Ten thousand words to sort out the past of American tariffs: history will not repeat itself, but it will be plagiarized

転載元: panewslab

04/26/2025·1MAuthor: Citrini , Analyst

Compiled by: Felix, PANews

Affected by the US tariffs, the global economy seems to have entered a state of disorder. Is the Trump administration's tariffs a magical stroke or a bad move? Analyst Citrini published an article from a historical perspective, reviewing historical tariff events and gradually analyzing the future economic situation. The following is the full text of the content.

"This may be a wrong view"

Benjamin Franklin wrote in 1781:

"But I find myself more inclined to adopt a more modern view that every country is better off leaving trade completely unhindered. In general, I just want to point out that commerce is the exchange of necessities of life and conveniences. The freer and unrestricted, the more prosperous it is, and the happier it is. The restrictions imposed by countries on commerce seem to be implemented for their own interests under the banner of public interest."

In the two weeks since "Liberation Day" ( PANews note: Trump calls April 2 a " Liberation Day " and announces the global tariff plan) , I have been in the United States for a week and in China for a week. In both countries, I’m talking to entrepreneurs affected by tariffs.

Whether it is an importer or an exporter, companies engaged in international trade of varying degrees have one thing in common in these two completely different regions: uncertainty.

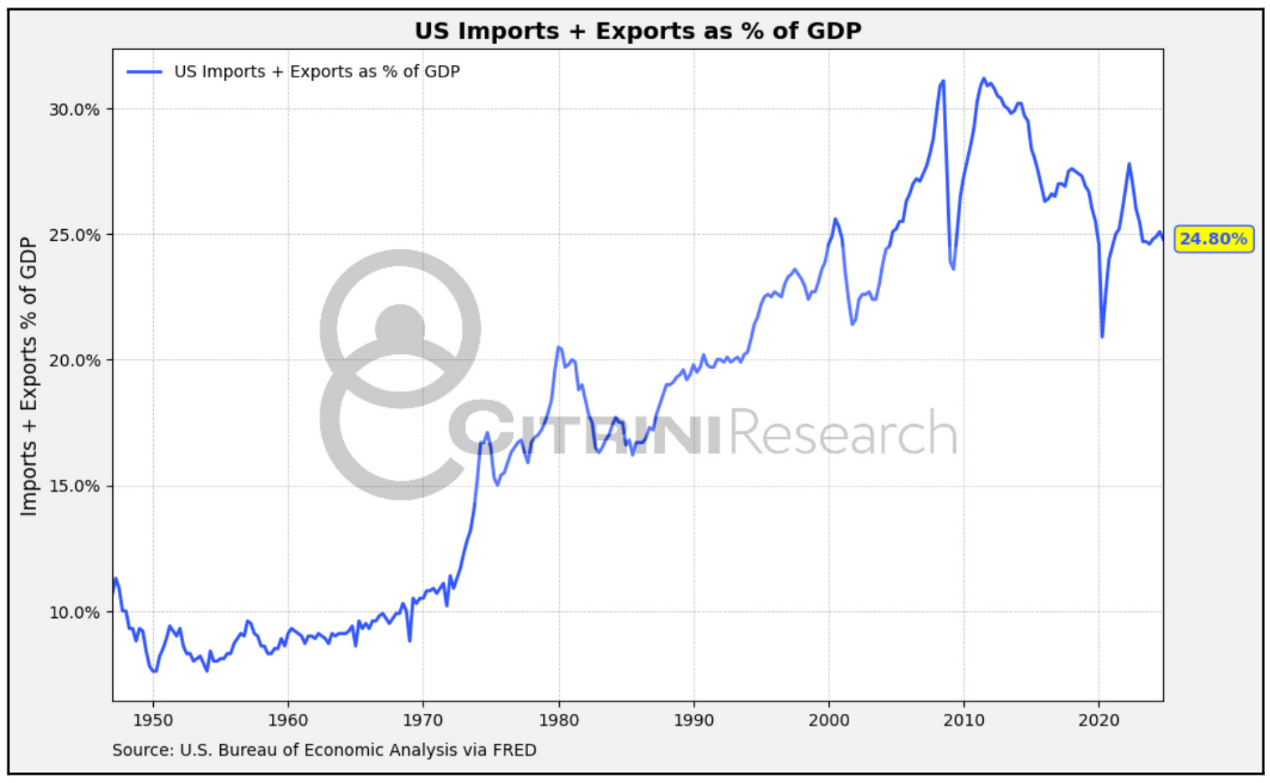

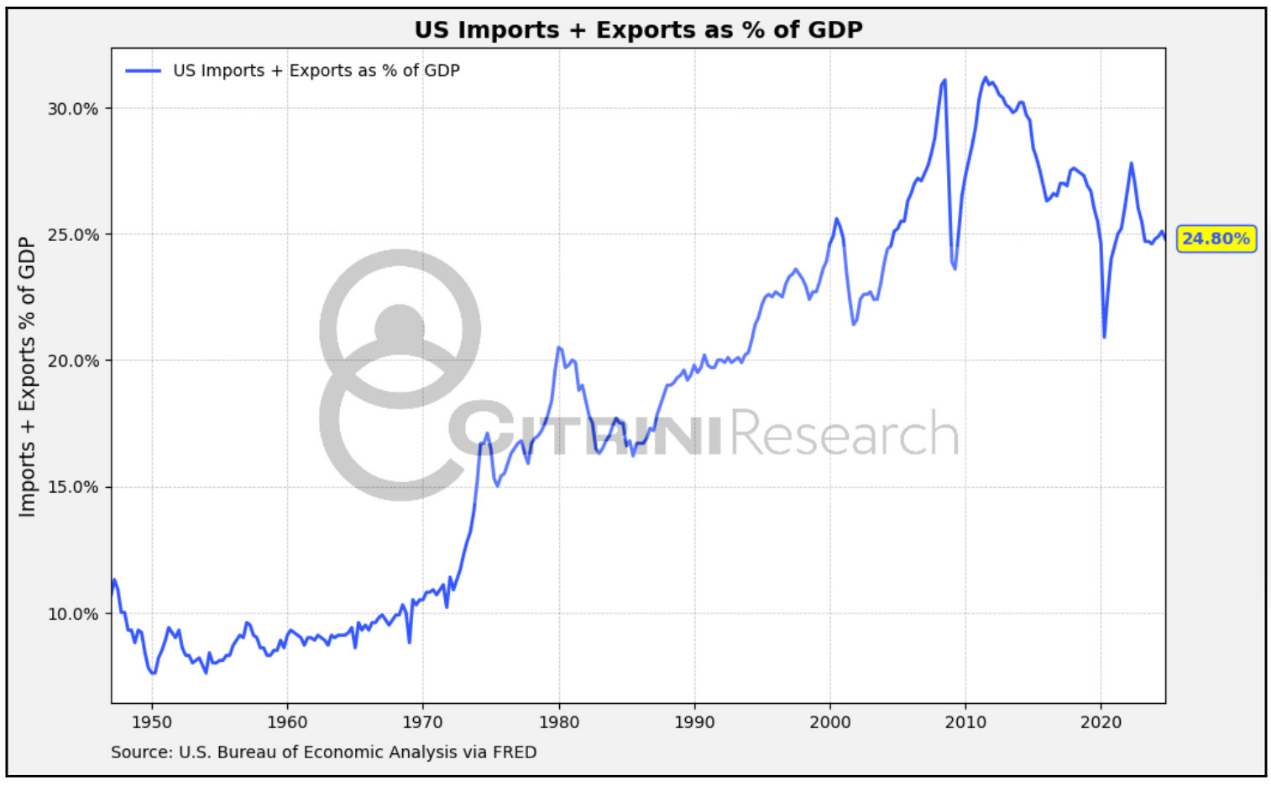

Why do you feel uncertain? A simple fact is that almost everyone today has only experienced a world where globalization is increasing, trade is relatively free, and the United States is the world hegemon and reserve currency.

With this being questioned, investors and operators are clearly looking for framework solutions that can cope with the future. For systems based on "instant system", "waiting and watching" is a fatal strategy, but there is no choice.

For example, when talking with a top 100 company in Shanghai (ranked by trade volume), he said: "We should have stepped up the process of holiday orders now. But at present, no order has been received." Anyone who is unfamiliar with how imported goods operate should realize that first, ordering items for an event is usually 8 months in advance. Second, we are going through a considerable shift.

Chinese companies have always believed that tariffs are something they can adapt. In the past, a 10% tariff could have caused buyers to seek price cuts from Chinese factories (which can be easily done). While factories obviously cannot handle over 100% tariffs by price cuts, they do believe that they can maintain their cost advantage over U.S. domestic manufacturing after the tariff is imposed. But when no one makes a deal, it doesn't matter.

I haven't published a historical article in more than two years. These articles are not necessarily actionable. But this article seems to be at the right time. Sometimes, the only way to understand the future is to understand the past.

Many philosophies such as mercantilism, isolationism, protectionism, etc. are thrown out randomly, but few people care about the meaning behind them. Although I am not an economist, I am an economic history enthusiast. You might as well treat this article as a popular science article. This article does not talk about what stocks you want to buy or sell, nor does it make directional judgments on foreign exchange, stocks or interest rates.

Understanding tariffs from a historical perspective

Nowadays, few people have truly experienced the economic situation in a similar tariff period as today. The best book on the history of US tariffs is Clashing over Commerce, which has been reading repeatedly over the past few weeks.

