Take a look at the popular crypto payment products. What are the highlights and benefits of the exchange-based players?

転載元: panewslab

05/02/2025·18D

Author: Weilin, PANews

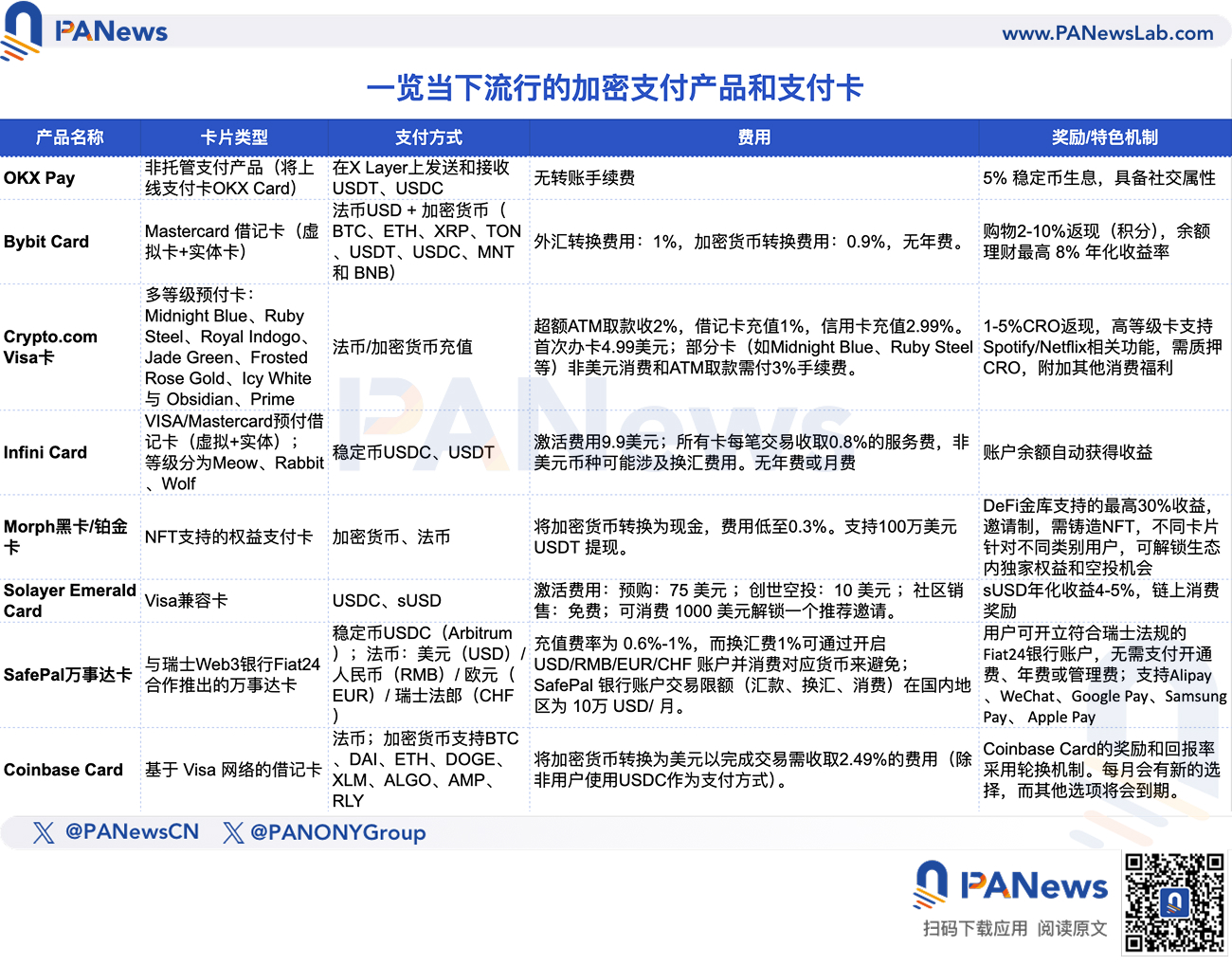

The market for crypto payment products and payment cards (U cards) is becoming increasingly rich. With the recent launch of new products such as OKX Pay, Infini Card, Solayer Jade Card, etc., coupled with the previous Bybit Card, Crypto.Com Visa Card, Morph Card, SafePal Mastercard and Coinbase Card, the discussion on crypto payment cards has heated up again.

