Grayscale Select Latest Report: The list of Q1 is not performing well, and Q2 focuses on RWA, DePIN and IP tokenization

Reprinted from panewslab

03/27/2025·1MOriginal text from Grayscale Research

Compiled by Odaily Planet Daily Golem

Editor's note: Grayscale selects the Top 20 tokens with the most growth potential from hundreds of digital assets at the beginning of each quarter. In the Q2 quarter of 2025, Grayscale focused on RWA, DePIN and IP tokenization, so three new tokens were added to the Top 20, namely IP, SYRUP and GEOD. At the same time, in this article, Grayscale reviewed the overall performance of the crypto market in Q1 2025.

In order to enable readers to better understand the performance of "Greyscale Selection" tokens, Odaily counted the performance of the six new tokens added by Grayscale in Q1 in 2025 in Q1. The result is that due to the overall market environment in Q1, the prices of the six new tokens added by Grayscale have fallen since January 1, 2025, of which VIRTUAL fell even more than 80%. See the full content below.

Summarize:

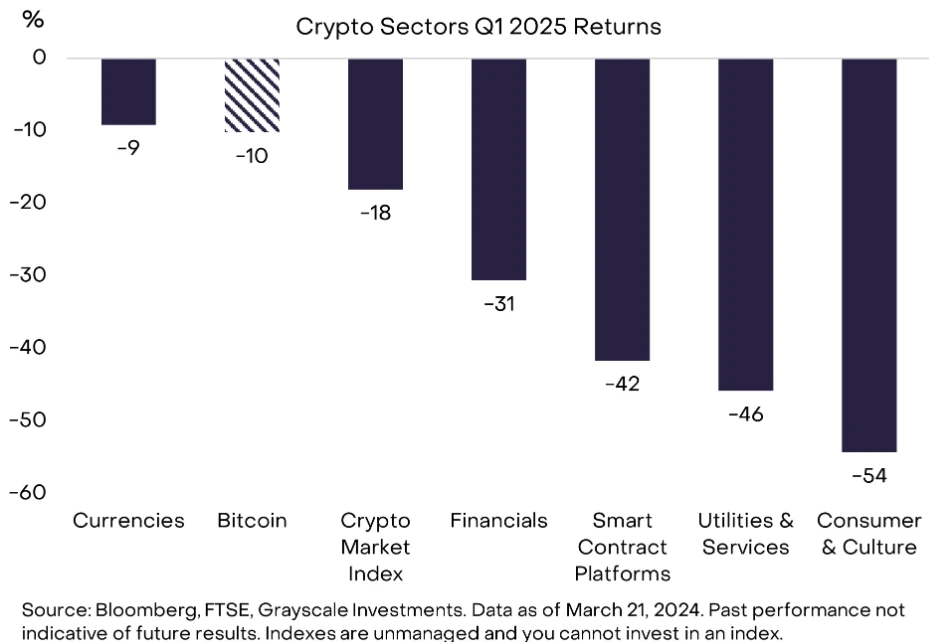

- According to the FTSE/Grayscale Crypto Sectors Index, cryptocurrency valuations fell in the first quarter of 2025, while technology stocks and other risky assets also fell.

- Indicators of Bitcoin network activity in the first quarter performed well overall. In contrast, as Meme trading on Solana slows down, smart contract platforms also use has also declined. Application-related crypto asset classes account for three of the five crypto markets divided by Grayscale, which generated a total of more than $2 billion in revenue in the first quarter.