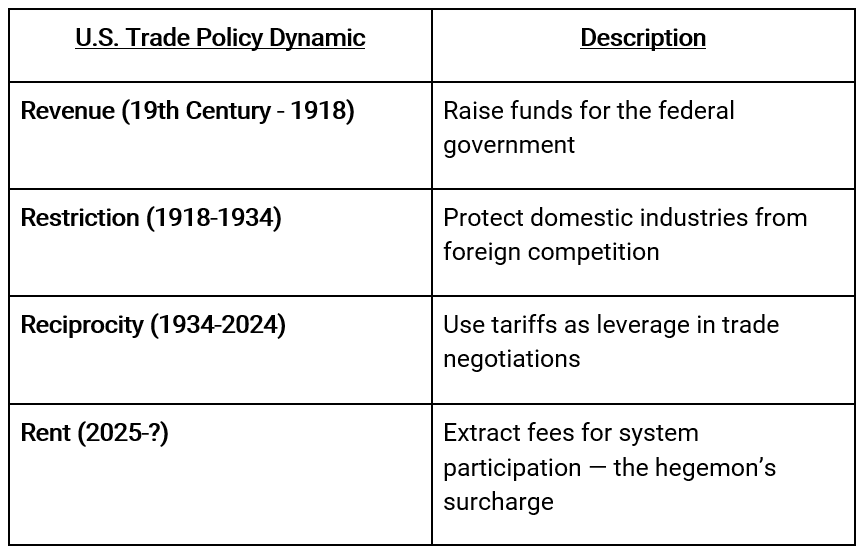

Written by Douglas Irwin, a famous historian and archaeologist who studies U.S. trade policy, the book proposes a "3R" framework for understanding tariff political economy.

Historically, the "3R" framework of US tariffs:

income

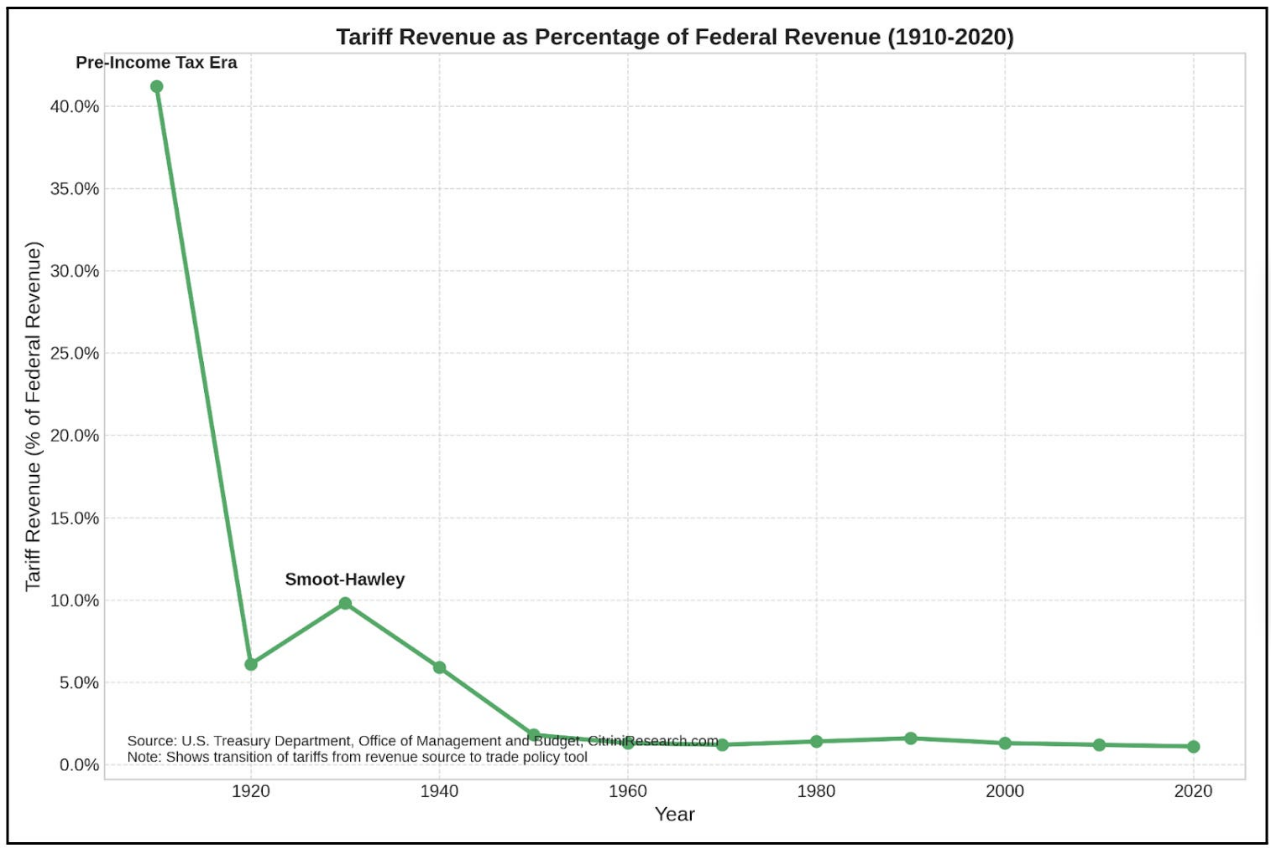

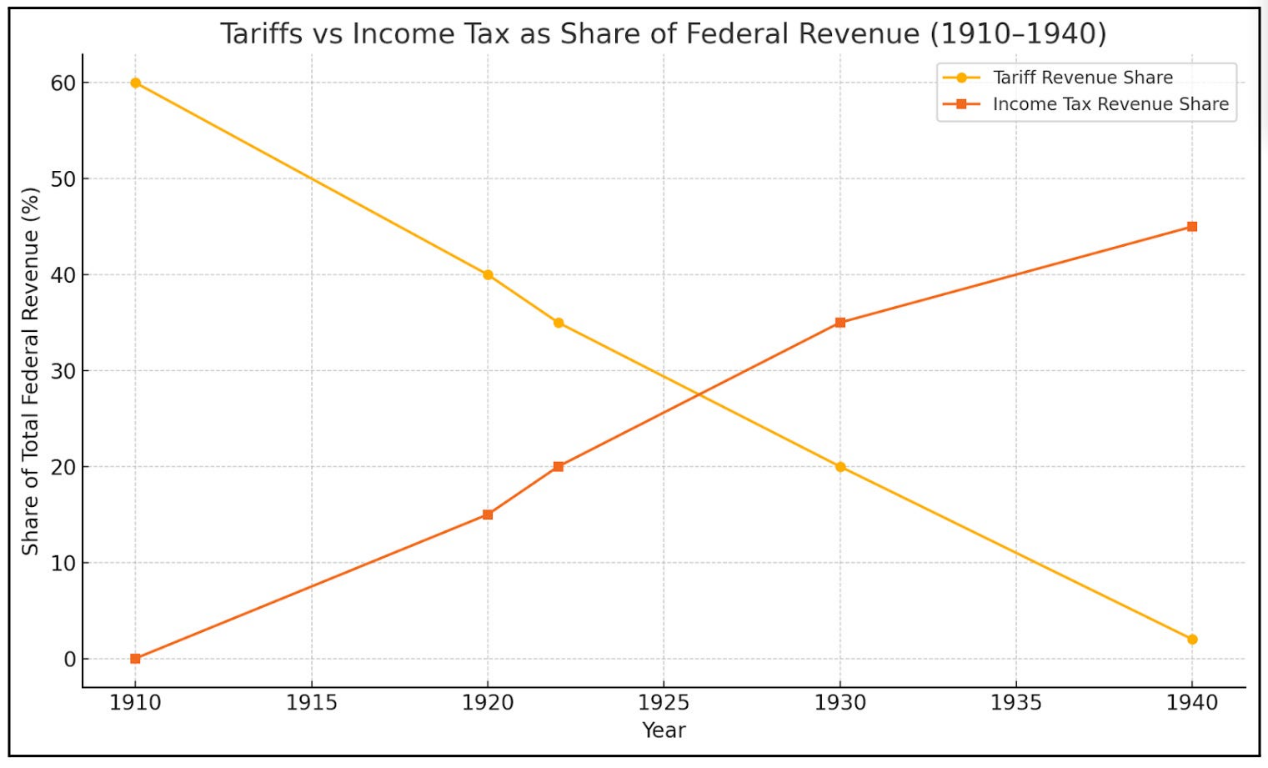

Tariffs are the main source of government revenue. This was especially true in the 19th and early 20th centuries.

_The tariff bills have long been criticized as opaque and difficult to operate policy tools, even if they are the main source of government funding, as_ _shown in_ this _1883_ political cartoon.

Before the IRS was founded (1913), there was no income tax in the United States. In the 19th century, tariffs accounted for more than 90% of government revenue. At the time, tariffs were mainly used to increase income rather than protectionism—this was seen as a more acceptable way to tax the people without triggering rebellion. In the first third of the 20th century, less than 15% of U.S. citizens paid income tax. The rest are paid intangible at the prices of imported sugar, wood and wool. Tariffs are the initial invisible tax: levied at the port and paid at checkout.

First, they are a way to fund the state, avoiding the establishment of internal taxes that could trigger a political backlash (a lesson learned from events like the whiskey riot). In Irving's narrative, the income issue dominated the early trade policy of the Republic, and even the protectionist arguments must be elaborated through the perspective of income priority.

limit

Tariffs are the protection of domestic industries.

After World War I, tariffs became more of a political tool to cater to the foreign competition faced by domestic industries—the driving force of protectionism.

Irving pointed out that as income motivation declines (thanks to income tax), motivation for restrictions has increased. After World War I, tariffs increasingly served industrial lobby groups rather than the Ministry of Finance.

Reciprocity

Tariffs are bargaining chips in international trade negotiations.

By 1934, income tax gradually replaced tariffs and became the main source of federal funds—the New Deal and World War II accelerated this transition. Tariffs have become bargaining chips in global trade negotiations.

This is the logic behind the 1934 Reciprocal Trade Agreement Act, the General Agreement on Tariffs and Trade, and later the World Trade Organization. The era of reciprocity marks the move towards liberalization and escape from isolationism. The hegemonic state (US) exchanges the opportunity to enter foreign markets by reducing tariffs. Tariffs are no longer a barrier, but more like leverage. VERs, the behind-the-scenes transactions designed to force countries to impose export restrictions, replaced tariffs and eventually replaced by more, larger free trade agreements. This drove the arrival of the era of multilateral free trade in the late 20th and early 21st centuries.

