What will happen if gold prices reach $5,000 BTC?

転載元: jinse

05/06/2025·10DAuthor: Yashu Gola, CoinTelegraph; Translated by: Deng Tong, Golden Finance

summary

-

Bitcoin has performed better than gold in history, and has recently been six times higher than gold.

-

Gold climbed to $5,000, which could lay the foundation for a sharp rise in Bitcoin.

-

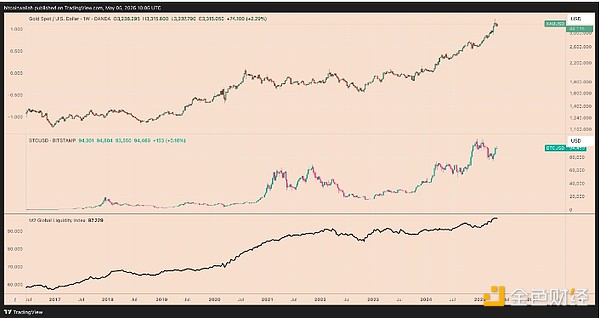

Weaker U.S. dollar and increased global liquidity remain the main drivers of both assets.

Gold prices approaching $5,000 per ounce and more have become a hot topic for hard asset longs, including Ed Yardeni, head of Yardeni Research and billionaire investor John Paulson.

But what will happen to the price of Bitcoin, which many people call "digital gold" if the price of this precious metal soars further?

The last time gold rose, Bitcoin price rose 6 times

Historically, when Bitcoin and gold markets rose at the same time, Bitcoin’s gains far exceeded that of gold.

From March 2020 to March 2022, during the Fed's ultra-loose monetary policy, Bitcoin price soared about 1110%, while gold rose only 35.5%.

Weekly charts of XAU/USD and BTC/USD and global M2 supply. Source: TradingView

In the rebound from November 2022 to November 2023, gold rose by about 25%, while Bitcoin rose by 150%, a gain of nearly 6 times.

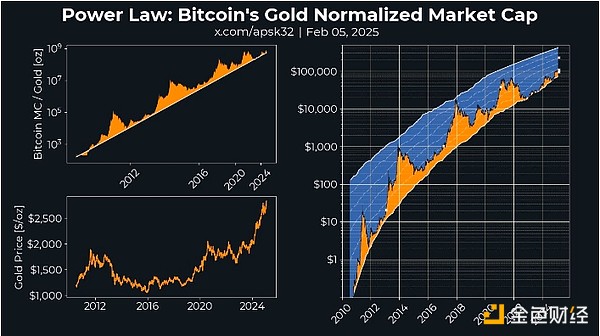

Gold prices rose from the current $3,265 to $5,000, equivalent to a 50% increase. So if history repeats itself, the price of Bitcoin could rise by 300%, or $285,000 per BTC.

This is consistent with the Bitcoin target price forecast by analyst apsk32, based on a power law model standardized by gold market capitalization.

Senior fund manager: Gold boom will push Bitcoin to $250,000

Frank Holmes, CEO of the US Global Investors, believes that gold prices will rise to $6,000 during Trump 's presidency, and he believes that the growth rate of gold prices has lagged behind the surge in global M2 money supply.

He linked this bold goal to Trump's tariff policies, which he believes could lead to a depreciation of the dollar by about 25%, thereby increasing the attractiveness of gold, while central bank demand is strong and investors have reduced their holdings.

Holmes predicts that Bitcoin could break through the $97,000 oversupply glut and climb to $120,000-150,000 in the short term, with the acceleration of adoption, which could reach $250,000 in the long term.

If the lag correlation of gold remains unchanged, the price of Bitcoin is expected to exceed $155,000.

In late April, gold prices climbed to an all-time high of $3,500, up 33.35% year-to-date. As of May 5, gold prices have slightly rebounded to $3,237. By comparison, Bitcoin has only risen 0.82% year-on-date.

Comparison of BTC/USD and XAU/USD daily charts. Source: TradingView

Some market observers, including analyst Cryptollica, pointed out that Bitcoin’s past behavior lags behind gold, meaning that if Bitcoin breaks through the current consolidation range, it is likely to rise to the $155,000 level.

Comparison of BTC/USD vs. XAU/USD trends. Source: Cryptollica/X

Bitcoin has fallen 30% from its all-time high of about $110,000, which is milder than past sales of more than 50%. This resilience enhances its position to go hand in hand with gold and increases the possibility that Bitcoin will follow gold if market conditions improve.

panewslab

panewslab