Etherealize Research Report: Bullish new oil in the digital age of Ethereum

転載元: jinse

06/20/2025·2DAuthor: Etherealize Compilation: SNZ Capital

summary

The global financial system is on the eve of an epoch-making change, and assets around the world are gradually being digitalized and transferred to blockchain. Evolving from semi-digital, independent financial systems to fully digital, composable financial systems requires a secure, neutral and reliable global settlement layer to support the operation of global assets. Ethereum has become this foundation.

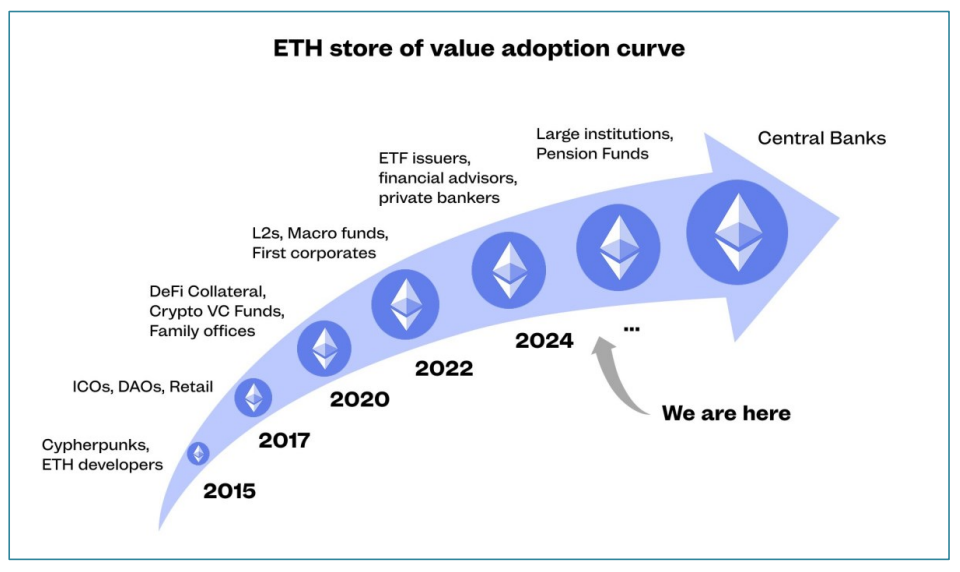

Ethereum’s institutional adoption is accelerating rapidly, with the US regulatory framework openly supporting blockchain innovation, and digital assets are becoming the mainstream component of traditional investment portfolios.

It took Bitcoin 15 years to be widely recognized as digital gold: a scarce currency asset that transcends sovereign control. Ethereum has supplemented it on the basis of Bitcoin: it can not only store value, but also promote the seamless transfer of value, trust establishment and global collaboration. ETH is the next generation of asymmetric investment opportunities and is expected to become the core holding of institutional digital asset portfolios .

Ethereum has become the default platform for stablecoins, high-value tokenized assets and institutional blockchain infrastructure. Currently, more than 80% of tokenized assets exist on Ethereum. With its powerful architecture, Ethereum has won the trust of the world's leading asset managers and infrastructure providers: It is the world 's most secure and decentralized blockchain, providing unparalleled reliability and zero downtime.

However, as an asset supporting this transformative system, ETH remains one of the severely undervalued opportunities in the global market. Although Ethereum has a clear dominance in the market and has undergone major technological upgrades, ETH is currently trading at a much lower price than its all-time high in 2021. We believe this price difference will not last and understanding ETH's unique value proposition will bring one of the biggest upside opportunities in today's asset classes.

