The currency circle starts subsidy war: the traffic game behind Alpha points

転載元: panewslab

05/07/2025·5DAuthor: Scof, ChainCatcher

Recently, the takeaway market has suddenly become lively.

JD.com has made efforts, Alibaba has entered the game, and Meituan has faced a challenge, and a tripartite melee has begun. You can see "free milk tea", "10 billion subsidies", and "30 minutes of good goods arrive at home" one after another, but the logic behind it is not complicated: bind users through high-frequency consumption scenarios (takeout), thereby laying a foundation for your instant retail business.

This is essentially very similar to the fierce competition among exchanges in the crypto circle. Binance's Alpha points system is the most typical example, with new points, airdrop rankings, and transaction rankings - in other words, it is also a "subsidy war" in the field of digital assets. It is not a competition for new users, but a competition for users' attention, trading behavior and loyalty.

And other exchanges are not idle either. Bybit followed suit and launched the pledged Alpha points airdrop, benchmarking Binance's gameplay, trying to compete for the same group of high-active users; OKX announced that it will launch a million-dollar airdrop plan.

This is a typical stock game.

Alpha points are rolled out to a new level, and ordinary users are

marginalized

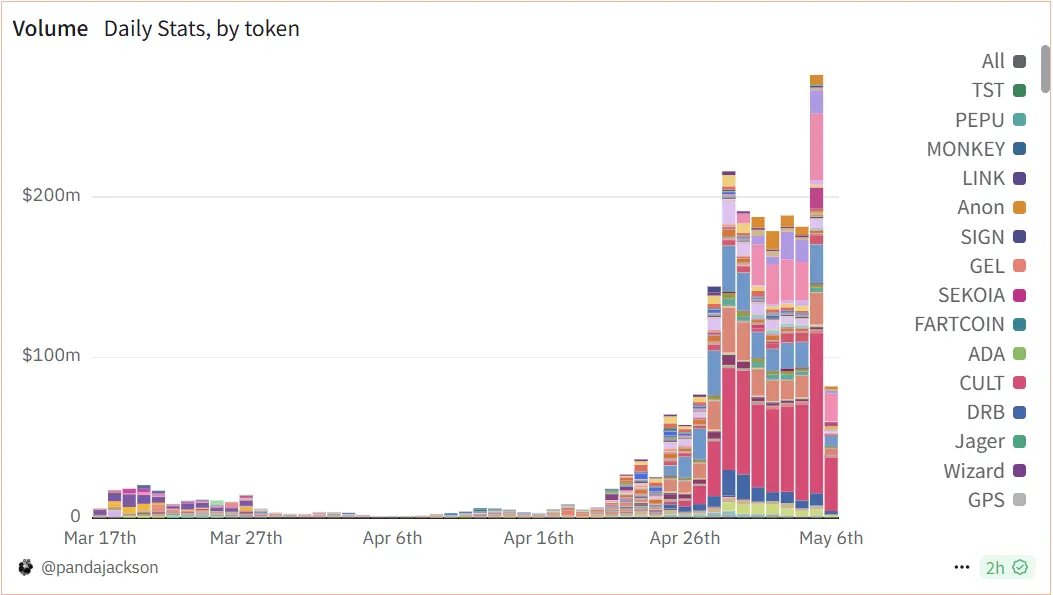

The popularity of the Alpha sector continues to rise. On May 5, Binance Alpha's transaction volume exceeded US$274 million, and the number of daily transactions exceeded 1 million for the first time. The key to this surge in data is the rising "Alpha Points" threshold.

Source: Dune, @Pandajackson

In the initial stage, you may get a short investment space with 50 points. But the latest round score line soared to 142 points, and nearly 10 points per day must be earned in the past 15 days, corresponding to a trading volume of $1,024. Many ordinary players are caught off guard.

Crypto KOL Xia Xueyi said that she lost tens of thousands of dollars in a month and is still "ineligible". Because under this mechanism, only large players and studios that are constantly active and trade frequently can maintain their competitiveness in points.

At the same time, although Binance launched consolation prizes such as "UID tail number X lucky airdrop", it actually has limited appeal to real retail users. The ultimate goal of large subsidies is the institutional users and the scoring team.

This is very similar to the "wool party" in the takeaway war: new platforms are pouring into the forefront of short-term subsidies, but once the price advantage is no longer there, most people will still return to the platform they are familiar with and trusted.

Binance Ecology’s open plot: design rules, manufacturing traffic

Let’s look at the strategies behind the Alpha points system: the Stakestone project uses 5% tokens for IDO, 1.5% is used for main site airdrops, 3.93% is given back to old users, and a total of 10.43% of tokens are invested. These tokens bring potential selling pressure of over $5 million at the price of $0.06, even close to $9 million at highs.

However, the project party did not choose to sell immediately, but instead guided the trading volume and maintained the currency price to stabilize, and finally achieved the "standard requirements" for Binance's main website to list the currency. This is not a simple market behavior, but a "coordination game of algorithms".

In other words, the exchange is not waiting for the project party to grow naturally, but designed an access system that "if you want to go online, you have to dance at my pace." Alpha points are to filter users, trading volume is to filter project parties, and currency price performance is to filter market value management capabilities.

The closed loop was finally completed: traffic comes in, the data is beautiful, the transaction volume soars, and the platform wins.

Who is the winner? Who can still stick to it?

The war between exchanges is actually the same as the takeaway platform: burning money to attract people, subsidies to grab the market, and creating a traffic climax. But for users, what is really left after the excitement? Many people strive to get points and get qualifying in the Alpha points system. In the end, they found that they did not get the airdrop and did not participate in the issuance of new products, which only added bricks to the platform data.

The platform can change its playing style repeatedly, but the user's choice is always realistic. Many people will switch platforms for short-term subsidies, but once the price advantage disappears and the rules become complicated, most people will still return to the place they are familiar with. Subsidies can only bring traffic and cannot retain trust.

This also raises a realistic problem: Alpha is defined as a place for "incubating high-quality projects", but projects after coin listing do not always perform ideally. Some projects opened high and ended low, making it difficult to enter the spot area of Binance's main site, and are regarded as "temporary project area" by users. Over time, will this frequent low-quality currency listing damage Alpha's reputation and even affect users' confidence in the entire Binance currency listing system?

From a more macro perspective, is there still an "incremental market" in the crypto world? If everything has become a dispute over stock, then how can the user's value be measured in the end?

In this era of stock game, exchanges require users' loyalty and behavior; users need platform trust and long-term returns. If this relationship begins to become unbalanced, it is a greater price than missing out on an airdrop.

The takeaway war can at least bring a cup of "free milk tea", so many users hope that the subsidy war can last for a while so that they can save more money. Similarly, seeing Binance, OKX, and Bybit take turns to compete for users, users also expect other exchanges to be more aggressive - don't just let users "work and score points", but really make concessions and turn competition into a benign game that is beneficial to users.

jinse

jinse