Crypto payment cards allow users to use cryptocurrencies (such as Bitcoin, Ethereum) directly for daily consumption, similar to traditional debit or credit cards. They can instantly convert cryptocurrencies into fiat currencies (such as USD, Euro), eliminating technical barriers to merchants accepting cryptocurrencies, while reducing the complexity of using cryptocurrencies (such as managing private keys or exchange exchanges). Some Web3 payment cards integrate social functions, such as sending cryptocurrencies through messages as red envelope gifts. In the future, Web3 payment cards may also integrate with more DeFi protocols, giving users greater financial freedom.

In this article, PANews sorted out a number of popular Web3 payment products and payment cards, focusing on their payment functions and reward mechanisms. This information mainly comes from the official website, official social platforms and publicly published content by the project manager.

OKX Pay

On April 28, OKX officially launched the first version of OKX Pay, which is a payment application that realizes the integration of non-hosted and compliant, embedded in the OKX App. The product was developed internally for 8-9 months and has undergone internal iterations of 4 versions. It is currently peer-to-peer payment. In the future, it will cooperate with Mastercard to launch the payment card OKX Card. At present, OKX Pay has 5% stablecoin interest-generating income, which is carried out for a limited time. More on-chain interest-generating agreements will be connected to the subsequent event and more events will be held.

OKX Pay also integrates social features such as built-in messaging

capabilities to communicate with others, and sending cryptocurrencies as

personalized gifts.

According to the official introduction, OKX Pay easily realizes non-hosting and convenient payment, aiming to allow users to have a smooth user experience like Web2 applications in Web3 payment applications. OKX Pay adopts the method of private key shard management, splitting the private key into two, half stored in the user's Passkey, and the other half stored by OKX. OKX Pay will focus on stablecoin payment, supporting USDT and USDC in the first issue, and will gradually connect to more stablecoins in the future. At the heart of OKX Pay is the implementation of a non-hosted experience that does not require users to manage private keys themselves - this has always been an important threshold that hinders many people from participating in the encryption field. At the compliance level, OKX Pay ensures the security of users and assets through mechanisms such as real-name authentication (KYC), anti-money laundering (AML) and multisig (Multisig).

Bybit Card

Bybit Card is a Mastercard cryptocurrency debit card, which allows users to easily and quickly access cryptocurrency funds and use cryptocurrency anytime, anywhere. Supports virtual and physical cards, and is currently open to users in the EEA (European Economic Area) and CH (Switzerland), AIFC (Astana International Financial Centre), Australia, Brazil and Argentina.

The foreign exchange conversion fee for the transaction is 1% (on Mastercard exchange rate basis), the cryptocurrency conversion fee is 0.9% (on spot transaction fee basis), and there is no annual fee.

Users can choose to pay in cryptocurrency or fiat currency balance. Supported fiat currencies include: USD; supported cryptocurrencies include: BTC, ETH, XRP, TON, USDT, USDC, MNT and BNB.

With this debit card, users can instantly use the income earned from Bybit's full-line trading products to pay for their shopping expenses. When purchasing, users can enjoy a 2-10% cashback (through points), depending on the Bybit VIP level. Turn on "automatic financial management" and enjoy a maximum annualized rate of return of 8% by card balance, without transferring funds between accounts.

