When Mutoujie "sells" and retail investors FOMO: Why did Circle break through $200 overnight?

転載元: chaincatcher

06/19/2025·3DAuthor: White55, Mars Finance

1. Historic Breakthrough: The Bretton Woods Moment from Crypto Assets to

Digital Dollars

In the early morning of June 19, 2025, the US capital market once again witnessed a carnival that was enough to be recorded in financial history: the stock price of stablecoin giant Circle (CRCL) soared 34% in a single day, hitting the $200 mark during the session, setting the largest increase since its listing on June 5. Behind this number is not only capital's fanatical pursuit of emerging asset classes, but also a game of reconstruction of monetary sovereignty, financial power and regulatory order.

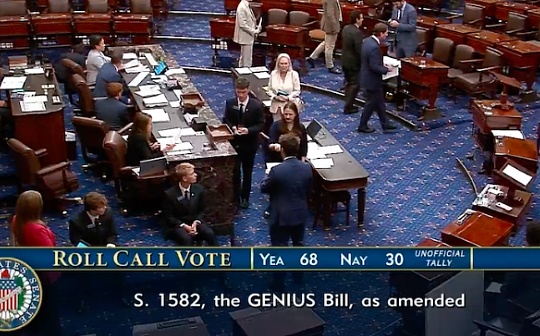

Just 48 hours ago, the U.S. Senate passed the GENIUS Act (full name: The Guidance and Establishment of the U.S. Stable Currency Countries Innovation Act) with an overwhelming vote of 68:30, establishing a federal regulatory framework for the U.S. stablecoin. The bill defines stablecoins as "digital cash", requiring issuers to reserve high-liquidity assets (such as short-term US Treasury, cash deposits), and prohibits the payment of interest to users to strengthen their payment tool attributes. This legislative breakthrough marks the first time that crypto assets that have been free from the gray area since the birth of Bitcoin have been officially incorporated by the traditional financial system. As Circle CEO Jeremy Allaire declared on social media: "This is the 'iPhone Moment' for the Digital Dollar - the currency's form will be completely rewritten when stablecoins evolve from lubricants for crypto transactions to infrastructure for global payments."

The market's reaction confirms this judgment. Circle's stock price has risen by 543% since its IPO of $31 on June 5, with a market value exceeding $40 billion, surpassing PayPal and approaching Square's peak valuation. The core logic of this round of surge lies in the "triple empowerment" of the bill to USDC (the US dollar stablecoin issued by Circle):

- Compliance premium: The bill brings stablecoin issuers with a market value of more than $10 billion into Federal Reserve regulation, forcing competitors such as Tether to face stricter audit and reserve requirements, while USDC becomes the first-movered safe haven for institutional funds with its first-mover compliance advantage (99.5% of reserves are U.S. Treasury and cash);

- Scenario expansion: The bill clearly allows stablecoins to be used in daily payments, cross-border settlement and other scenarios, breaking the current situation where more than 80% of its transaction volume is concentrated on crypto asset redemption, and paving the way for USDC to penetrate traditional payment networks such as Visa and SWIFT;

- Geographical dividends: The bill prohibits non-USD stablecoins from entering the US market and forces foreign issuers (such as Tether) to accept equivalent supervision, which essentially incorporates the global stablecoin market into the US dollar hegemony system. Against this backdrop, USDC's US$61 billion circulation (accounting for 29% of the global stablecoin market) has become a strategic tool for the United States to consolidate the hegemony of the "digital dollar".

2. Fission of business model: From "US debt arbitrageurs" to "on-chain

Fed"

The rise of Circle is essentially a revolution in the functions of traditional financial intermediaries. Its core business model can be summarized as "three steps":

Step 1: Mint stablecoins and absorb global dollar liquidity

When a user purchases 1 USDC through a platform such as Coinbase, Circle receives 1 USD cash. As of the first quarter of 2025, Circle managed reserve assets of US$61.4 billion, of which 80% were invested in short-term US Treasury bonds and 20% were deposited in systemically important institutions such as Bank of New York Mellon. This model has generated huge profits under the Fed's high interest rate cycle (current 10-year Treasury yield of 4.3%): Circle's total revenue in 2024 was US$1.676 billion, of which 99% came from reserve interest and net profit of US$156 million.

Step 2: Build a payment network to replace SWIFT’s century-old hegemony

Circle is secretly advancing the "CPN" (Circle Payments Network) program, which is trying to use blockchain technology to achieve second-level settlement of cross-border payments, with the rate compressed from 1% of traditional SWIFT to 0.01%. This ambition is endorsed by the bill, which requires stablecoin issuers to connect with FedNow (Fed Real-time Payment System), laying the foundation for the interoperability of digital dollars and USDC. If CPN is successful, Circle will become an "on-chain hub" connecting central bank digital currency (CBDC) and private stablecoins, and its status is comparable to AWS in the Internet era.

