Ripple once offered $5 billion to acquire Circle but failed, unveiling an unexpected Game of Thrones

転載元: panewslab

05/01/2025·20DSource: Forbes

Compiled by: Moni, Odaily Planet Daily

Editor's note: A major news has been made in the stablecoin market - Ripple has proposed a $4-5 billion acquisition offer to Circle Internet Group, a competitor that is promoting IPO listing! Yes, you heard it right, just got the SEC to give up the appeal and admit that XRP is not the Ripple of the Securities and Exchange Commission, but the offer was denied as being too low. Ripple is allegedly still very interested in Circle, but has not decided whether to make a offer again.

For Rippl, a well-known crypto company in the industry, why did it make business considerations to try to acquire Circle at this point in time? Will Circle end up saying “Yes” or “No”? In response to these questions, Forbes published an article to deeply analyze some "insider information". Odaily Planet Daily compiled the original text as follows, enjoy~

Why is Ripple going to acquire a stablecoin company?

Stablecoins require both size and speed.

The news of Ripple's acquisition of stablecoin Circle does not sound like a typical acquisition transaction at first glance, but for industry insiders who are familiar with Ripple's corporate strategic layout, the acquisition of Circle is actually "unexpected and reasonable."

In early April, Ripple acquired brokerage company Hidden Road for $1.25 billion and announced that it would use RLUSD stablecoins as collateral for its main brokerage products to transfer its post-trade activity to the XRP Ledger blockchain. Ripple believes the acquisition has the potential to optimize the cost and liquidity of its cross-border payment service, Ripple Payments, and provide hosting services to Hidden Road customers.

It is worth mentioning that Hidden Road has successfully obtained a brokerage license, which means that the acquisition transaction has given Ripple the legal right to contact the traditional financial track as an institution. XRP and RLUSD may evolve into liquidity bridge assets under institutional transaction execution, repurchase financing and even sovereign debt swaps, opening the door to tokenized treasury bonds, central bank digital currencies and RWA.

Obviously, Ripple 's "ambition" has gone beyond the crypto track, and its power tentacles have begun to embed more deeply into traditional financial infrastructure, and stablecoins anchored to fiat currencies are undoubtedly the best bridge to open up the world of encryption and traditional finance.

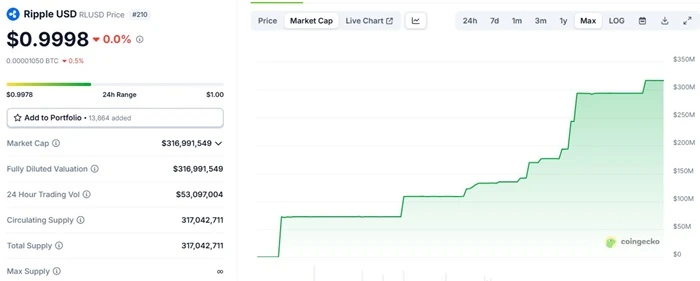

In fact, Ripple CEO Brad Garlinghouse determined the stablecoin strategy as early as mid-2024 and announced the launch of the stablecoin RLUSD at the XRP Ledger Community Summit. After obtaining approval from the New York Department of Financial Services (NYDFS), RLUSD was officially launched at the end of last year and currently has a market value of approximately US$316.9 million, which is a good start.

However, for the current stablecoin market with a market value of nearly US$245 billion, RLUSD's performance is lukewarm. If a "stable" strategy is adopted, it seems difficult to keep up with its rapidly developing competitors. Not to mention the USDT with a market value of nearly US$149 billion and USDC with a market value of approximately US$61.5 billion, RLUSD's advantages are extremely insignificant compared with USD1, which broke through US$2 billion shortly after its launch.

Therefore, Rippl’s acquisition of Circle is not only about expansion, but also an acceleration strategy that allows it to overtake, allowing Ripple to quickly gain a place in the global stablecoin economy.

Will Circle say "Yes"?

From Circle's perspective, being acquired is not a bad thing.