According to official reports, more than 90 million merchants currently support the use of Bybit cryptocurrency debit cards. Bybit cryptocurrency debit cards support EMV 3D security and are an advanced anti-fraud technology that allows for consumer identity authentication when making online payments.

Crypto.com Visa Card

Crypto.com Visa Card is a prepaid card, similar to a debit card, and requires stored value. Users can transfer money using bank accounts, or store value for Crypto.com Visa cards with other credit cards or cryptocurrency wallets.

When opening the card, Midnight Blue Crypto.com Visa card can be used without CRO pledge or CRO Lockup. If you want to apply for Ruby Steel, Royal Indogo, Jade Green, Frosted Rose Gold, Icy White and Obsidian Crypto.com Visa cards, users need to lock the CRO for up to 365 days.

There is no annual fee for Crypto.com Visa cards. Users can get 1-5% CRO (Crypto.com native tokens) cashback when spending, and advanced cards provide a higher proportion.

All payment card feedback is paid in CRO and deposited into the user's cryptocurrency wallet in the Crypto.com App. Each eligible transaction will generate a CRO reward immediately. Consumer rewards will be rewarded in equivalent US dollars. The Spotify and Netflix consumption rewards enjoyed by Royal Indigo, Jade Green, and Ruby Steel-level cardholders will expire after six months of opening the payment card.

In terms of fees, a 2% fee is required to exceed the monthly free ATM withdrawal limit, a 1% fee is charged for debit card recharge, and a 2.99% fee is charged for credit card recharge. For the first time ordering Midnight Blue Crypto.com Visa card, you will be charged $4.99; for Midnight Blue, Ruby Steel, Royal Indigo and Jade Green Cards, all non-USD purchases and ATM withdrawals are subject to a 3% fee.

Infini Card

Infini Card is a VISA/Mastercard prepaid debit card provided by Infini, designed to provide users with transparent, low-cost solutions. With Infini Card, users can trade directly with millions of merchants around the world with their stablecoins.

There is no annual or monthly fee for Infini Card. The Infini account balance automatically receives revenue. Support payments from online and offline merchants around the world. Cards can be added to Apple Pay, Google Pay and Alipay.

The Infini Lite Card (Meow) is a low-cost virtual card that belongs to the Mastercard network and is suitable for daily expenses. It can be used on multiple platforms such as Uber, WeChat, Alipay, etc.

Infini Tech Card (Rabbit) is a virtual card for subscription payments. It belongs to the Visa network and focuses more on US dollar merchants. Supports X, ChatGPT, OpenAI and developer tools. The fee for non-US merchants or non-US dollar transactions is a fixed 1% plus $0.50, and there is also a minimum rate threshold of $0.01.

The activation fee for both cards is $9.9, with no annual or monthly fees. In terms of commission fees, all cards charge a service fee of 0.8% per transaction, and non-USD currencies involve corresponding foreign exchange fees.

The upcoming third-class card Infini Global Card (Woof) can be added to Apple Pay and Google Pay, and can apply for physical cards.

Morph Black Card and Platinum Card

According to the official website, Morph Black Card is an identity symbol of cryptocurrency users, providing high-yield asset strategies, unlimited withdrawal options, low conversion fees and traditional banking services, as well as Morph ecosystem benefits, including token airdrops and activity participation rights. Exclusive high-yield DeFi vault designed for black card holders, users can enjoy up to 30% return on assets. Convert cryptocurrency to cash with a fee of as low as 0.3%. Supports $1M USDT withdrawal. To obtain an invitation system or a whitelist, you need to cast an NFT.

Compared with black cards facing high-net-worth users and "whale", Morph Platinum Card is aimed at more popular users. DeFi income is the basis income, and platinum cards also need to cast corresponding NFTs.

According to official introduction, holders of Morph cards can enjoy a variety of exclusive rights and future airdrop rights within the ecosystem.

Solayer Jade Card

The Solayer Emerald Card combines real-world consumption, on-chain rewards and fully decentralized finance. It is a Visa-compatible payment card. Open to more than 40,000 users and fully supports Apple Pay, Google Pay and Visa's global network.