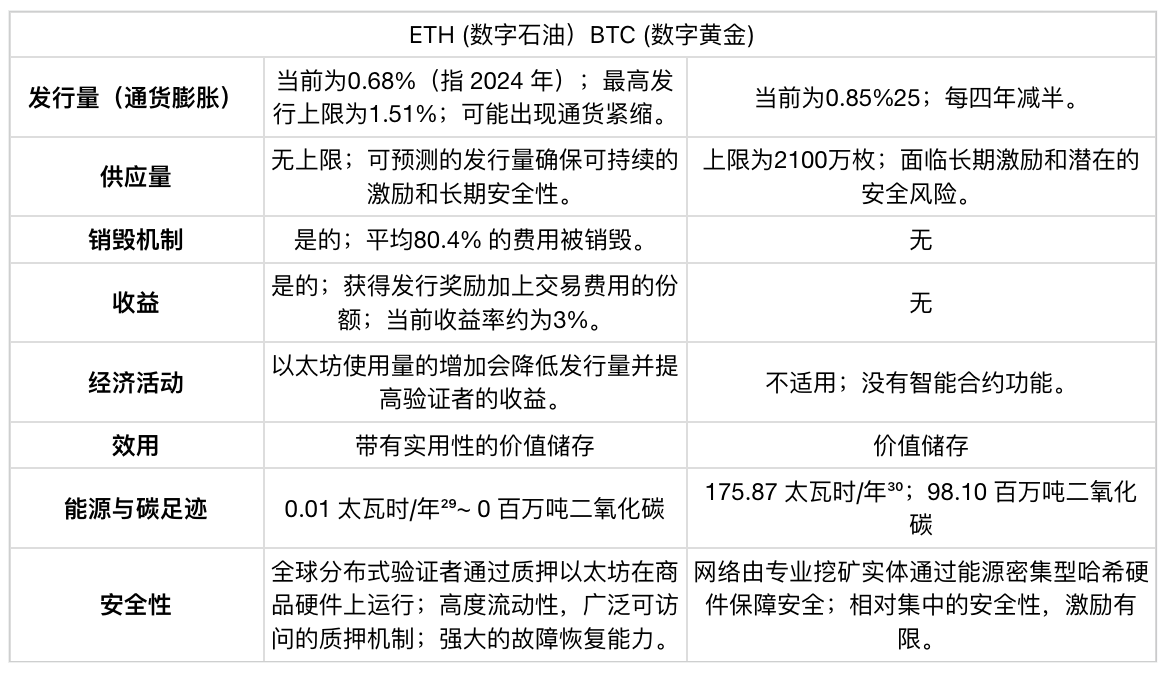

ETH is not just a token, it is also a collateral for on-chain economy, computing fuel and interest-generating financial infrastructure. It is actively stockpiled, pledged, destroyed and used. Bitcoin is a commodity as a simple store of value, and Ethereum is also a commodity that can be stored as a store of value, but at the same time has great practicality – which effectively makes it a productive reserve asset: digital oil that powers the digital economy.

Report Overview

This report aims to illustrate why ETH should be viewed as a core configuration in institutional strategies, especially those that prioritize long-term value creation, technological exposure and future-oriented financial infrastructure. The report is divided into three core parts:

Learn about ETH: Digital Oil that Drives the Digital Economy

This section will explore the relationship between Ethereum and ETH, the practicality and unique characteristics of ETH, the appropriate valuation framework for evaluating ETH as asset value, and why it is currently undervalued and under-equipped in institutional investors' portfolios seeking asymmetric opportunities and productive store of value.

Ethereum: The underlying infrastructure that drives the rise of ETH

This section will cover the structural, technical and economic drivers behind the growing momentum of the Ethereum network. It will elaborate on the possible position of Ethereum as the basic layer of the global digital financial system and how this position will support and amplify the economic importance of ETH.

Ethereum and AI : The economic engine of the independent economy

This section will look forward to assess the possible role and potential value of Ethereum — and through its derived ETH — in a financial system driven by autonomous agents and its potential value

Core points

ETH is digital oil: ETH powers the Ethereum economy and accumulates value through its utility, scarcity and benefits.

ETH is a store of value that is anti-censorship: ETH is a settlement, security and collateral asset for the digital economy. With the increase in the number of externally controlled tokenized assets on Ethereum (stablecoins, real-world assets and licensed financial instruments), it is crucial to the demand for global neutral, censorship-resistant reserve assets as the underlying store of value.

ETH is not a tech company: the valuation framework must evolve; ETH cannot be valued just like tech stocks based on expense revenue—Ethereum is a unique digital infrastructure that is encapsulated as a global reserve asset.

Programmatic Issues + Destruction = Predictable Scarcity: The theoretical maximum total issuance for ETH is 1.51%¹, but destruction of goods generated by platform use usually results in lower net issuances. ETH supply inflation has hovered around 0.09%² since September 2022, below fiat and Bitcoin.

ETH provides native income: Verifier pledge makes pledged ETH a productive, profitable digital commodity.

ETH is already a reserve asset: ETH is already a reserve asset of the Ethereum digital economy and will soon become a reserve asset of institutions and sovereign states.

ETH is undervalued: ETH's lag behind BTC is a temporary mispricing rather than a structural weakness, creating a rare asymmetric investment opportunity.

The role of ETH in the future AI economy has not been priced: as autonomous agents integrate into the financial world, a new type of economic infrastructure will be needed. Ethereum is the most suitable and most likely platform to support this future, and will serve as the operating layer of the human-machine hybrid economy—with ETH as its native currency and reserve asset.

ETH has trillion-dollar potential: the short-term target is $8,000; in the long run, it is conservatively estimated that as a monetary reserve/commodity asset, ETH may reach more than $80,000.

ETH: Digital Oil that Drives the Digital Economy

ETH is a native asset of the Ethereum network and the economic engine that drives its operation.

It is digital oil – an asset that powers, guarantees and reserves the new financial system of the Internet.

The traditional financial system is at the beginning of a structural transformation from analog infrastructure to digital native architecture. Ethereum is expected to become the basic software layer—similar to an operating system, such as Microsoft Windows—on it will be built on top of a new global financial system.

When all this is achieved, ETH will become the underlying asset of a comprehensive global platform that will cover the future of finance, tokenization, identity, computing, artificial intelligence and more. This inherent complexity makes ETH more difficult to define, especially relative to a simple store of value assets like Bitcoin – but it also makes ETH more strategically valuable and means ETH has greater long-term potential.

ETH is not just a cryptocurrency, it is a multi-functional asset whose functions include:

Calculate fuel: Each on-chain operation consumes (destroys) ETH. It is the underlying asset that drives computing, data storage, asset transfer and value settlement on Ethereum as fuel for:

o Every stablecoin transfer.

o Every tokenized real-world asset issuance.

o Every transaction executed on Ethereum.

o Every new application—DeFi, games, AI, identity—their operation destroys ETH.

