How much Bitcoin can Berkshire Hathaway buy?

転載元: jinse

05/07/2025·5DAuthor: Yashu Gola, CoinTelegraph; Translated by: Baishui, Golden Finance

Key points:

-

Berkshire holds $347 billion in cash, enough to buy about 18% of the Bitcoin supply.

-

Greg Abel has not yet suggested a change in Warren Buffett's anti-bitcoin stance.

-

Berkshire has indirectly invested in cryptocurrencies through Nu Holdings and Jefferies.

On May 3, Warren Buffett announced at Berkshire Hathaway 's annual shareholders' meeting that he will step down as CEO by the end of 2025 and be taken over by Greg Abel. The change has sparked speculation about Berkshire's financial ability to buy Bitcoin under the new leadership.

Berkshire's Bitcoin holdings can easily surpass Strategy's Bitcoin

reserves

As of the fourth quarter of 2024, Berkshire held a record $347 billion in cash and U.S. Treasury bonds, accounting for about 32% of its $1.1 trillion market capitalization.

If Berkshire buys Bitcoin for around $95,000 in May, it can earn about 3.52 million bitcoins, equivalent to 17.88% of Bitcoin circulation (19.69 million).

If Berkshire only used its estimated US$295.98 billion worth of US Treasury bonds, it could buy about 3.12 million bitcoins, accounting for 15.85% of the circulation, thus becoming the dominant player in the cryptocurrency market.

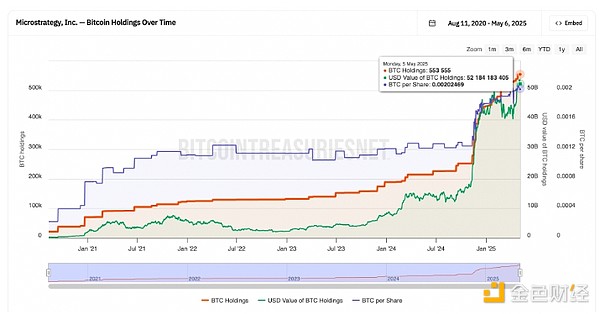

The move will easily surpass Nasdaq-listed Strategy Inc. (formerly MicroStrategy), the world's largest corporate Bitcoin holder, which held 553,555 bitcoins worth approximately $52.2 billion as of May 6.

In other words, if Berkshire Hathaway converts about one-sixth of its cash reserves into bitcoin, it could theoretically be comparable to Strategy 's Bitcoin reserves.

Strategy Inc. Bitcoin positions change over time. Source: BitcoinTeasuries.net

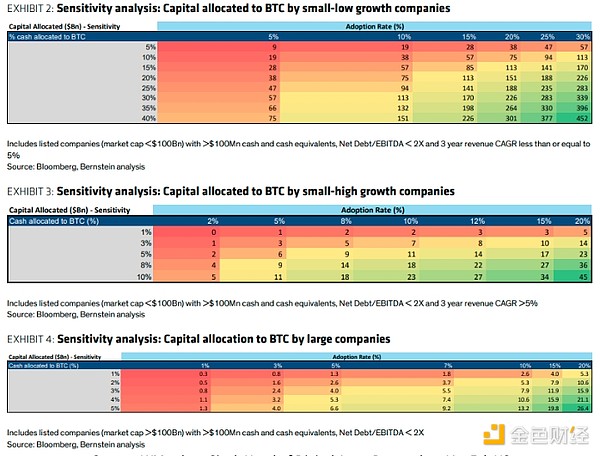

Bernstein analysts predict that by 2029, corporate funds will flow into the Bitcoin market, with a capital inflow of about $330 billion, of which the inflow of listed companies is expected to reach $205 billion between 2025 and 2029.

Analysts say most of that funding will come from smaller, slow-growing companies that are trying to replicate Strategy Inc.’s Bitcoin strategy. They believe that this is one of the few ways to enhance their own value when other growth options are scarce.

Source: X/Matthew Sigel, Director of Digital Assets Research, VanEck US

Bernstein's optimistic forecast shows that Strategy alone will purchase an additional $124 billion in Bitcoin, thanks to the company's recently expanded financing plan, which aims to raise $84 billion by 2027, almost double its previous target.

Does Greg Abel support cryptocurrency?

Whether Berkshire Hathaway will buy Bitcoin under Abel's leadership is yet to be determined.

The new Berkshire Hathaway leader has yet to publicly say he wants to change Buffett's value investment philosophy, which is to prioritize assets with tangible cash flow rather than speculative assets like Bitcoin, which Buffett once called "the square of rat poison."

Bitcoin’s price has risen nearly 900% since Buffett criticized Bitcoin in May 2018.

BTC/USD Two-week Price Chart. Source: TradingView

However, despite Berkshire's opposition to cryptocurrency, it has indirectly got involved in the field by investing in crypto-friendly companies such as Nu Holdings and Jefferies Financial Group, which owns shares in BlackRock iShares Bitcoin Trust (IBIT).

This strategy is similar to Berkshire's investment strategy in gold, which Buffett has repeatedly ridiculed gold for its lack of productivity. However, Berkshire unexpectedly bought shares in Barrick Gold, a gold mining company, in 2020, although it later sold the holding.

Under Abel's leadership, Berkshire may not get involved in Bitcoin directly, but its cautious, indirect investment strategies may expand as the market develops. It remains to be seen whether this will eventually lead to the full popularity of Bitcoin and test the waters carefully.

chaincatcher

chaincatcher

panewslab

panewslab