First of all, huge amounts of funds are attractive enough . Ripple's $5 billion acquisition offer is very attractive, and this scale of injection could greatly accelerate Circle's global expansion, and additional funds could also drive deeper research and development and expand Circle's partnerships, especially in markets where infrastructure and access are still forming.

Secondly, Ripple and Circle may play the potential of "Win-Win" . Ripple brings rich experience in harnessing complex global regulations and a proven blockchain network, while Circle already has extensive experience in stablecoin operation. Combining the two may inspire the creation of new financial products, such as tokenized payment systems, cross-border settlement innovations, and hybrid DeFi/TradFi solutions.

We must not forget our geographical advantages, Ripple has a complete international footprint . Its network is far beyond the U.S. borders and has strong relations in Asia, Latin America and Europe. Ripple's 90% of its business is conducted outside the United States, and this influence could drive USDC into a market where stablecoin adoption is still in its infancy but growing rapidly.

Will Circle say "No"?

Although Ripple may re-put the acquisition offer, Circle has temporarily rejected its acquisition offer on the grounds that the offer is too low. Judging from the latest progress, Circle's decision may involve three reasons: valuation, vision and regulation.

In terms of valuation, the current USDC market value is close to $62 billion, and Circle's IPO plan is in full swing. Ripple's offer at this point in time seems more like a "speculation". Circle is not a company seeking to exit, but is moving towards a broader stablecoin market future. The $5 billion acquisition may not only underestimate Circle's financial situation, but also underestimate the strategic importance of USDC in the evolving digital dollar landscape.

Second, Circle has a clear vision that merging with direct competitors can create friction. While both Ripple and Circle operate in the stablecoin space, RLUSD and USDC are not completely consistent in governance models, market strategies, etc. The acquisition may lead to a readjustment of priorities and may undermine Circle’s mission-oriented approach to open financial systems.

Third, the regulatory perspective cannot be ignored. The merger of two heavyweight companies in the crypto ecosystem will trigger more scrutiny from regulators around the world. Especially in the current environment – where U.S. lawmakers are actively defining the digital asset framework – a move could lead to severe operational slowdowns, legal complexity, and even boycotts from certain jurisdictions.

What does Circle's decision mean for the market and stablecoins?

Circle's rejection of Ripple's acquisition is not just a story about price, but a signal of belief—that is, Circle believes its independent strategy is stronger than a quick acquisition. As the IPO advances, Circle attempts to build USDC into a global standard for stablecoins backed by the U.S. dollar, doubles its reputation for transparency, compliance and innovation.

At the same time, Ripple will not give up the "big cake" of the stablecoin market. RLUSD is now in the early stages of its life cycle, but Ripple's move demonstrates a long-term strategy to integrate blockchain infrastructure with traditional finance. Whether it is through additional acquisitions, deeper ecosystem investments, or policy collaborations, Ripple will stick with it and fight for victory.

It can be said that stablecoins are no longer a simple encryption tool, but have quickly become a digital pipeline for global capital flows, a coveted game of throneous - whoever controls stablecoin standards, access and integration points can shape the future of cross-border payments, institutional-level DeFi and programmable finance.

Game of Thrones – Bigger than Circle and Ripple

For leaders in fintech, digital assets and global payments: market share alone cannot win the future, and "winning" is about ecosystem coverage, interactivity and trust. The stablecoin race is far from over, and the real winners will be those who can boldly innovate while maintaining sufficient resilience to deal with regulation, market volatility and global demand. Stablecoins are becoming the core pillar of the cryptocurrency ecosystem. In the next few years, integration, competition and regulatory game around the "compliant stablecoin + payment network" will become the main theme.

Ripple's offer to Circle seems to be an acquisition transaction, but it reflects the maturity of the stablecoin ecosystem and the blurred boundaries between crypto-native innovation and institutional adoption, and further reflects the importance of strategic consistency when traditional finance meets crypto-native innovation.

chaincatcher

chaincatcher