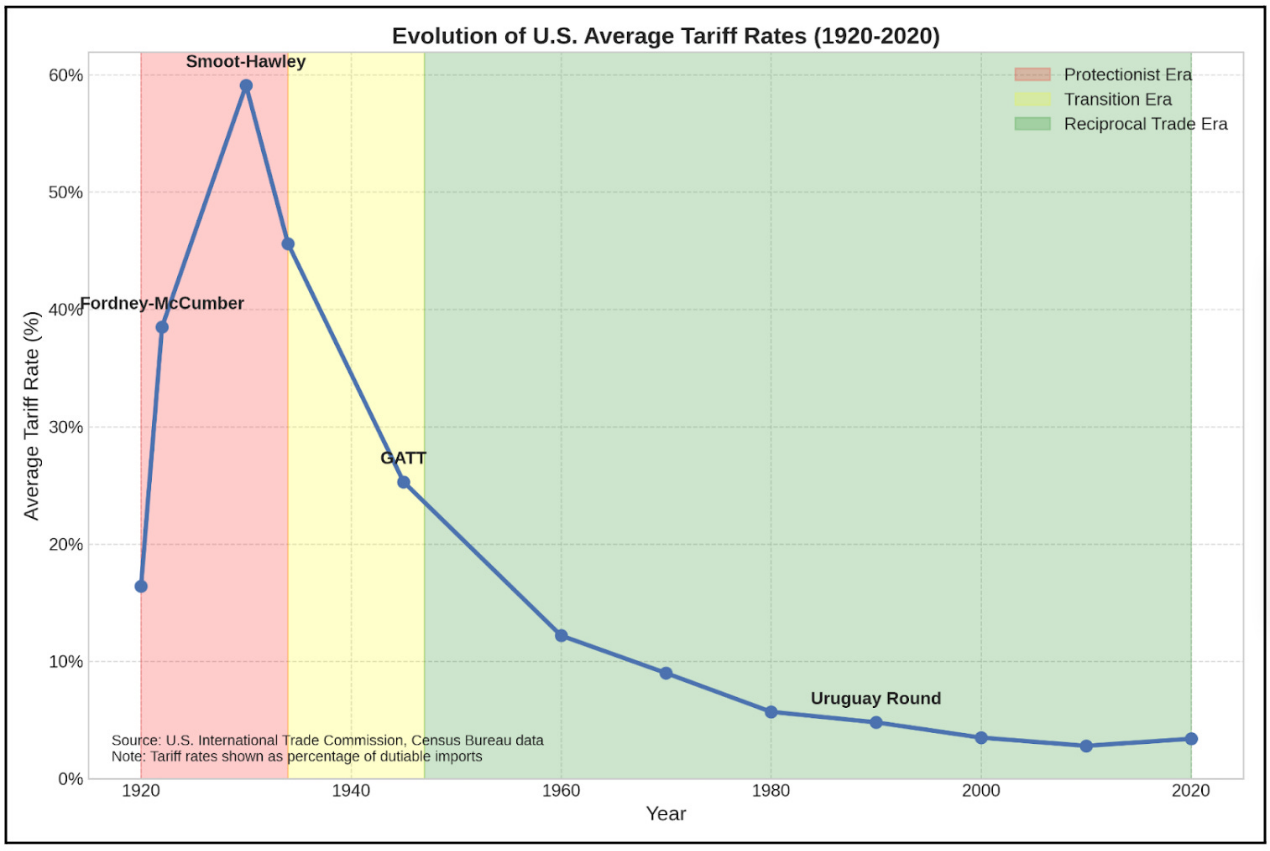

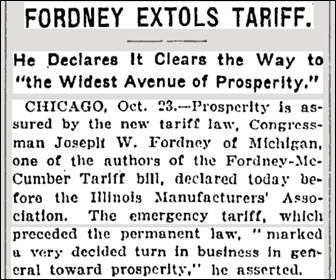

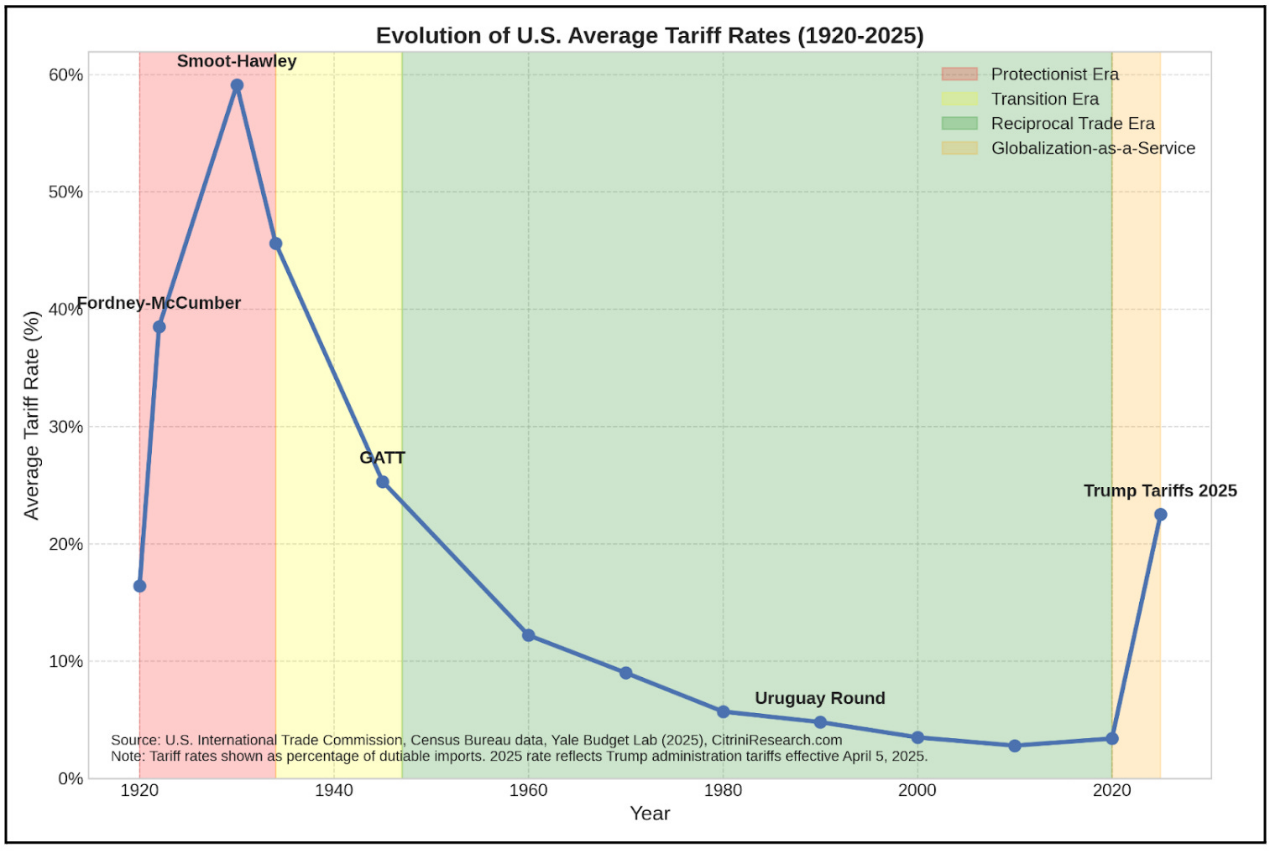

1922 : Fordney - Mccomber tariffs

The Fordney-Mccomber Tariff Act is the prototype of early protectionism overdesign and the first real case of tariffs imposed for non-fiscal revenue purposes.

Imagine the glorious scene of America after World War I: America’s industrial output is abundant, but its farmers are becoming increasingly poor. The most worrying thing at the time was the cheap competition from Europe, but Europe still owed the United States a lot of money, and because the United States continued to raise tariffs, Europe could not sell anything to the United States at all. So, it is obvious that the United States has raised tariffs again.

In 1921, Congress passed an emergency tariff bill, followed by the comprehensive Fordney-Mccomber tariff law of 1922, signed by President Warren Harding.

This law greatly increased tariffs, far exceeding the low levels set by the Underwood Tariff Act of 1913 and above the tariff levels since the Civil War (but in terms of imported goods subject to tariffs, the tax rate was roughly the same as the Penn-Aldridge Tariff Act of 1909). In addition, the law also gives the president the power to adjust the tax rate, with a range of up to 50%, to "balance domestic and foreign production costs."

What is the result? Urban industries flourished in the 1920s, but agriculture fell into a long-term recession, and Europe's trade surplus gradually shrank. You should know that they had to rely on the trade surplus to repay the supplies provided by the United States during the war.

The 1920s were a brilliant decade for American industry. Between 1922 and 1929, manufacturing output increased by nearly 50%. The unemployment rate dropped from 6.7% in 1922 to 3.2% in 1923. Steel, chemical, automobile and other industries are booming under the protection of tariff barriers. Protected industries have expanded, increased hiring and made profits. During this period, corporate profits almost doubled.

However, the situation in the agricultural sector is completely opposite. Agricultural income plummeted from US$22 billion in 1919 to US$13 billion in 1922. While cities are booming, rural America has fallen into a decade-long Great Depression, ten years ahead of the Great Depression. What is the reason? European markets were closed due to retaliation, while American farmers who expanded production during the war faced a plunge in demand and prices.

In the 1920s, protectionism brought about concentrated benefits. If you are an urban industrial worker, it is a good time. If you are a farmer, this is the beginning of 20 years of suffering. The momentum of protectionism has begun and has achieved some success for some (although others have paid a high price).

1930 : Mistakes

Large-scale tariffs, massive depression.

In 1928, Herbert Hoover was in a thrilling mood. The great engineer won the presidential election by a landslide: 444 electoral votes, while Al Smith won only 87, and Hoover won even more counties than Warren Harding in 1920, and won 58% of the popular vote. In his inauguration speech, the "prosperous president" promised the American people "totally overcome poverty" - but these words quickly became his nightmare.