Officially, using USDC to spend like cash can earn on-chain rewards and experience the real-world practicality of cryptocurrencies. Users can withdraw local cash from ATMs worldwide. Deposit to USDC can be consumed immediately, or choose sUSD, a stablecoin backed by government bonds, with an annualized yield of 4-5%. Users can instantly cast/redemption sUSD (no lock-up period, no minimum limit), payment card is not hosted, aiming to achieve seamless switching between consumption and savings.

Emerald Card is built on Solayer's InfiniSVM, a hardware-accelerated Solana virtual machine (SVM) that provides Visa-level throughput while enabling true on-chain execution.

At present, the card's invitation waiting list performance has been opened, and the official service has been opened to 40,000 users sold by Chuangshi Airdrop and community. Activation fee: Pre-order: $75; Genesis Airdrop: $10; Community Sales: Free. If the user wants to skip the waiting, he can spend $1,000 to unlock a recommendation invitation.

It is worth noting that during this marketing, Solayer also directly played the meme of Empress Dowager Cixi's love of collecting jade, realizing that marketing "becoming the circle".

SafePal Mastercard

SafePal's crypto payment card is Mastercard launched in partnership with Swiss Web3 bank Fiat24, which aims to provide users with convenient cryptocurrency consumption and fiat currency conversion services. This Mastercard supports direct recharge using the stablecoin USDC (Arbitrum) and daily consumption in offline/online scenarios when bound to Alipay and WeChat. It can also be used for member subscription services on popular overseas platforms such as Twitter and Telegram. There is no card opening fee, management fee or annual fee or monthly fee.

This card supports four currencies: USD/RMB/EUR/CHF. You can open the USD/RMB/EUR/CHF account and recharge funds. There is no need to exchange foreign exchange fees for these currencies. The recharge fee rate of SafePal Mastercard is 0.6%-1%, and the exchange fee of 1% can be avoided by opening the USD/RMB/EUR/CHF account and consuming the corresponding currency: for example, when you spend a RMB account in China, you can open GPT, Twitter membership US dollars and other accounts, and you can exempt the exchange fee of 1% from the exchange fee. SafePal bank account transaction limit (remittance, exchange, consumption) is USD 100,000 per month in the domestic region.

Coinbase Card

Coinbase Card is a debit card issued by Pathward, NA, based on the Visa network, and is only for US users outside Hawaii. Allow users to spend on cryptocurrencies or US dollars worldwide. Card fees are settled at real-time exchange rates.

Supports cash and cryptocurrencies BTC, DAI, ETH, DOGE, XLM, ALGO, AMP, RLY. Coinbase automatically converts all cryptocurrencies into USD for shopping and ATM withdrawals. US users can quickly accumulate cryptocurrency rewards through daily consumption.

Public reviews show that converting cryptocurrencies into USD to complete transactions requires a 2.49% fee (unless users use USDC as payment method).

Coinbase allows cardholders to choose from a variety of cryptocurrencies, each corresponding to a specific percentage of returns. Some examples of the return rate in the past: Cosmos: 14.04%, Ethereum: 2.09%, Polkadot: 10.2%, Solana: 6.51%. Coinbase Card's rewards and returns are rotated. There will be new options every month, and other options will expire.

MetaMask will launch payment cards soon

Little Fox Wallet MetaMask and Mastercard are also about to launch their own payment cards. On April 29, fintech companies CompoSecure, Baanx and MetaMask jointly launched the payment card "MetaMask Metal Card", which is planned to be launched globally in the second quarter. This card allows users to make payments directly from the MetaMask self-hosted wallet, without pre-recharge or converting fiat currency through centralized exchanges. All transactions are authorized within 5 seconds through smart contracts. Users must store cryptocurrencies on Linea network.

chaincatcher

chaincatcher