Store of value assets with income: In addition to simply holding ETH as a store of value, ETH can also earn profits through pledge. When someone pledged ETH, they agreed to lock it in the system and become a validator—a network participant whose role is similar to referees, checking and verifying transactions. The verification process is mainly automatic, so the person or entity that pledges the verifier usually does not need to do any additional work other than pledging their ETH. The network will randomly select a validator to propose or confirm a new transaction block. If the validators do the job correctly, they will receive a reward in the form of ETH.

Original Settlement Collateral: ETH provides security for billions of stablecoins, RWA (real-world assets) and financial applications. ETH is censorship-resistant, trustworthy and neutral, and not affected by depreciation. It is the basic collateral of the Ethereum ecosystem. Currently, about 32.6% of the total ETH supply is used for the collateral role, and another 3.5% is exported for other blockchains. With the growing number of externally controlled tokenized assets on Ethereum, such as stablecoins, RWA and licensed financial instruments, the demand for neutral reserve assets as the underlying store of value becomes crucial. Tokenized assets may carry issuer, jurisdiction, and counterparty risks; by contrast, ETH anchors the entire system in a globally accessible, non-sovereign, neutral store of value, enabling settlement, collateral and liquidity routing without introducing systematic dependence on any single actor.

In a world increasingly filled with tokenized assets that rely on external counterparties, the value of truly neutral, native and non-sovereign collateral assets has increased significantly. ETH is the only original collateral in the smart contract economy—completely independent of external counterparty risk. ETH represents the highest level of trust on Earth, which will make an increasingly important contribution to its future monetary premium.

Deflation Assets: ETH becomes deflation as network activity increases. About 80.4% of transaction fees will be destroyed, reducing the total supply of ETH. At an annual cap issuance rate of 1.51%⁷ (which is only achieved in the extreme case where 100% ETH is pledged and no transaction fee is destroyed), ETH will turn into a deflation commodity when the demand for network resources is strong. Unlike traditional commodities, an increase in ETH demand does not trigger an increase in output, resulting in demand that may exceed supply dynamics over a longer period of time.

The manifestation of tokenized economic growth: Just as global demand for oil grows with economic expansion, ETH also draws value from the growth of the on-chain economy—but due to its issuance cap, its supply elasticity is much less than oil:

- Ethereum 's Total Value Secured: Ethereum currently carries more than $767 billion in assets. This represents the highest TVS of all blockchains, consolidating Ethereum’s position as the foundation of tokenized economics.

- Exponential growth: The paradigm shift is moving towards an increasingly decentralized global economy. Ethereum's economic throughput is expected to achieve exponential growth as business, trade and asset ownership is transferred to the chain. This will significantly increase the demand for ETH, both as trading fuel and as the core monetary reserves supporting the new global financial system.

Reserve trading pairs: ETH is the main reserve trading pair in decentralized exchanges. On Ethereum, 70.6% of trading pairs⁹ are denominated in ETH. Similar to the fact that most currencies in traditional finance are traded with the US dollar, in order to efficiently trade most digital assets, they must be traded with ETH or US dollar stablecoins.

Strategic reserve assets: More and more applications, DeFi protocols and institutional fund managers are accumulating ETH as strategic reserve assets. This trend is accelerating as more institutions and sovereign entities turn to Ethereum’s financial infrastructure. Unlike inert reserve assets, ETH is fully programmable, enabling automation of the fund bank and complex financial management. The reserved ETH can be pledged programmatically and deployed as collateral for lending, used to automate market makers (AMMs), or directly integrated into custodial agreements, attribution plans, payment systems, bridging mechanisms, etc. Although BTC is mainly idle as a fund bank asset, ETH actively improves the productivity and operational efficiency of the fund bank. As a neutral reserve asset, ETH is unique in ensuring and driving the global tokenized financial system.