Stocks soared, unemployment rates were low, and Americans bought cars, radios and refrigerators at an unprecedented rate. Since McKinley's victory in 1896, the fourth party system dominated by the Republicans ( PANews note: The political ecology of the United States between 1896 and 1932 ) seems to be as deeply rooted as ever.

Like his Republican predecessor, Hoover is a big fan of protective tariffs. "For 70 years, the Republican Party has supported a tariff aimed at fully protecting American labor, American industry and American farms from foreign competition," Hoover declared during the campaign. He has made tariff protection, especially agriculture, a cornerstone of his economic agenda.

As Secretary of Commerce of Harding and Coolidge administrations, Hoover formed a clear protectionist concept: the United States should basically limit imports to products that cannot be produced at home. This is not a radical move, but a pinnacle of McKinley's Republican tradition and a natural extension of the economic orthodox thinking of the Fourth Party system.

Hoover used the "success" of the Fortney-Mccomber tariff law (the total U.S. imports have increased since the passage of the bill) as evidence that the United States can simultaneously protect its own industry and expand sales in Canada. “In view of the broad prospects of our trade, we can ignore the concern that raising tariffs would significantly reduce our total imports, thus destroying other countries’ ability to buy products from us,” he wrote in 1926. “The claim that we cannot have both protective tariffs and growing foreign trade is unfounded. Today, we have both.”

Then came the "Black Thursday" on October 24, 1929. Five days later, the stock market value evaporated by more than $30 billion, almost twice the amount of the United States invested in World War I. The noisy 20s came to an abrupt end. In the midst of turmoil, tariff negotiations have not subsided, but have become increasingly fierce:

In view of the economic turmoil, Congress has not only failed to reconsider tariff legislation, but has become more and more serious. The original agricultural tariff bill evolved into what is now known as the Smurt-Holly Tariff Act, named after its main sponsors, Senator Reed Smurt of Utah and Rep. Willis C. Hawley of Oregon. The bill originally intended to first relieve farmers, but eventually turned into a freak of industrial protectionism.

Oriented moves initially aimed at protecting American farmers turned into a protectionist melee. Between 1929 and early 1930, the bill was under Congressional consideration, and the number of protected industries grew exponentially. Ultimately, the bill raised tariffs on more than 20,000 imported goods, setting the highest tariff rate in U.S. history since the "notorious tariff" in 1828.

_The cartoon depicts a exhausted Republican elephant sitting in the middle of the road, leaning against a_ _large rock_ marked _\"_ _Tariff Act_ _\"_

The market is not buying it. 1028 economists, despite their end of disagreement on how to get rid of the economic hardship of the Great Depression, reached a consensus on one point – if the bill was passed, it would be a disaster.

They wrote to Hoover, begging him to veto the bill:

_Front page news_ _on_ _May_ _8_ _,_ _1930_

"I almost knelt down and begged Herbert Hoover to veto the stupid Holly-Sumter Tariff Act. This bill would intensify nationalist sentiment around the world," JPMorgan partner Thomas Lamont later recalled.

Henry Ford spent the whole night in the White House trying to convince Hoover that the tariff bill would cause serious economic damage.

However, on June 17, 1930, Hoover signed the bill, which was sufficient, although political suicide was not achieved overnight. The rapid increase in unpopularity of this tariff bill is evident from frequent readers' letters from The New York Times:

What happened next, as they said: More than 25 countries took revenge. Global trade collapses.

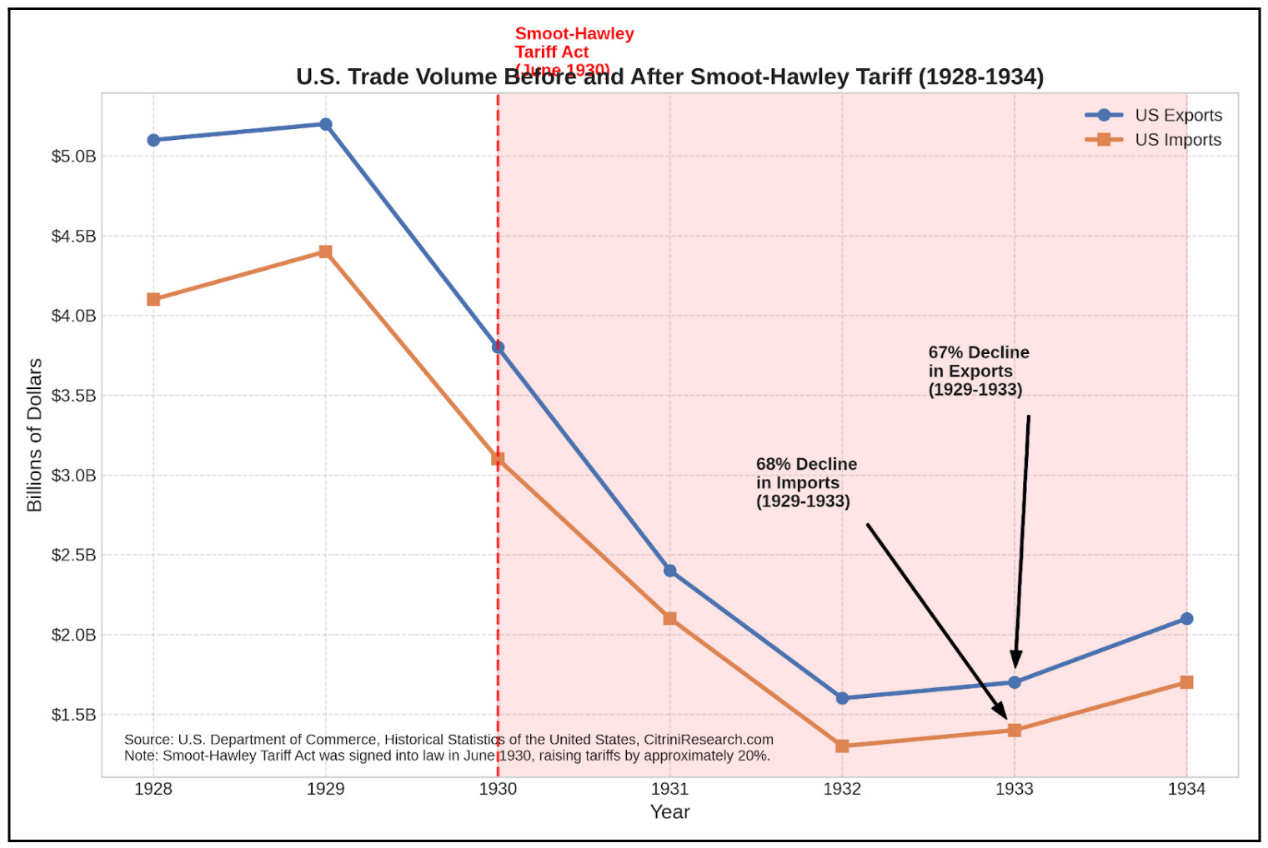

In 1929, the United States imported $4.4 billion, and fell to $1.3 billion by 1932. Exports fell sharply from US$5.4 billion to US$1.6 billion during the same period. Between 1929 and 1934, world trade volume decreased by about two-thirds.

The 1929 stock market crash triggered an economic recession, and tariffs turned it into a Great Depression.

It was just a financial shock at first, but it later turned into a systemic crisis because policies - especially the Smut-Holly Tariff Act - were stifled from the supply side when the demand side declined.

As economists predict, American consumers and businesses pay the price for it. Tariffs may protect some jobs in specific industries, but they have destroyed more jobs by raising the prices of imported raw materials and closing the door to foreign markets for exporting goods to the United States.

Democrats realized the disaster and used tariff reform as a key campaign platform in the 1930 midterm elections—the first time they had taken control of both houses of Congress since 1918. Roosevelt said of the Smut-Holly Tariff Act that it “forced countries around the world to build such high tariff barriers that world trade is decreasing to a point where it almost disappears.”

The ending is obvious: The Smurt-Holly Tariff Act has completely failed.

How are the tariffs in 1922 and 1930 different?

First of all, from the starting point: The Fordney-Mccomber tariff law was implemented during a period of relative global economic growth, especially in the United States. The hustle and bustle of the 20s obscures many of its inefficiencies. The Smut-Holly Tariff Act was passed after the stock market crash in 1929, when global demand was already shrinking. It makes the bad situation worse. From a protectionist perspective, tariffs are a catalyst for recession, but they still need a blow-out point.

In 1922, enterprises and consumers were full of confidence, abundant credit funds, and a relaxed financial environment. By 1930, bank bankruptcies, stock prices fell sharply, and credit tightening was common. At this time, the Smut-Holly Tariff Law was introduced, significantly raising the tax rate, covering as many as 20,000 types of commodities, which undoubtedly added to the insult, indicating that the government adopted crazy policies at critical moments, causing investors to panic and worry about further escalation of protectionism.

Secondly, retaliatory measures. The Fordney-Mccomber Tariff Act triggered some limited retaliation (such as the measures taken by France in 1928 and the selective tariff imposed by some European countries), but global trade was still expanding in the 1920s. It is easy to measure the damage caused by the Smurt-Holly Tariff Act from direct economic impacts—raising the average U.S. tariffs on imported goods subject to tariffs to 59.1%, the highest level since 1830. But the real disaster is not the tariff itself, but the global retaliation it triggers.

Canada was the largest trading partner of the United States at the time and did not take major retaliation against the United States' tariff hikes. The Fordney-Mccomber Tariff Act of 1922 raised tariffs on important Canadian exports such as wheat, cattle and milk, but Canadian producers believed that these were just restored to pre-World War I levels and were tolerated.

The Smut-Holly Tariff Act is different. At that time, the global economic recession continued to intensify, and Canada's export industry had suffered a heavy blow. In July 1930, the Smurt-Holly Tariff Act was just passed, and the Canadian Liberal government lost to Conservative leader Richard Bennett in the general election. Bennett fulfilled his campaign promise to "force" open up the world market by raising tariffs. If you push other countries into desperate situations, your reaction will become increasingly difficult to predict.