Step 3: Swallow real assets and start the RWA (real asset tokenization) revolution

USYC, a tokenized Treasury bond fund launched in collaboration with BlackRock, marks that Circle is extending its tentacles to the $16 trillion U.S. bond market. By converting bonds, real estate and other assets into on-chain tokens, USDC will become the natural settlement medium for these assets, charging minting and circulation fees. If this transformation is successful, Circle's income structure will shift from a single interest dependence to a three-legged stalemate of "reserve interest + payment fee + RWA service fee", completely getting rid of the label of "US Treasury yield puppet".

However, this grand narrative hides fatal risks. Circle's net profit margin is only 9.3%, far below the average level of tech giants. The core problem is its high distribution costs: the share paid to Coinbase in 2024 reached US$908 million (accounting for 60% of the total cost), exposing the weak ecological control. What’s even more serious is that once the Fed cuts interest rates to 3% in 2026 as expected, Circle’s interest income will shrink by 30%, forcing management to demonstrate the profitability of payments and RWA businesses in the next 18 months.

3. Capital Secret War: The "Ice and Fire" of Institutional Retreat and

Retail Ventures Carnival

As the market cheers for the surge in Circle, a secret capital game is taking place. On June 17, Ark Invest founder Cathie Wood sold 643,000 shares of Circle stock for two consecutive days, cashing out $96.5 million, causing the market to panic about "all the good news." This operation is in sharp contrast to its consistent subversive technological beliefs - is it a profit-taking or a sniff of uncertainty after the implementation of supervision?

Compared with other capital trends, the answer may be hidden in the details:

- BlackRock holds its back: As a cornerstone investor of Circle, BlackRock holds a 10% stake and has not disclosed its share reduction, apparently betting on the long-term value of RWA tokenization;

- Insider restricted sales game: CEO Jeremy Allaire only plans to sell 8% of his shares (about 1.58 million shares), which is far lower than the IPO lifting limit, conveying management confidence;

- Retail investors flocked in: Data from platforms such as Robinhood showed that the proportion of retail trading soared from 15% in the early stage of IPO to 34%, and the open positions of leveraged contracts surged by 300%, suggesting that market sentiment has entered an irrational range.

Behind this differentiation is the fundamental difference between institutions and retail investors on the Circle valuation model:

- Institutional perspective: Based on the DCF (Cash Flow Discount) model, Circle's current 174-fold price-to-earnings ratio has overdrawn its growth expectations for the next three years, especially the construction of payment networks requires billions of dollars, which may squeeze short-term profits;

- Retail investors’ narrative: Comparing Circle to the “on-chain Fed”, believing that its market value should be based on the size of the central bank’s balance sheet (the current Fed assets are $8.9 trillion), thus giving it a higher premium.

This cognitive gap is a classic portrayal of the symbiosis of the bubbles and opportunities in the capital market.

4. The ultimate challenge: The "spear and shield" of US dollar hegemony

Circle's fate has long gone beyond the scope of business and has become a micro-micro-ecological figure of the financial game between great powers. The passage of the GENIUS bill is essentially a "digital expedition to the US dollar": by forcibly anchoring stablecoin reserves to US bonds, the United States is transforming global cryptocurrency liquidity into a "new buyer" of US bonds. Data shows that Tether and Circle have held US$122 billion in short-term U.S. Treasury bonds, accounting for 2% of the market's stock. If the stablecoin scale reaches US$3 trillion in 2030 (Standard Chartered Bank predicts), its purchasing power for US bonds will exceed the total holdings of Japan and China.

But this precision design faces a triple backlash:

- Technical transgression: The cross-border nature of blockchain has fundamental conflicts with the long-arm jurisdiction of US dollar regulation. Decentralized stablecoins (such as DAI) may bypass the constraints of the bill and form a "regulatory enclave";

- Geographical rebound: China is accelerating cross-border settlement of digital RMB, and Hong Kong's "Stablecoin Ordinance" clearly supports Hong Kong dollar stablecoins, trying to replace USDC in the "Belt and Road" trade;

- Internal split: The bill prohibits large technology companies (such as Amazon and Meta) from issuing stablecoins, but traditional giants such as Walmart and JPMorgan Chase have made secret arrangements and may fight head-on with Circle in the future.

Conclusion: Reconstructing the future of currency on the blade

At 2:30 a.m., Circle's stock price was set at $199.59 on the electronic screen of the New York Stock Exchange. This number is not only the price of capital for a technological revolution, but also the yardstick for the old order to compromise with the new world. When Federal Reserve Chairman Powell shunned the "digital dollar" timeline at a congressional hearing, Circle has quietly laid the track to connect the traditional and crypto worlds.

The end of this feast may be as full of bubbles and shatters as the 19th century railway stock craze, or it may reshape the human economic form like the Internet revolution. The only certain thing is that when the dollar hegemony was reborn through blockchain, Circle was both a chess player and a piece - every rise and fall of it was writing a modern apocalypse about the power of currency.

jinse

jinse