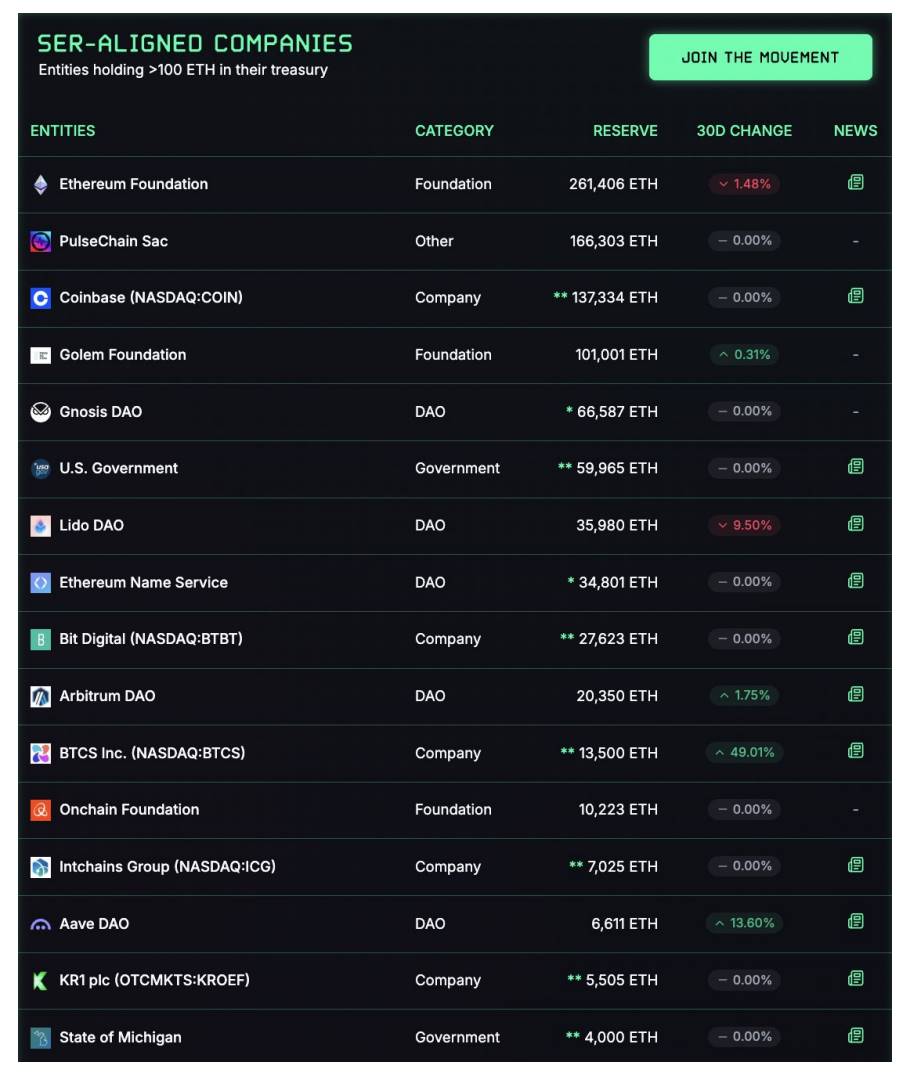

- This is not a theory, the competition for hoarding ETH has begun. Strategic ETH reserves are expanding rapidly, and the publicly disclosed institutional ETH holdings have reached nearly US$2 billion. As institutions increasingly recognize ETH's multifaceted value proposition, the opportunities for pioneers become clear and compelling. ETH is not only becoming a strategic reserve asset, but also an indispensable part of institutional fund management.

Source: strategythreserve.xyz by Fabrice Cheng

Because of all these unique features and features, we cannot evaluate ETH as a tech stock. ETH is a completely new category of assets.

Therefore, ETH cannot accurately value through the discounted cash flow method. Instead, ETH must be viewed from the perspective of strategic value storage and utility-driven scarcity. Only this perspective can capture the real upward potential of ETH and may even surpass Bitcoin’s “digital gold” narrative.

Oil is a consumable commodity asset that is stored as a reserve and consumed as fuel. Oil has shaped the country, promoted industrial development, and driven global trade. The inherent utility, inherent scarcity and strategic importance of oil make it one of the most valuable commodities in history—shaping the country, driving industry and driving global trade. Therefore, the total market value of global proven oil reserves is approximately US$85 trillion.

Considering that ETH is on a similar development trajectory, but aiming at the digital realm, this is a meaningful reference point for ETH:

ETH provides power to the digital economy.

ETH ensures the security of the digital economy.

ETH takes value from the growth of the digital economy.

ETH has inherent scarcity due to its supply dynamics and issuance cap.

As the global economy transforms into tokenized infrastructure, ETH will become indispensable, not only as fuel, but also as a native asset in the future currency and settlement layer of the financial system.

ETH 's currency design: simple, transparent, and sustainable

The economic principles of ETH are elegant and concise, but their importance is often overlooked. Unlike traditional commodities, Ethereum’s supply and demand dynamically transparently encoded in its protocol, enabling predictable issuance and sustainable cybersecurity. Ethereum has developed the best issuance plan for ETH, combining strong security (about $88 billion ¹¹ staking ETH, compared to about $10 billion ¹² that guarantees Bitcoin security) with extremely low inflation rates, with an average annual inflation rate of only 0.09%¹³ since the merger in September 2022 (the network switches from proof of work to proof of stake consensus). The more ETH staked, the more expensive and impractical it is to attack Ethereum, because the attacker needs to obtain at least 51% of the existing ETH to successfully destroy or change the network. This structure also provides protection against cartel-style, price- manipulating entities that appear around traditional commodities like OPEC.

issued

Issuing mechanism

The issuance of ETH is programmed and transparent. Similar to Bitcoin’s halving mechanism, newly minted ETH is allocated as a reward to the validator (i.e., the individual or entity group that has been pledged to help protect the network and verify transactions; this is the “earnings” component of ETH mentioned earlier and will be discussed further below). However, unlike Bitcoin, Ethereum issuance is dynamically adjusted to network security needs rather than fixed plans. The calculation method is very simple:

Maximum ETH issuance per year = 166.3× pledged ETH

This formula establishes a natural balance: as more ETH is pledged to protect the network, the circulation will increase, but the growth rate will decrease. This structure while motivating validators, ensures that the upper limit of inflation is very low.

The key is that this mechanism sets a clear upper limit on the issuance of ETH . Even in extreme assumption scenarios—that is, all ETH supplies in circulation (currently about 120.8 million¹⁴ETH) are pledged and network usage does not destroy any ETH— the maximum possible inflation rate is limited to 1.51% ¹⁵. In fact, the issuance of ETH will always be below this theoretical upper limit. Currently, only about 28%¹⁶ of ETH is pledged, which means that the inflation rate before destruction is about 0.8%¹⁷.