In September 1930, Canada significantly increased tariffs on 16 American products, which accounted for about 30% of U.S. exports to Canada. Canada is not satisfied with this and has negotiated preferential trade agreements with other Commonwealth countries, further weakening the competitiveness of U.S. export products.

The retaliation did not stop in Canada. By 1932, at least 25 countries had taken retaliatory measures against U.S. goods. Spain has specially formulated "Wess tariffs" for American cars and tires. Switzerland boycotts American products. France and Italy impose quota restrictions on U.S. goods. Britain abandoned its traditional free trade policy and adopted protectionist measures. This has led to a deterioration of the situation and global trade has stalled due to uncertainty and the ongoing escalation of tit-for-tat trade policies.

Third, global financial situation. In 1922, the United States remained a rising creditor, but the gold standard had not yet been fully restored, and many countries were still recovering from World War I. There was no closely integrated global financial system at that time. However, by 1930, the gold standard had been reestablished globally. International trade and debt flows are more closely linked.

Finally, from a symbolic point of view, the Fordney-Mccomber tariff law is a bad policy, but it is also expected. Tariffs have been the norm in the United States since the American Civil War, and many trading partners believe that the Fordney-Mccomber tariff law is just back to pre-World War I levels. However, the Smurt-Holly Tariff Act is seen as an escalation in a time of obvious fragility around the world. It shows that the United States is turning to an inward economy as it has consolidated its creditorship status. It weakens confidence in global coordination and may prompt many countries to abandon the gold standard soon after.

Market and policy makers interpreted the Smurt Act as not just a matter of tariffs, but a worldview: isolationism, chaos and irrationality. Uncertainty has suppressed business investment.

This is a unique and unprecedented disaster in the era of protectionist trade policy that paved the way for Roosevelt's election. Roosevelt quickly abolished tariffs and passed the Reciprocal Trade Agreement Act (RTAA).

1934 : RTAA – The Beginning of Reciprocity

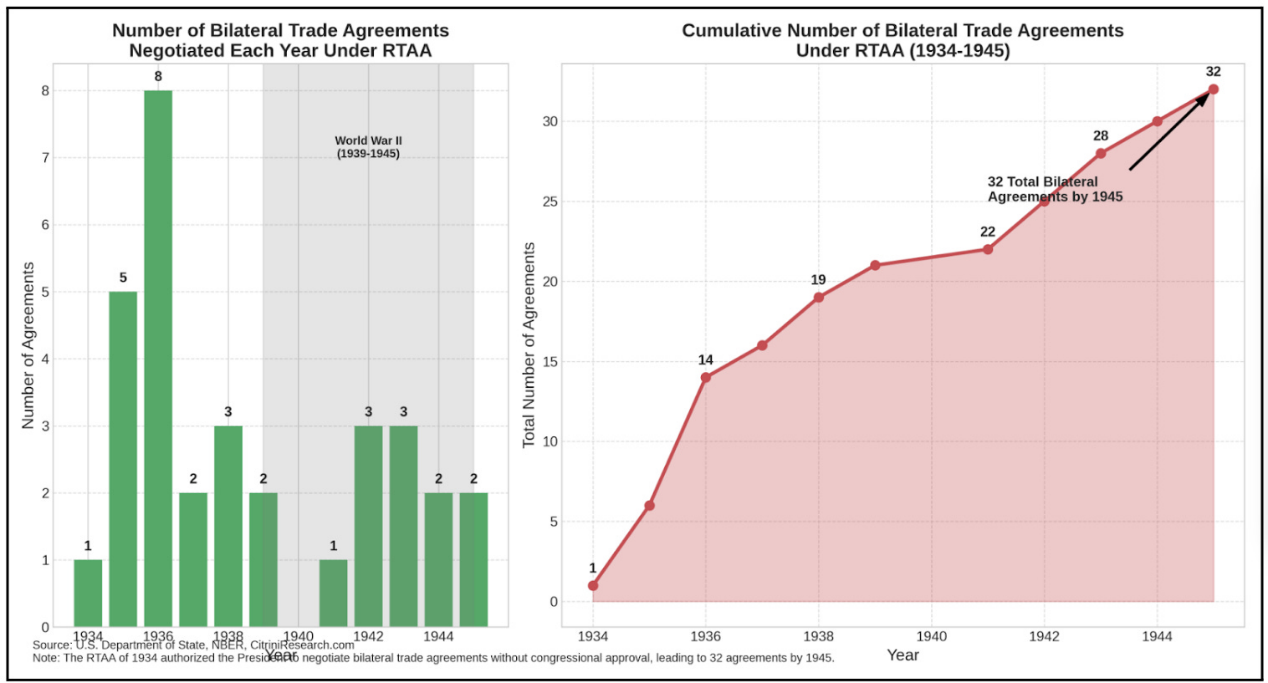

U.S. trade policy has reached a crossroads after the protectionist disaster triggered by the Smurt-Holly Tariff Act. The introduction of the 1934 Reciprocal Trade Agreement Act marked the shift of power to decide trade policies from Congress to the executive branch, thus opening the transition from “restriction” to “reciprocal.” This institutional change fundamentally changed the way trade policies were formulated and laid the foundation for a more liberal trading system after World War II.

The history of modern international trade began with Cordell Hull, a Democrat from Tennessee who later became the longest-serving Secretary of State in the United States. Hull walked all the way from the developed agricultural South, which profoundly influenced his views on tariffs and trade. Unlike his northern colleagues who tried to protect manufacturing, Hull knew that high tariffs would hurt agricultural exports.

_Sign the United States_ _-_ _Canada Trade Agreement. (Front row, left to right): Cordell_ _Hull_ _,_ _WL_ _Mackenzie_ _King_ _, Franklin_ _Roosevelt_ _, Washington, DC, USA_

November 16 , 1935

Hull's understanding of the international level of trade is gradually formed. He later recalled that before taking office in Washington, he “had experienced a fierce tariff war in person—but these battles were all at home, arguing whether high or low tariffs were good or bad at home. Few people thought about their impact on other countries.”

The Reciprocal Trade Agreement Act emerged from the ruins of the failed Smut-Holly Tariff Act. The Smurt-Holly Tariff Act, as a protectionist bill, has triggered retaliatory tariffs from countries, seriously hindering the development of world trade, while the Reciprocal Trade Agreement Act has opened up a new path for international cooperation. It introduces three revolutionary concepts that will define the era of reciprocity trade:

- Executive Power: For nearly 150 years, Congress has carefully defended the power of “management and foreign trade” under its constitution, resulting in trade policies being swayed by local interests. The Reciprocal Trade Agreement Act transfers a large amount of negotiation power to the president, allowing the president to reduce tariffs by up to 50% without the approval of Congress.

- Bilateral cuts: The bill allows targeted negotiations with various trading partners, creating a more strategic pathway for trade liberalization and gives the export industry the same status as the import competition industry at the negotiating table.

- Most-favored-nation clause: Tariff cuts negotiated with any country will automatically apply to all countries that have signed commercial agreements with the United States, thus creating an expansion effect and accelerating the process of global trade liberalization.

_While the bill initially focused on bilateral agreements, it created a template that later provided reference for the international trade architecture_

1947 **: Bretton Woods System and General Agreement on Tariffs and

Trade** — Rules for the World of War

With the end of World War II, the founders of the post-war economic order gathered at a resort hotel in the White Mountains, New Hampshire. The Mount Washington Hotel in Bretton Woods will name the system they designed — a framework designed to prevent economic nationalism and financial instability, which are the causes of World War II.

The Bretton Woods Conference in July 1944 brought together 730 delegates from 44 Allies for three weeks of intense negotiations. The meeting reflected two competing ideas about the post-war economic order. On one side is British economist John Maynard Keynes, who represents the war-torn Britain now relies on US financial aid. The other side is Harry Dexter White, who represents the United States, which is now an economic giant.

Keynes proposed an ambitious "United Nations Settlements Alliance" program that would set up a global currency (which he calls "bancor") that automatically balances trade and prevents excessive surpluses or deficits. White's plan is more conservative. While retaining the sovereignty of various countries, it established exchange rate stability rules based on the US dollar and gold of 35 US dollars per ounce.

White's plan was largely victorious, but also made important concessions to Keynes' concerns about adjusting flexibility. The final agreement established two key institutions: the International Monetary Fund (IMF), which monitors exchange rates and provides short-term financing to countries facing balance of payments difficulties; and the International Bank for Reconstruction and Development (IBRD, now part of the World Bank), which promotes reconstruction and development through long-term lending.

The Bretton Woods system represents a compromise between the rigidity of the gold standard before 1914 and the chaos in the currency wars during the two world wars. Countries will maintain a fixed but adjustable exchange rate to the US dollar, which acts as the anchor of the system through its peg to gold. The IMF will provide short-term financing to countries facing temporary balance of payments issues, allowing them to adjust without immediate appeal to austerity or competitive currency depreciation.

The system was designed with a clear intention to prevent catastrophic economic nationalism in the 1930s. By providing liquidity and assistance, the system aims to provide countries with breathing space to maintain domestic economic stability and international cooperation. The founders of the Bretton Woods system are well aware that the choice between domestic economic goals and international obligations tear apart the economic system during the two world wars. Crucially, the founders of the Bretton Woods system realized that monetary stability alone was not enough.

A complementary trade framework is needed. This is reflected in the General Agreement on Tariffs and Trade (GATT) signed in 1947.

Although the United States and the United Kingdom agreed on the framework of the system, there were differences on core issues. The United States wants to eliminate the British imperial special offer. Britain hopes the U.S. cuts its tariffs significantly, as these tariffs have remained high since the Smut-Holly Tariff Act era. What is the compromise plan? Multilateralization, downplay political influence, and disperse pressure from all parties.

Its core pillars:

- Most-Fast-National Treatment (MFN): Every trade offer made to a member state must apply to all member states.