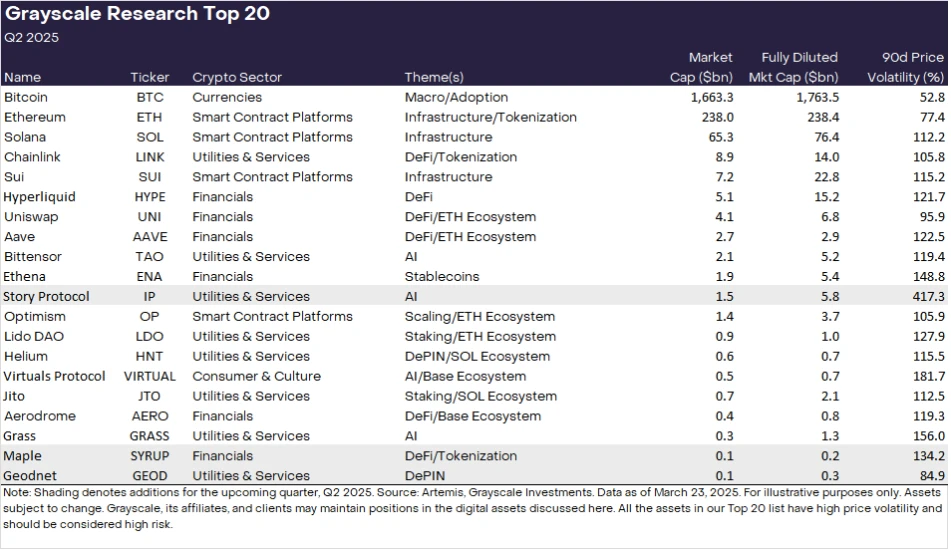

- At the same time, Grayscale updated the Top 20 potential tokens for Grayscale Research. Top 20 represents diversified assets in the cryptocurrency space, which Grayscale believes have high potential in the next quarter. The three new assets added this quarter are Maple (SYRUP), Geodnet (GEOD) and Story Protocol (IP). All assets on the Top 20 list have high price volatility and should be considered high-risk assets.

Today, there are more than 40 million tokens (excluding NFTs) in the entire digital asset industry. To track them, Grayscale Research divides them into five different cryptocurrency markets based on actual usage of the underlying software. Investors can monitor the performance of each segment through Grayscale’s Crypto Sectors tool. As of the latest data, the Crypto Sectors framework now covers 227 different assets with a total market value of US$2.6 trillion, accounting for about 85-90% of the total market value of cryptocurrencies.

Crypto Sectors divides digital assets into five segments

Summary of Q1 2025: Cryptocurrency valuation declines across the board

Cryptocurrency valuations fell as broadly as tech stocks and other risky assets in the first quarter of 2025. The industry-wide market cap-weighted cryptocurrency industry price index fell 18% this quarter (as of Friday, March 21), but Bitcoin and some other cryptocurrencies have fallen less or prices are still rising (such as XRP). The weakest segments of the quarter were consumer and culture, mainly due to the decline in prices of DOGE and other Meme coins.

Cryptocurrency valuations decline in Q1 2025

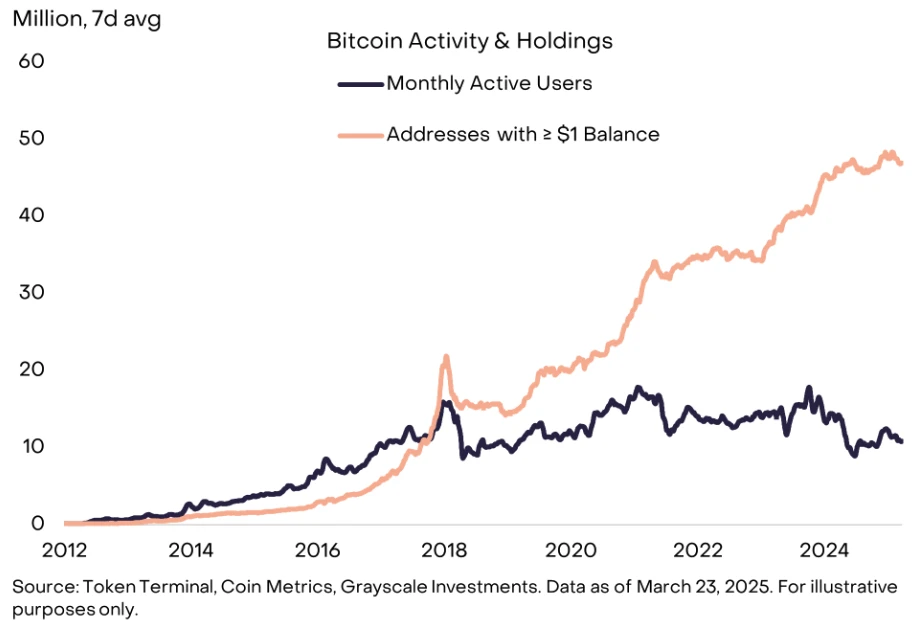

In the first quarter, indicators of Bitcoin network activity performed well overall. For example, the number of addresses with a balance of more than or equal to USD 1 reached a new high of 48 million. In contrast, the monthly active on-chain users were basically the same as in the previous quarter, at 11 million. The expanding differences between the two metrics suggest that recent demand for Bitcoin may come from users interested in the functionality of using it as a “store of value” rather than a “mediate exchange.” Bitcoin’s hash rate increased to nearly 800exahash (EH/s) in the first quarter, which means that a network of 5-6 million Bitcoin mining machines around the world is trying to solve the proof-of-work algorithm with about 800 trillion computing times per second.

