanding cryptocurrency program. After a setback in 2014 in support of Bitcoin, the company began serious rebuilding its cryptocurrency team in 2021. On October 9, 2024, the company opened USDC support to users in 70 countries.

UAE's largest bank to issue stablecoins

Abu Dhabi International Holdings Abu Dhabi Development Holdings and Abu Dhabi First Bank (FAB) jointly launched a stablecoin supported by Dhram on April 28.

According to the UAE National, the largest bank, FAB, will issue the stablecoin on the ADI network after obtaining central bank approval.

The ADI Network is a project of the ADI Foundation of Abu Dhabi, which itself is a nonprofit founded by Sirius International Holding, a local holding company with a market value of US$243 billion.

The two companies claim that the stablecoin will have a "significant impact on various industries, including finance, commerce and trade."

Visa, SBI and Mastercard add support for stablecoins

New stablecoin issuances are accelerating, and payment companies, banks and financial institutions are also increasing their support for them.

On April 28, international payment giant Mastercard partnered with OKX to expand its stablecoin card option, allowing cardholders to use stablecoins through Mastercards associated with well-known cryptocurrency companies.

Two days later, Visa announced on April 30 that it would work with Stripe and Bridge to provide stablecoin payment services on its Latin American network, first in Argentina, Colombia, Ecuador, Mexico, Peru and Chile.

SBI VC Trade, a cryptocurrency subsidiary of Japanese financial group SBI, said it is preparing to increase support for USDC after local regulators relax their regulation of foreign stablecoins. After formal approval, the trading platform will become one of the first platforms in Japan to offer USDC cryptocurrency trading.

SBI VC Trade CEO Tomohiko Kondo shows the company's process of obtaining approval from Japanese regulators. Source: Tomohiko Kondo

Regulators and payment providers around the world are actively embracing stablecoins. U.S. lawmakers have not voted on the cryptocurrency bill, but if the stablecoin framework is passed, its adoption rate is expected to rise significantly as businesses can enter a large financial market with clear guidelines.

panewslab

panewslab