- Tariff constraints: Once tariffs are cut, tariffs cannot be raised free of charge.

- Quota cancellation (for the most part): because nothing reflects the "central plan" better than chicken import restrictions.

Over the next few decades, a series of negotiations by the General Agreement on Tariffs and Trade (GATT) (Annecy, Torquay, Dillon, Kennedy, Tokyo, Uruguay) gradually weakened global tariffs and transformed temporary peace after the war into a well-functioning world order. By 1994, the GATT was renamed to the WTO, and the global average tariffs had dropped from 22% to below 4%. From the initial 23 founding parties, it gradually expanded to cover most of the world's trading countries and witnessed a sharp expansion of international trade in the decades after the war.

The exquisiteness of the General Agreement on Tariffs and Trade lies in its simplicity. It regards tariffs as nuclear weapons: dangerous use, and contagious retaliation. The core principle of the GATT is that not all trade is beneficial, but that any retaliatory protectionism is bad. In fact, it is a behavioral contract: there are no more weaponized tariffs. No more trade collapses. If you want to raise barriers, you have to pay the price. If you reach an agreement, you have to share it.

Because of this, the General Agreement on Tariffs and Trade has been unexpectedly enduring. For decades, it worked for a simple reason: When it fails, everyone remembers what happened.

However, it turns out that the Bretton Woods monetary system is less elastic. Faced with the ongoing balance of payments deficit and declining gold reserves, President Nixon suspended the convertibility of the US dollar to gold in August 1971, effectively ending the fixed exchange rate Bretton Woods system.

1971 : Convertible end of USD and Gold

From the Age of Discovery to the Colonial Age (about 1400 to the mid-1900s), gold and silver widely acted as currencies for international trade settlement. In particular, Spanish silver dollars are most commonly used in international trade settlement (the term "dollar" has the etymology of silver mines). Generally speaking, fiat currency systems based on IOUs may work well locally (trust and law enforcement are practical) but not internationally.

For example, in the Golden Age of Pirates, the Caribbean was a melting pot of European colonial empires (UK, France and the Netherlands), and all colonial empires used Spanish silver dollars for trade settlement. The Spanish Empire was the largest source of silver and minted standardized, ubiquitous silver coins. Even on the other side of the earth, China only accepts silver (especially Spanish silver dollars) in exchange for tea it sells to the UK.

During the period when the British pound (gold backed) was the main reserve currency, the United States became the world's largest economy during the American Industrial Revolution in the late 19th century and became a recognized military superpower in 1944. After 1971, the US dollar became the first truly legal global reserve currency. It can be understood as follows: under the winner-take-all network effect, the US dollar has become and continues to become the dominant global reserve currency.

It is not difficult to understand what impact this has had on the US economy:

Given that gold and silver minerals are everywhere, even the monetary system under the Bretton Woods system means that no country is the only source of global reserve assets. Under the Bretton Woods System (1944-1971), the currencies of various countries are pegged to the US dollar, and the US dollar can be converted to gold at a fixed exchange rate. Therefore, besides gold itself, the pound and Swiss franc are also functional alternatives to reserve assets.

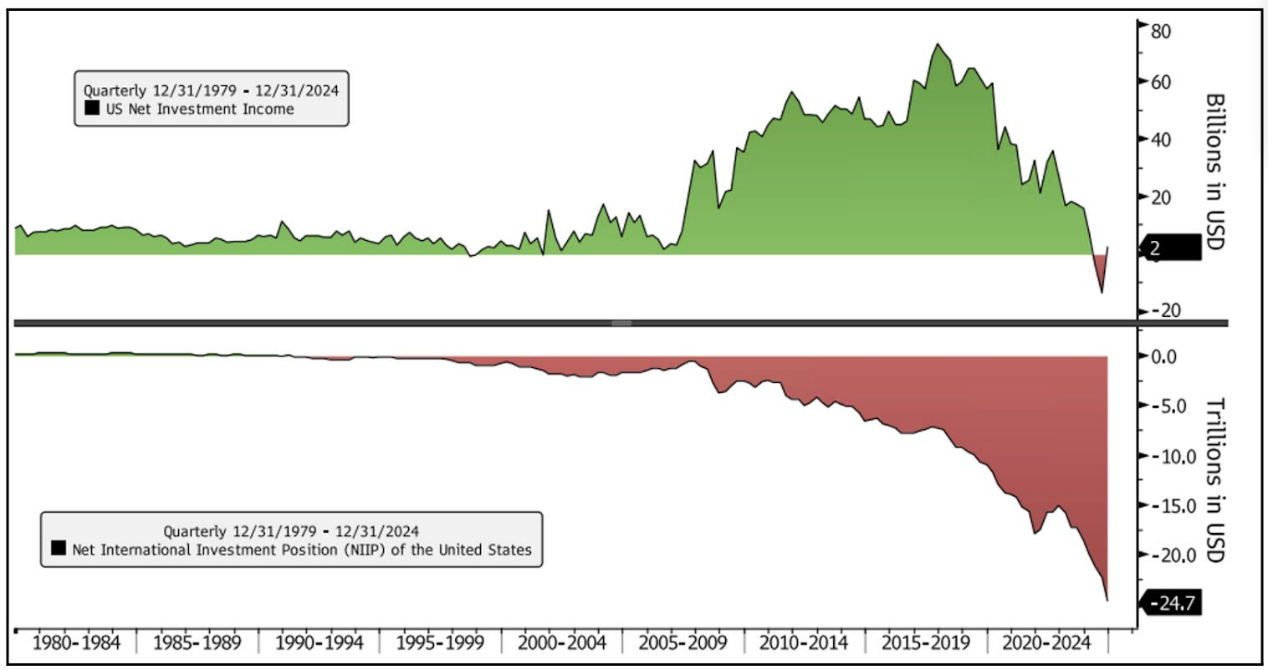

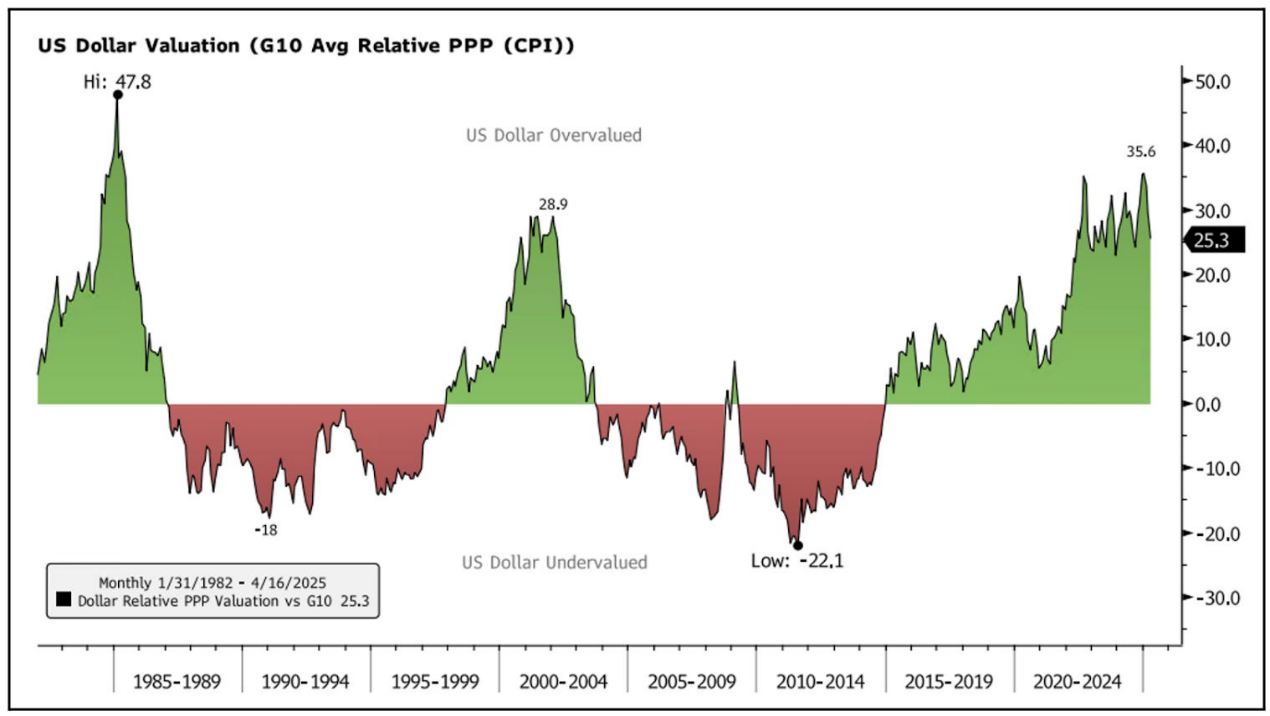

Somewhat surprisingly, the end of the Bretton Woods system in 1971 consolidated the US dollar's status as the world reserve currency. As the only source of major reserve currency, the United States ended up falling into a dynamic of sustained trade deficit to provide liquid reserve assets to the rest of the world. This seems abnormal because at first the dollar was abandoned, people tended toward the "real" thing-gold. In the 1980s, Volker reestablished the US dollar as the world's reserve currency. In 1980, gold was no longer a one-way bet relative to the US dollar. It was "revealed" as an unstable commodity that is susceptible to speculative booms and busts-not a stable means of storage of purchasing power. Since the 1980s, the United States has struggled to achieve a trade surplus (because the rest of the world naturally tends to accumulate financial wealth denominated in reserve currencies).

However, the dollar's reserve currency status is not without its benefits to the United States. The concept of “overprivileges” means that while the rest of the world owns more U.S. assets than the rest of the world owns in the rest of the world, the United States actually gains more from its overseas investments. This is because a large proportion of the assets held by the United States overseas exist in the form of high-quality, low-yield dollar currency balances and fixed-income securities (such as US Treasury bonds, institutional MBS, etc.).

When international trust and enforcement exist (and for decades), an IOU statutory system can work globally, but the global order of American hegemony is now being questioned—not from the rest of the world, but from the United States itself.