Steady growth in the number of Bitcoin “hodlers”

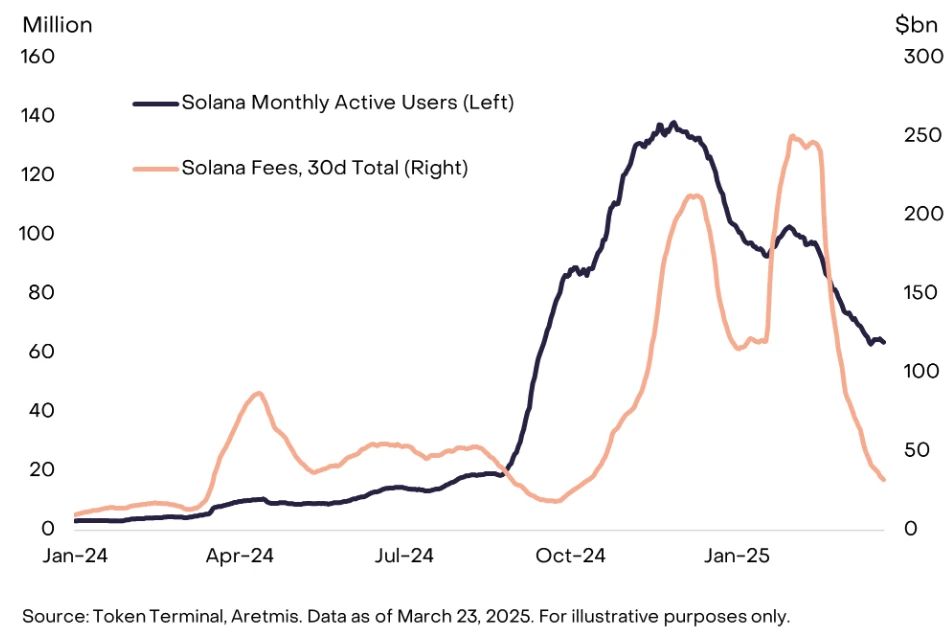

At the beginning of 2025, basic indicators in the smart contract platform sector generally declined, mainly due to the decline in Meme currency trading activity on the Solana blockchain. Although Meme coins do not provide real-world practicality and may pose particularly high risks to investors, interest in Meme coins trading may have brought many new users to the Solana ecosystem.

According to Token Terminal, Solana's monthly active users reached 140 million at the end of the fourth quarter of 2024, and averaged nearly 90 million in the first quarter of 2025. Even as Meme trading slowed, Solana incurred about $390 million in the first quarter, accounting for about half of the estimated total cost of smart contract platforms.