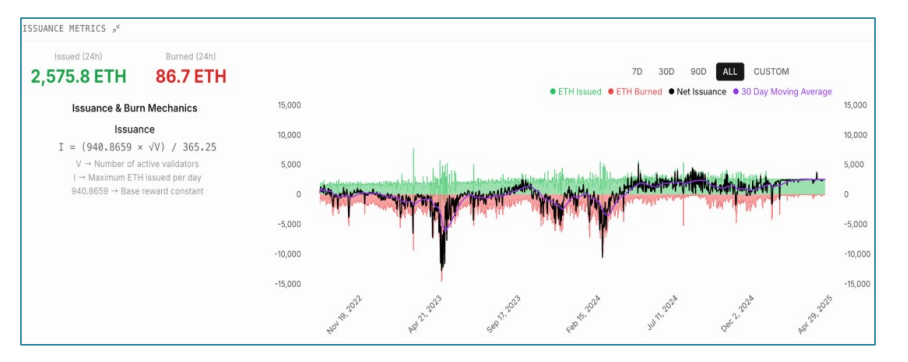

In practice, since Ethereum converted to Proof-of-Stake consensus mechanism, the issuance of ETH is much lower than the theoretical maximum. Since the merger (Merge) on September 15, 2022, the average annual issuance of ETH has been only 0.09%¹⁸, while the current annualisation issuance is about 0.68%¹⁹. As network activity increases—especially driven by institutional adoption and tokenized asset deployment—the issuance of ETH may turn into net deflation, further enhancing ETH’s monetary dynamics. The impact of the improved development trend after the Ethereum merger is still seriously underestimated by mainstream investors.

Over the past decade, ETH's issuance rate has been continuously declining following the principle of "minimum viable issuance". Between 2015 and 2017, an average of about 30,000 ETH was issued to miners every day. By 2019, this ratio dropped to about 13,000 ETH per day. Since the merger in 2022, the ETH issued to validators daily now ranges from slightly negative values to about 2,500 pieces per day.

How can this achieve sustainability? Unlike miners, validators have minimal operating expenses—i.e. no high electricity bills or significant hardware depreciation costs—this allows them to maintain network security with significantly lower token issuances. Due to much higher operating margins, validators sell their pledged tokens to cover overheads lower than Proof of Work miners, which further enhances ETH's price stability and currency robustness.

destroy

In addition to predictable issuances, Ethereum also incorporates a unique and powerful currency feature: a programmatic fee destruction mechanism . This mechanism directly links the money supply of ETH with network activities, closely combining token economics with actual economic demand.

On average, 80.4% of all transaction fees paid to the validator are permanently destroyed , thus creating deflationary pressure on the circulation supply of ETH. As Ethereum economic activity grows, increasing demand increases total expenses, strengthening this deflation effect and reducing the net issuance of ETH.

This creates a self-regulating balance:

The issuance is adjusted based on the amount of ETH pledged to protect the network.

The amount of destruction varies according to the demand for Ethereum block space and transaction execution.

Together, these forces create a dynamic monetary framework that allows ETH's net inflation to fluctuate between slightly positive and complete deflation, all driven by transparent protocol-level rules. This is a monetary system designed not only for scarcity, but also for sustainability, security and alignment with real-world needs.

Source: dashboard.etherealize.com

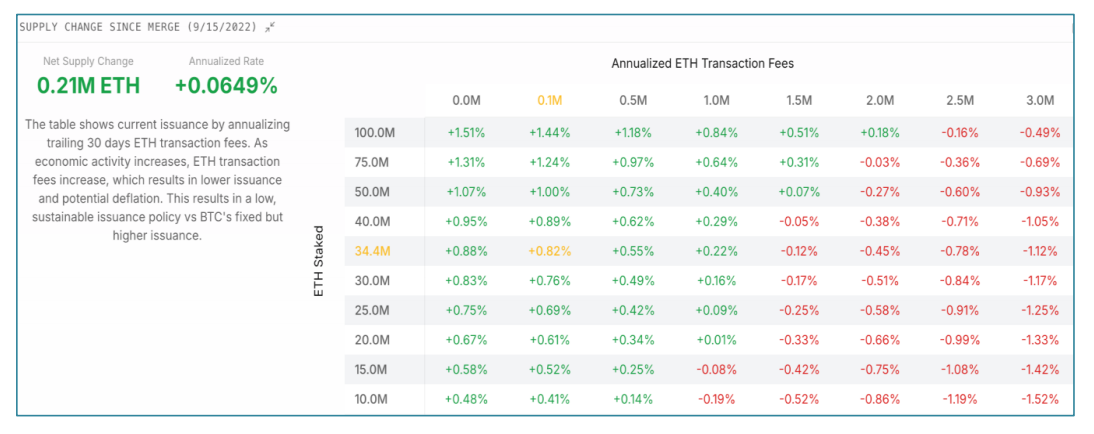

Therefore, modeling the net ETH issuance comes down to two core variables:

The number of pledged ETH determines the basic issuance volume that ensures network security.

Transaction fees based on ETH drive programmatic destruction mechanisms

Together, these two factors create a dynamic, self-regulated monetary balance. Under the theoretical upper limit, if 100% of ETH is pledged and no fees are incurred, the annual issuance will be limited to 1.51% ²¹. But in practice, activity on Ethereum offsets issuance through cost destruction, often pushing net issuance to zero or even negative values. As institutional adoption and the continued acceleration of demand for Ethereum block space, ETH's generation dynamics may shift structurally to sustained deflation.