How will it develop in the future?

Although the world has undergone earth-shaking changes since the era of reciprocity after World War II, the fundamental contradictions that have shaped the history of US tariffs still exist. Today is at the inflection point of changing trade policies in 1930, 1947 and 1971. Just as those turning points are driven by a shift in the U.S. position in the global order, today’s tariff recovery reflects another adjustment of economic strength. However, there is a key difference between the two: the United States is actively breaking the system it has built.

The crisis will not end in three months.

Everything the U.S. has done in the next three months is not to reduce the burden on trade or return to a reasonable model (such as 10% full tariffs and targeted reciprocity), which will be the first shot. Its focus will be on isolating China, trying to force it to sit on the negotiating table. If you don't stand with us, it's like going against us.

Inventories equivalent to 2-3 months in domestic warehouses in the United States are sufficient to offset or distort the initial impact of global trade. As these inventory dry up, it will begin to witness the real impact of the global trade freeze and its subsequent effects. Foreign exchange reserve management agencies will continue to reduce investment in the US dollar, as the US dollar has entered a long-term bear market.

The suspension of tariffs is a tactical stance in ongoing negotiations. There is little chance that the United States and China will reach a permanent solution in the next 2-3 months, but trade negotiations with Europe and even Latin American countries may make some indirect progress. The market interprets this as a move to ease tensions, but the reality is that it increases uncertainty in the business environment. In order to survive the next 90 days, it must be clear...

How to understand the government’s view?

Under this context, it will be of great benefit to understand the government’s view. In Trump's view, the United States' hegemony and reserve currency status are unfair treatment for the United States - not only losing its advantages in the trade and manufacturing sectors, but also maintaining the global trade system "free". Therefore, the current position of the United States can be roughly summarized as:

The real strange thing is not the use of tariffs, which is nothing strange. Trump has been keen on tariffs for decades. If you are surprised by the tariffs imposed by "tariffs", you'd better make a fortune.

Surprisingly, these three "Rs" returned at the same time, but still failed to show the whole picture.

Revenue, fiscal revenue in the form of billions of new federal revenue, is not called tax increase, but is essentially no different from tax increase.

Restrictions are not only an industrial strategy, but also a populist aesthetic - a wall built in a port rather than a border, suitable for everything.

Reciprocity has changed from mutual relaxation barriers to grudges calculated by trade deficits.

Furthermore, there are other factors at work, which is not a mere income issue, but unique to this practice and the globalized world in which it occurs. An “R” is needed to define the change represented by this seemingly simple tariff rate hike. Because we are not really going back to the past dynamics, but are entering a completely new situation.

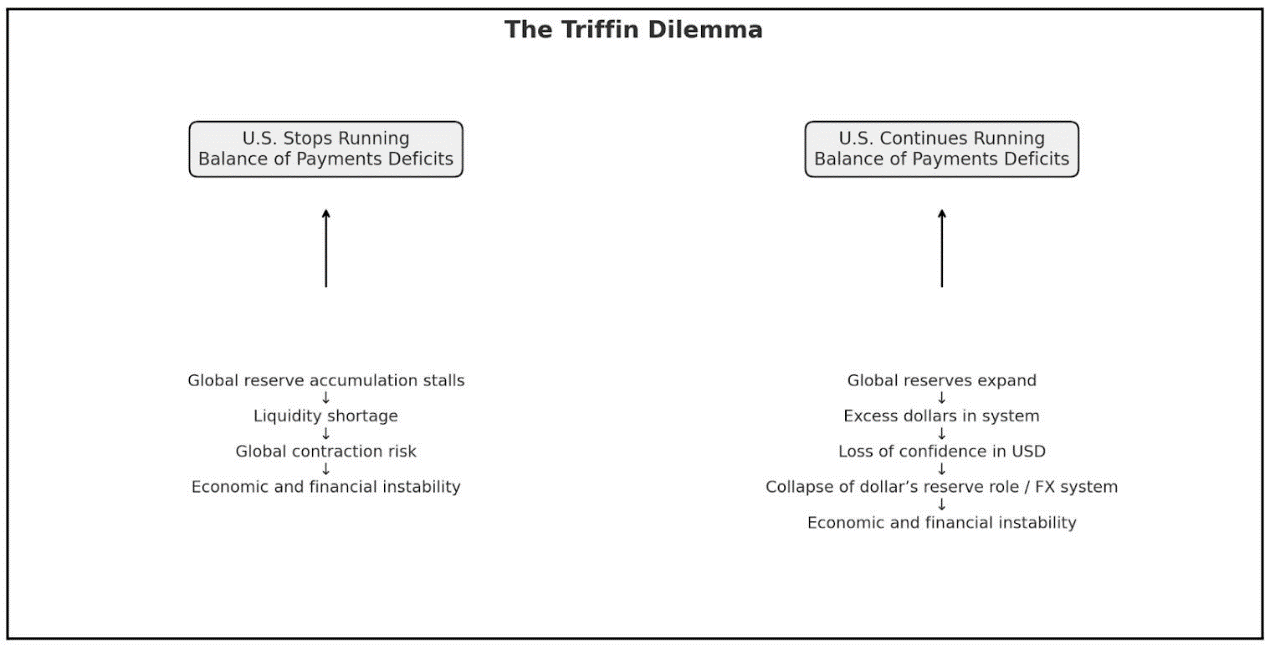

要做到这一点,必须充分理解政府的观点。我们在两周前的文章《Seeing the Stag》中提到了试图通过瞄准其他国家的逆差来重新平衡全球贸易所面临的挑战。“特里芬两难”描述了一个储备货币国家面临的悖论(在美元与黄金的可兑换性终止之前就曾出现过)。这个悖论如下:

_“_ _为全世界提供储备和兑换服务,对于一个国家和一种货币来说,实在难以承受。_ _”_ _亨利_ _·H·_ _福勒(美国财政部长)_

不出所料,特朗普政府对“特里芬两难”的解读,与其说是国际货币基金组织的白皮书,不如说是更多的是账单。他们认为美国被利用了,被迫承担对外贸易顺差,他们想要纠正这种现象。通过对各国的贸易逆差征收关税,很好地表明了他们的优先事项和担忧所在。

从特朗普政府的角度来看,现有体系中已经发生/正在发生的事情是:

- 外国央行购买美元不是出于偏好,而是出于义务——因为如果你想压低本币汇率,增加出口,就需要囤积美元。

- 那些美元被存入美国国债,而这恰好为抱怨被占便宜的同一个美国政府提供了资金。

- 美元仍然处于结构性高估状态,这是美元作为其他所有人的储蓄账户和救生艇的直接后果。

- 美国制造业被掏空,并非因为中国作弊,而是因为美国在一个它无法完全控制的网络中扮演系统管理员的角色。

- 最终,贸易逆差不断加剧,特朗普不喜欢“逆差”这个词,也不喜欢成为世界最大“债务国”的想法。储备货币的角色开始被视为一种负债,而不是一种特权。

从这个角度来看,关税不仅仅是为了保护工厂或资助政府。它们是系统维护的逾期费用。实际上,它们就像地缘政治版的“租金”,相当于你忘记订阅了却要每月支付14.99美元。更简单地说,政府的观点是:

“我们管理着这个系统——调节流量,保障航道安全,购买你们的出口产品,发行你们的储备资产。现在我们要向你收费了。”

第四个 R :租金

租金将关税重新定义为一种全球经济参与的按服务收费模式,而非一种为国家提供资金(收入)、保护国内生产者(限制)或确保互惠准入(互惠)的手段。这种新模式本质上……

全球化即服务

关税、北约威胁、反对外国收购等,正在形成一种刻意为之的模式:利用一切可用的手段,从外国依附国攫取国民财富。即使这种手段会破坏全球贸易和美元的储备资产地位。

关税是一种生硬的工具,特朗普显然正将其作为更广泛谈判的一部分,试图颠覆这一体系。对华125% 的关税税率就是最明显的例证。如此高的关税会导致贸易中断。那么,为什么不使用制裁或配额呢?因为从“支付费用”的角度开启谈判至关重要。

90 天关税暂停期的谈判可能会有多种结果。主要焦点将是组建一个联盟,迫使中国坐到谈判桌前,但也可能开始看到有关以更持久的方式征收这种“费用”的讨论。

租金如何支付?

我一直对“海湖庄园”协议的想法持怀疑态度,而且极不可能实现。但是,研究讨论仍然是有价值的。拟议发行的百年期债券可能会带来意想不到的负面后果,但却很好地诠释了第四个“R”(租金)如何运作的。

其理念是:通过发行百年期国债,并设定负实际利率,并鼓励(迫使)各国将其现有的长期债券换成新发行的债券,美国可以从继续保持世界储备货币地位和全球贸易促进者的地位中获得额外的经济利益。

尽管其影响不可预测,而且可能是混乱的,损害美国的信誉,并严重扰乱收益率曲线,但特朗普可能会热衷于对那些同意将其国债转换为百年期、实际利率为负的债券的国家取消关税(或大幅降低关税)。毕竟,他一生都在为特朗普旗下的各个机构重组和再融资债务。

这只是一个例子,而且是一个不太可能的例子。斯蒂芬·米兰最近表示,他并不提倡这种想法。但事实是,特朗普正在对现有的国际游戏规则发起冲击,并对美元和美国国债的作用提出质疑。 ,Why?因为他只关注当前形势对美国财政的影响。这种观点有只见树木不见森林的风险。

如果美国在敌对的世纪债券发行/互换中对外国持有的国债实际违约,这可能会导致金价上涨,美元下跌。这对收益率曲线的影响将令人瞩目。即使没有这种情况发生,官方外汇储备资产似乎也会进一步多元化,转向黄金、欧元、法郎和日元。而且,有可能达成以美元以外的货币结算贸易的协议。