Solana\'s monthly active users peaked at ~140 million

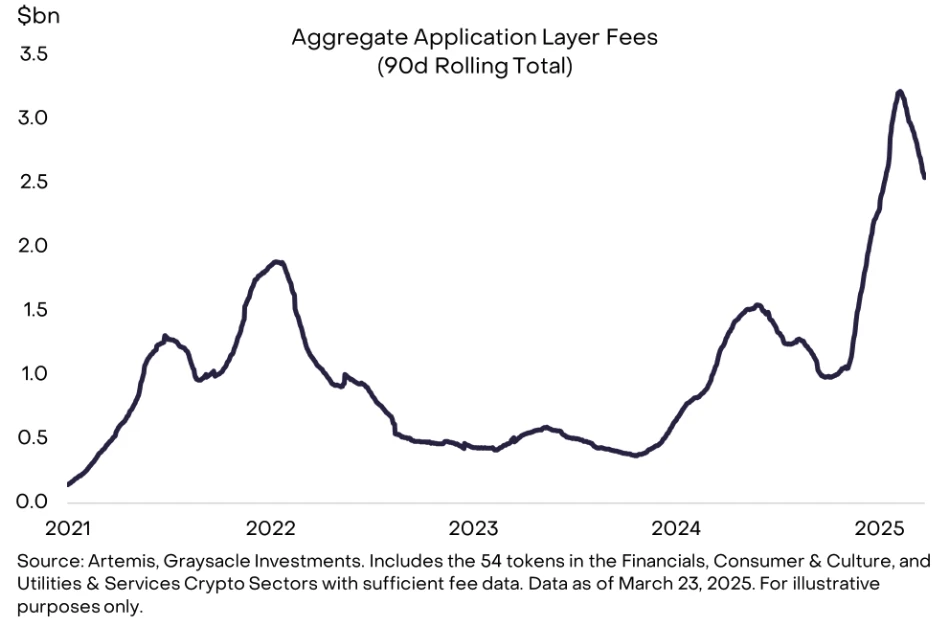

The Grayscale Crypto Sectors framework includes three application-related crypto asset classes: finance, consumer and culture, and utilities and services. These segments include all components of on-chain economic activity, including user-facing applications, related application infrastructures (such as oracles and cross-chain bridges), and dedicated blockchains. Therefore, the category is highly diverse, and Grayscale believes it is best to evaluate them based on similar assets that are focused on a specific field. That being said, we estimate the total expenses for assets in the crypto categories related to these three applications are approximately US$2.6 billion, up 99% from the first quarter of 2024.

Blockchain applications generate more than $2 billion in quarterly fees

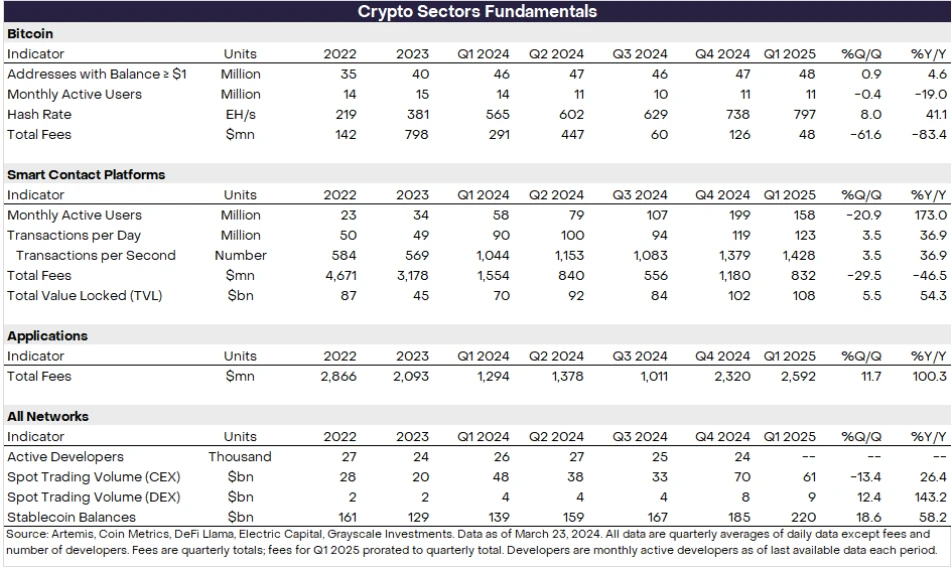

The following figure provides some key basic statistics for each part of the digital asset market. Overall, these indicators have grown steadily from the same period last year, but have mixed changes compared with the previous quarter.

Grayscale Research Top 20 Token List

Each quarter, the Grayscale Research team analyzes hundreds of digital assets to inform the reevaluation process of the FTSE/Grayscale Crypto Sectors index. After this process, Grayscale Research generates a list of the top 20 assets of Crypto Sectors. The top 20 represent diversified assets in the cryptocurrency industry, which Grayscale believes have high potential in the coming quarter, combining a range of factors including network growth/adoption, upcoming catalysts, fundamental sustainability, token valuation, token supply inflation and potential tail risks.

New token performance in Q1 2025

Grayscale Research has been inspired by emerging assets in the blockchain application layer, rather than infrastructure layer. HYPE, ENA, VIRTUAL, JUP, JTO and GRASS are added to the Q1 Grayscale Top 20 list in 2025 .

According to CoinGecko data, these six new tokens have performed as follows after the disclosure of Grayscale (January 1, 2025):

-

Hyperliquid (HYPE) : The price on January 1, 2025 was US$24, down 33% so far ; the price in Q1 2025 reached US$27.94, a relative increase of 16%; the price in Q1 2025 was as low as US$12.15, a relative decrease of 49.37%, and the lowest price has risen 33% so far.