Source: dashboard.etherealize.com

The supply and demand dynamics of ETH are simple and sustainable: ETH is digital oil with predictable and programmatic issuance formulas supplemented by a destruction mechanism directly linked to the actual usage of Ethereum.

supply

Unlike Bitcoin, ETH has no hard supply cap. Instead, Ethereum adopts a predictable, formula-based issuance strategy designed to achieve long-term sustainability and security. Bitcoin’s fixed cap of 21 million, although attractive as a narrative, can pose security risks. The entity that secures the Bitcoin network—i.e., miners—is compensated for newly minted Bitcoins and transaction fees. When Bitcoin reaches the supply cap and stops issuing new bitcoins as a reward, securing the network will become much less attractive to miners, potentially causing them to leave the network to find more profitable activities, making the Bitcoin network less secure. Ethereum will not face this problem.

The current supply of ETH is approximately 120.8 million pieces, with a theoretical maximum annual issuance cap of 1.51%²³. In fact, net supply growth is expected to be significantly lower and even deflation may occur as the increase in Ethereum network usage drives higher transaction fee destruction (as mentioned above).

Bitcoin has a supply cap. ETH has an issuance limit.

income

As mentioned earlier, ETH has pledge proceeds . Verifiers who stake ETH to ensure Ethereum network security will be compensated for the newly issued ETH. This benefit directly inspires cybersecurity, much like Bitcoin miners receive rewards by investing in hardware and consuming energy to ensure Bitcoin cybersecurity.

The underlying income earned by the validator is determined by Ethereum’s programmatic issuance (detailed above) and is supplemented by a portion of the transaction fees incurred by network activities. Therefore, as Ethereum economic activity expands, the benefits of validators will also increase. ETH is a unique asset: an increase in economic usage leads to more expenses, which can also reduce net issuances below the issuance ceiling (by expense destruction) and increase validator earnings. No other asset can combine these dynamics, making ETH a structurally attractive, collateral income digital asset.

Summarize

ETH's "digital oil" has economic characteristics complementary to BTC's "digital gold" and is more attractive in multiple dimensions: As the blockchain ecosystem flourishes, there will be multiple institutional-level digital assets. In a diversified crypto portfolio, ETH uniquely provides exposure to the growth of the entire digital economy.

Why does ETH lag behind BTC?

From September 2022 to the present, the ETH/BTC ratio has dropped from 0.085 to 0.024 - a drop of more than 70%. As measured by BTC, ETH currently trades at a low of 2018 – a level before the emergence of DeFi, massive adoption of stablecoins, and many of Ethereum’s proven use cases. At those lows in 2018, many investors had abandoned Ethereum altogether. However, today, Ethereum is the dominant institutional smart contract blockchain. So, how to explain this disconnection?

The answer is simple: Bitcoin’s narrative has been accepted by institutions, while Ethereum’s narrative has not yet .

After 15 years of market existence, Bitcoin has firmly established its position as an institutional-level asset. As a narrative of digital gold , a scarce reserve currency that resists the depreciation of fiat currencies, it has now been widely understood, mainstreamed and available for investment. This narrative clarity drives substantial revaluation and massive adoption of Bitcoin.

By contrast, Ethereum's value proposition is harder to define—not because it is weaker, but because it is broader. Bitcoin is a single-purpose store of value asset, while Ethereum is the programmable foundation that supports the entire tokenized economy.

Based on the core innovation of Bitcoin, Ethereum has expanded by adding smart contract functions, thus opening up use cases covering fields such as finance, tokenization, identity, infrastructure, gaming and artificial intelligence . Over the past decade, Ethereum has grown into a dominant world ledger, carrying most of the ³¹ tokenized assets, institutional activities and on-chain value.

As mentioned earlier, this makes ETH inherently more complex than BTC. This multi-dimensional practicality makes it harder to clearly classify ETH, so the market also priced it slower and less accurate. However, this complexity is a feature, not a flaw . ETH represents a completely new asset class that uniquely combines the monetary premium of gold, the productive returns of bonds, and the strategic practicality of oil.

Ethereum draws on Amazon's strategy to self-subvert through its Layer-2 Network (L2) roadmap in 2021-2022. Ethereum L1—the basic, initial Ethereum blockchain—has reached a bottleneck in popularity, with transaction speed limits leading to network congestion and high fees during peak hours. To improve scalability, the L2 chain is launched on top of L1, used to bundle and process multiple transactions off-chain, and then submit the summary of these transactions back to L1 for final settlement. You can think of L1 as the foundation layer of a highway system, while L2 is a fast lane or shared lane, helping to divert traffic faster without building a brand new highway.

L2s greatly improves Ethereum’s throughput and customizability, although initially at the expense of liquidity fragmentation and user experience complexity (these challenges are being solved quickly today).

Critics who narrowly evaluate crypto assets through discounted cash flow perspectives believe that L2s have siphoned the value of ETH. However, this view fundamentally misunderstands the true nature of the ETH value proposition.

ETH: Valuation Framework

Before quantifying the potential valuation scenario of ETH, we must first correct a generally misused valuation method: the discounted cash flow (DCF) model, which fundamentally misunderstands the true nature and value drivers of ETH.