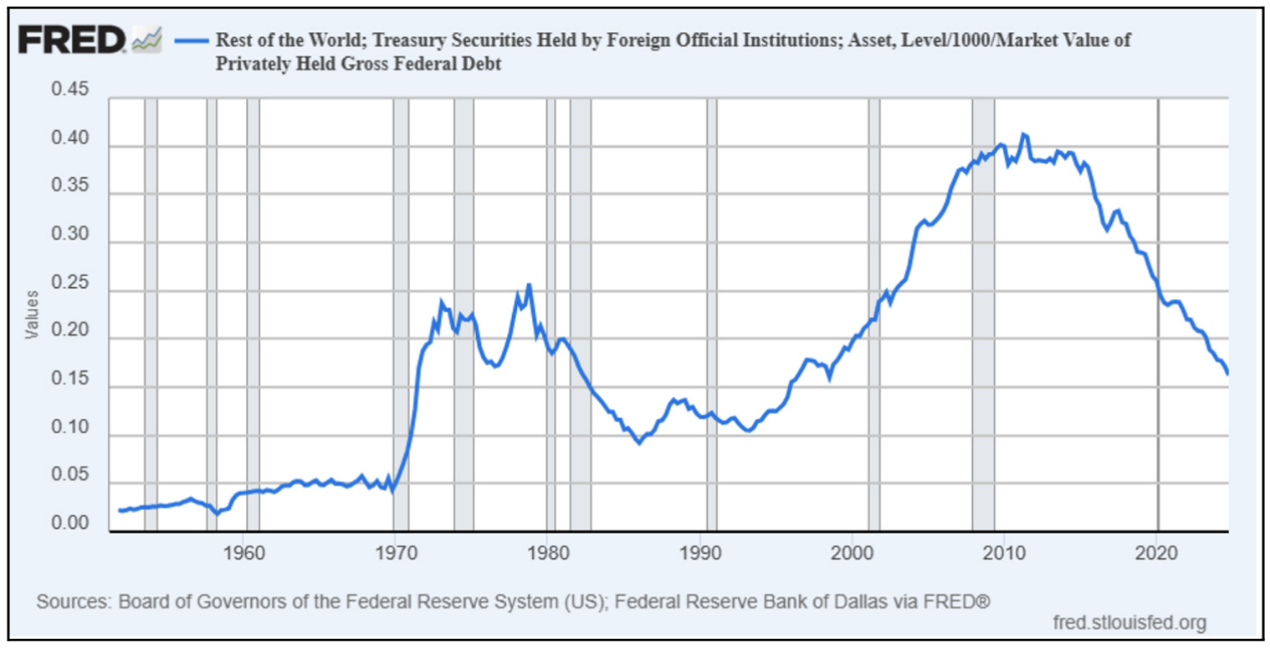

面对这一潜在现实,各国官方持有的美国国债多年来一直在下降也就不足为奇了:

美国现行政策很容易被其他国家视为敲诈勒索。这种经济边缘政策本身风险极高。如果实施失败,就好比美国既是银行又是客户,从银行贷款……然后决定自行违约。

但事实依然如此:目前各国仍在与一个随时准备摧毁整个体系的人进行谈判,无论后果如何。不难看出,有多少国家会宁愿屈从,也不愿面对去全球化的世界和困境。

这种情况会有不致于重创全球经济的结果吗?有,但不会有能迅速恢复全球对美国信任的结果。

无论谈判进展如何,很明显,贸易政策将成为今年跨资产回报和经济增长的主要驱动因素。很明显,我们正在目睹一场体制变革,它将在未来数年对宏观经济产生影响。

在这一新体制下,关税与其说是政策,不如说是先例。美国已表明,它会把市场准入当作一个调节器,根据地缘政治上的顺从程度而非经济效率来收紧或放宽贸易条件。无论政府提出大规模减税还是其他支持性措施,最终都将取决于美中贸易谈判的进展速度和方式。

眼下没有什么比这更重要的了。中美两国已经迅速经历了《斯姆特-霍利关税法》报复的螺旋式上升,高达145%。

因此,即使情况和环境截然不同,也不难理解1930年那些绝望的经济学家和银行家在目睹《斯姆特-霍利关税法》贸易战爆发时的感受。全球化已经变得有点像经济上的相互毁灭。可能会存在“赢家”。也许一个国家只被摧毁了80%,而其余国家则完全覆灭。但这真的是我们所期待的世界吗?

与胡佛政府不同,特朗普政府面临着既是债务国又是贸易限制国的矛盾。虽然两人都不顾经济学家的警告,试图通过关税来维持美国的地位,但胡佛的政策主要是为了保护美国工业而采取的防御性(且被误导的)措施,而如今的做法包含了额外的攻击性因素:故意利用美国的债务国地位作为筹码,将全球贸易和金融体系从公共产品变成私人收费公路。

虽然回到上次关税如此之高的时候,然后说“好吧,这种情况可能会重演”,这可能很诱人,但这样做是有问题的。

关税国家的回归?

如今已非19世纪90年代或20世纪30年代。如今的世界已经是全球化、一体化,从未尝试过重新分离。

我们距离一个让我们深刻认识到世界已变得何等相互关联的事件并不遥远。疫情不仅造成破坏,还揭示了真相。它以极其鲜明的方式向我们展示了全球贸易架构已变得何等脆弱。船舶停运,半导体消失,供应链强大的假象也随之破灭。

我认为我们不能就这样……拆解供应链。我也认为美国无法通过加征关税摆脱那些历经数十年才设计成的准时制、就地制和勉强具备弹性的体系。特朗普的贸易政策并非斯穆特-霍利法案,尽管有很多人试图将其相提并论。

我认为我们无法……轻易地瓦解供应链。我也不认为美国能够通过关税手段摆脱几十年来被设计成即时、就地、几乎毫无弹性的体系。无论有多少人试图将其与《斯姆特-霍利关税法》进行比较,特朗普的贸易政策并非《斯姆特-霍利关税法》。

这件事最令人不安的地方在于没有历史参照框架。你可以借鉴20 世纪70 年代、30 年代以及其他任何重塑系统底层架构的事件,但这并不能解释所有问题。

20 世纪30 年代,世界并未出现去全球化现象,因为当时全球化程度还很低。如今,我们首次目睹一个超级大国主动将一根木棍插进自己打造的全球化车轮的辐条里。

关键在于:它或许会奏效。只是暂时的、政治上的。直到它失效。

就像《斯穆特-霍利关税法》生效了大约三个月——直到加拿大采取报复行动,欧洲重新提高关税,全球贸易陷入陷阱。而美国农民破产人数创纪录,却仍投票支持那些压低他们农产品价格的人。

如今的关税在形式上有所不同,但在功能上并无二致。它们都基于同样的信念:认为通过破坏复杂性就能实现稳定。不幸的是,复杂性不会轻易屈服。

坦白讲:没人能完全弄懂我们这个复杂多变的全球系统在实时状态下是如何运作的。美联储不行,CEO们不行,国际货币基金组织也不行,当然,我和你更不行。其连锁反应根本无法理解。然而,照我们目前的这种趋势走下去,我们对它的集体认知似乎只能通过最令人不安的方式得以提升。

这引出了一个直截了当的问题:

在一个规则可能下一季度就发生变化的世界里,一家公司如何能承诺进行一项为期30 年、资本密集型的投资?

在关税并非政策而是取决于下一条推文、下一届选举、下一轮民粹主义浪潮的氛围中?

这不只是贸易问题,而是资本形成问题。长期投资只有在极为罕见的几种情况组合下才可能存在:可预测性和对制度的信任是其中最主要的两个因素。

尽管美国市场在世界大战、经济大萧条、滞胀、科技泡沫以及银行挤兑等考验下展现出了非凡的韧性,但这种韧性并非偶然。它是建立在一种罕见且易变的成分组合之上,大多数国家都无法拼凑出这样的组合,更不用说维持数十年之久。

首先是全球贸易。近一个世纪以来,美国一直是世界商业网络的中心节点——不是因为它生产最便宜的商品,而是因为它提供了最深厚的市场、最值得信赖的货币和最广泛的消费者群体。贸易一直是美国繁荣的幕后功臣,使美国能够进口低成本商品、出口高附加值服务,并将全球盈余转化为国内资产。

其次是政治稳定。不论人们如何评价两党制的极化和种种荒唐之处,但每四年一次权力的和平交接以及合同、法院和治理的可预见性延续,都让资本有信心留下来。投资者或许讨厌监管,但他们更讨厌混乱。

再加入一套健全的法律和监管框架。产权制度。破产法庭。可执行的合同。这些都是资本主义枯燥乏味的技术性架构,但没有它们,资本就无法流动。

当然,除此之外还有美元。美国的储备货币地位为全球资本创造了一种引力场。外国央行、主权财富基金、跨国公司:它们都持有美元储备、以美元结算交易并用美元管理风险。这种需求压低了美国的借贷成本,并赋予其在不立即产生后果的情况下维持赤字的无与伦比的能力。

最后,还有运气。两片大洋,纵横交错的河流和可通航的水道,天然良港,得天独厚的农业条件,一个半世纪以来没有敌对邻国。丰富的自然资源。在最关键的时期人口激增。一个大陆规模的内部市场。如果要设计一个注定称霸的国家,那美国的地图就是最好的蓝本。至少可以说,美国相当幸运。

这个体系表面上看似稳固,但实际上错综复杂、相互依存——这种平衡靠地缘政治的必然性、规范、激励措施以及一种礼貌的集体错觉维系着,即明天大致会和今天一样。只有对体系架构进行大规模调整的地缘政治事件,才会导致长期的波动,而不会出现“逢低买入”的时刻——1971 年就是一个典型的例子。

回到根本问题,这个问题很快就会找到答案。

不可预测性的代价是什么?

不可预测性的代价是什么?老实说,我不知道。我认为没人知道。但这个体系所能承受的限度是有限的,一旦越过,就无法逆转。或许好消息是,美国仍比世界上任何其他国家都拥有更多的影响力。不过,除非其他国家联合起来,或者愿意承受比特朗普政府所预期的更多的痛苦。

chaincatcher

chaincatcher