-

Ethena (ENA) : The price on January 1, 2025 was US$0.91, down 53% so far ; the price in Q1 2025 reached US$1.27, a relative increase of 39.5%; the price in Q1 2025 reached US$0.33, a relative decrease of 63%, and the lowest price has risen 30% so far.

-

Virtual Protocol (VIRTUAL) : The price on January 1, 2025 was US$4, down 80% so far ; the price in Q1 2025 reached US$4.99, a relative increase of 24%; the price in Q1 2025 reached US$0.53, a relative decrease of 86%, and the lowest price has risen 52% so far.

-

Jupiter (JUP) : The price on January 1, 2025 was US$0.82, down 30% so far ; the price in Q1 2025 reached US$1.26, a relative increase of 53%; the price in Q1 2025 was as low as US$0.46, a relative decrease of 43%, and the lowest price has risen 23% so far.

-

Jito (JTO) : The price on January 1, 2025 was US$3.2, down 22% so far ; the price in Q1 2025 reached US$3.5, a relative increase of 9.3%; the price in Q1 2025 reached US$2.1, a relative decrease of 34%, and the lowest price has risen 19% so far.

-

Grass (GRASS) : The price on January 1, 2025 was US$2.6, down 38% so far ; the price in Q1 2025 reached US$3.4, a relative increase of 30%; the price in Q1 2025 reached US$0.9, a relative decrease of 65%, and the price in Q1 2025 increased by 77% so far.

In summary, since Grayscale disclosed, the prices of these six tokens in Q1 2025 have experienced a significant drawdown, and if they hold the above tokens in Q1, they will be in a loss state without exception and will not make a penny. But if you can judge the bottom range and buy it so far, there will be a good increase.

New tokens added in Q2 2025

This quarter, Grayscale will focus on tokens that reflect the non-speculative application of blockchain technology in the real world, which are divided into three categories: RWA (real world assets), DePIN (decentralized physical infrastructure), and IP (intellectual property tokenization).

Based on the above topics, the following three assets were added to the Top 20 list for the second quarter of 2025:

-

Maple (SYRUP) : Maple is a decentralized finance (DeFi) protocol focused on institutional lending through its two core platforms: Maple Institutional (for qualified investors) and Syrup.fi (for DeFi native users). The total locked value of the protocol (TVL) has grown to over $600 million and has generated $20 million in annualized network expense revenue over the past 30 days. It also seeks to build Maple Institutional as a trusted institutional loan sponsor by working with traditional financial institutions.

-

Geodnet (GEOD) : Geodnet is a DePIN project used to collect real-time location data. As the world's largest real-time dynamic positioning (RTK) provider, Geodnet provides geospatial data with precision up to 1 cm, providing affordable solutions for farmers and other users. In the future, Geodnet may provide value for self-driving cars and robots. The network has expanded to over 14,000 devices in 130 countries, and annualized network expense revenue has increased to over $3 million over the past 30 days (a year-on-year increase of about 500%. It is worth noting that GEOD has a lower market cap and fewer listed exchanges compared to other assets in the top 20, so it can be considered to be more risky.

-

Story (IP): Story Protocol is trying to tokenize the $70 trillion intellectual property (IP) market. In the AI era, proprietary IP was used to train AI models, leading to copyright infringement claims and mass litigation, such as the previous litigation dispute between The New York Times and OpenAI. By bringing IP onto the chain, Story will enable companies to use their IP for AI model training while allowing any individual to invest, trade and earn IP royalties. Story has brought Justin Bieber and BTS’ songs to the chain and launched an IP-centric blockchain and token in February.

Top 20 list of Q2 2025

In addition to the new themes mentioned above, Grayscale is still optimistic about the themes of the previous quarters, such as Ethereum scaling solutions, the intersection of blockchain and AI development, and DeFi and staking solutions. These topics are represented in the Top 20, such as Optimism, Bittensor and Lido DAO.

Akash, Arweave and Jupiter were removed from the Top 20 this quarter. But Grayscale Research still recognizes the value of these projects, and they remain an important part of the crypto ecosystem. However, the new Top 20 list could provide a more attractive risk-reward for the next quarter.

Investing in crypto assets involves risks, some of which are unique to the crypto asset class, including smart contract vulnerabilities and regulatory uncertainties. In addition, all assets in the top 20 are highly volatile and should be considered high risk and therefore not suitable for all investors. Given the risk of asset classes, any investment in digital assets should be considered in the context of the portfolio and the investor’s financial position objectives.