ETH is not a tech stock ; it is a multi-purpose commodity asset that rivals physical oil, but has less elasticity in supply and is programmed to control through issuance caps. Valuations of oil, gold and Bitcoin are not based on cash flow, so ETH should not be evaluated based solely on income multiples . While DCF models based on future Layer-1 and Layer-2 fees can provide some insight, they ignore a bigger picture—these fees are driving demand for commodities like ETH. Since ETH issuance is capped by design, the growing ecosystem usage makes its price highly sensitive to supply and demand dynamics. In other words, fees alone represent only a small part of ETH 's valuation and significantly underestimates its wider commodity and currency characteristics .

Thinking of Ethereum's fees as traditional "income" fundamentally misunderstands their role. The ETH-denominated fee is primarily a basic industrial input—providing fuel and incentivizing validators for online transactions—rather than a profit stream denominated in USD. The true value of ETH stems from its unique productivity, robust store of value economics, and its key position as a neutral, original collateral in the Ethereum ecosystem.

This is not intended to downplay Ethereum's expense decline over the 2021-2022 period – although this decline is important for another reason. Although institutional adoption and tokenization reached record levels, revenue declines were precisely because Ethereum strategically disrupted itself to achieve mass popularity . Just as Amazon, Tesla and Uber deliberately sacrificed short-term profits to achieve global scale, Ethereum has also entered its own growth phase transformation, significantly reducing transaction fees through Layer-2 expansion. This strategy, while temporarily suppresses expense income, is structurally bullish: it ensures

The long-term popularity of Ethereum has expanded its total potential market on a large scale, and will ultimately amplify the cost destruction and pledge income of ETH.

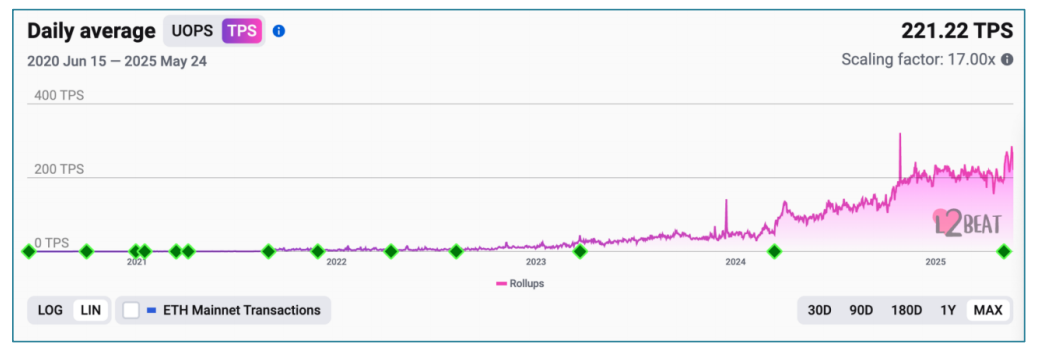

Source: https://l2beat.com/scaling/activity

Ethereum's throughput has increased by more than an order of magnitude since its market high in 2021, while its transaction costs have dropped significantly. The largest expansion breakthrough will be achieved in the next year, with some L2s expected to reach 100,000+ transactions per second.

If ETH is analyzed like tech stocks, these strategic expansion measures will be translated into orders of magnitude higher expected revenue, resulting in significantly higher intrinsic valuations. Adoption of Ethereum (and the broader blockchain) is still in its early stages, historically primarily restricted by regulatory uncertainty, which limits entry to institutions and consumers across the board. These barriers are rapidly eliminating today, paving the way for accelerated global adoption.

However, ETH is worth much more than fees and current and future revenue streams. ETH is digital oil that powers the world's ledger of assets, currencies and transactions. Like Bitcoin, ETH also has a significant store of value characteristics, with a currency premium far exceeding the valuation multiple based on income.

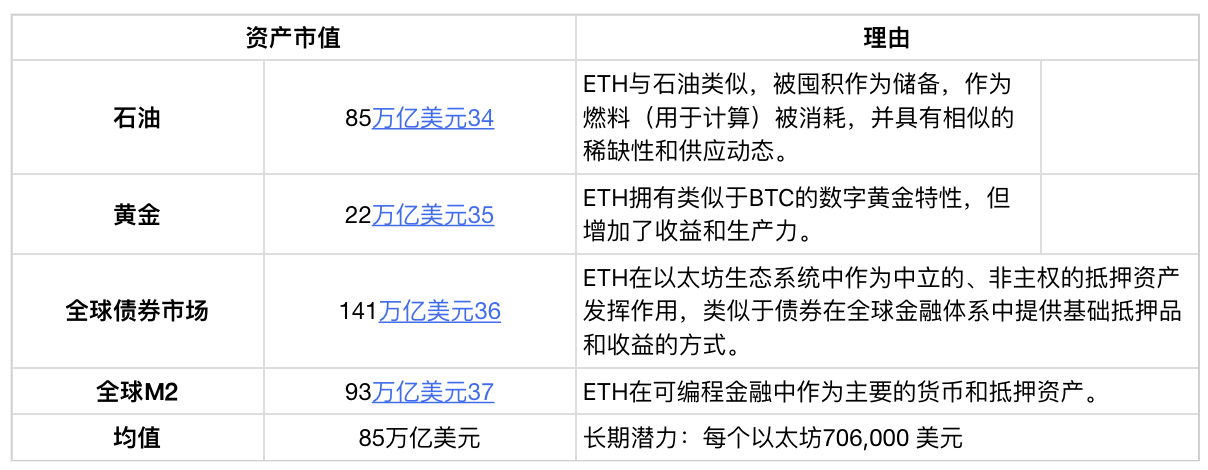

Instead of adopting the DCF model, we provide a comparable overall valuation framework for the long-term potential of ETH:

Oil Reserve Benchmark: Oil is a consumable commodity asset that is stored as a reserve and consumed as fuel. The total market value of proven oil reserves worldwide is approximately US$85 trillion³³²—which provides a meaningful reference point for ETH, given the scarcity of ETH, its capped dynamics and its key utility in the digital economy.

Asset tokenization benchmark: Global wealth totals approximately US$500 trillion³³. Even if conservatively assumes that Ethereum only tokenize 10% of global assets, Ethereum will carry more than $50 trillion in assets. In this scenario, ETH, which is a key asset in cybersecurity and settlement, will not stay at a valuation of US$300 billion.

Neutral, original collateral: ETH uniquely acts as a neutral, non- sovereign original collateral asset independent of external counterparties. It is essentially the safest and "risk-free" asset in the Ethereum economy, similar to the role U.S. Treasury bonds play in the U.S. economy—but with significantly greater upside potential.

Store of Value Economics: ETH reflects the core monetary characteristics of gold: low inflation, institutional reserve assets and non-sovereign currency premiums.

ETH Valuation Comparison: Compared with other global reserve assets

ETH represents a completely new asset class whose value drivers far exceed traditional equity-based cash flow. To accurately reflect the valuation potential of ETH as a global reserve asset, we must consider comparable global reserve assets as a benchmark.

Ethereum is the most tested and widely adopted ledger worldwide for tokenized assets, stablecoins and digital economic activities. Among digital assets, ETH uniquely provides investors with the highest upward opportunity to capture blockchain-driven finance, tokenization and global business growth.

As ETH is repriced as a global digital commodity and reserve asset, its valuation potential has become nearly unlimited. While long-term valuations of $85 trillion (approximately $706,000 per ETH) are possible worldwide, some medium-term valuation targets are as follows:

Short-term potential: USD 8,000 per ETH (about USD 1 trillion market capitalization)

Medium-term potential: US$80,000 per ETH (approximately US$10 trillion market capitalization)

Catalysts that drive ETH repricing

1. Rising demand: The institutional level has begun to adopt and deploy tokenized assets and financial infrastructure on Ethereum on a large scale.

2. The demand for native cryptocurrency income is accelerated: the pledged ETH ETF is about to be launched, and the emergence of the physical subscription/redemption model of institutions will greatly increase institutions' interest in ETH pledge income.

3. Strategic Hoarding of ETH: A competition is taking place within the Ethereum ecosystem to hoard ETH as a monetary premium value storage asset, which can be seen from the growing strategic ETH reserves (about $2.5 billion has been publicly disclosed).

4. ETH as an institutional funding asset: The unique characteristics of ETH—original collateral, neutrality, income and global utility—make it the preferred funding reserve asset for institutions and globally.

Ethereum: The infrastructure that drives ETH up

The first part of this report focuses on ETH as a unique digital commodity (combining scarcity, utility and benefits), but its long-term value cannot be fully understood without examining the infrastructure it empowers. Ethereum is not just the background of ETH; it is the basic platform that makes ETH's utility indispensable and its monetary design structure sustainable.

Ethereum has become the most important infrastructure layer in the digital economy. It is the location of tokenized assets, the location of decentralized financial applications, and the location of increasingly occurring institutional settlements. Ethereum has become the default platform for stablecoins, high-value tokenized assets and institutional blockchain infrastructure. Today, more than 81% of tokenized assets exist within the Ethereum ecosystem. Its resilience, trustworthiness neutrality and programmability make it the only platform that supports the future complex, programmable and globally scalable financial services and a broad economic base.

This section explores why Ethereum is uniquely suited to support the next era of financial and digital economy. We examine its architectural advantages, latest breakthroughs in scalability, improvements in user experience, and accelerated migration of institutions to their Layer-2 ecosystem. We will also explore what we believe will be the next major catalyst for the Ethereum network, which, if implemented, will make Ethereum more than just the underlying layer of future finance: the convergence of Ethereum with AI-driven autonomous agents. In such a future, Ethereum will not only be a financial infrastructure, but also a backbone of machine-native economic coordination.

In short, the value of ETH is a function of Ethereum's growing centrality in the digital economy. As Ethereum adoption grows in a compounded manner, so does its demand and strategic importance of native assets. Therefore, understanding the trajectory of Ethereum is crucial to understanding the full scope of ETH investment potential.

Why is Ethereum unique as a financial infrastructure

Advantages

For ETH's long-term success, Ethereum must be recognized by institutions as a legitimate financial infrastructure and an undisputed leader in institutional- level blockchains.

As institutional investors increasingly recognize the limitations of existing financial infrastructure, Ethereum’s capabilities—its security, stability, scalability, programmability, decentralization and trustworthiness—make it the most likely platform to carry the global financial system in the future.

Proven uptime and resilience: Ethereum has never been offline since its launch in 2015, and it has undergone major agreement upgrades such as "mergers" and have not been interrupted. More than 10 independent client implementations further enhance their redundancy and robustness. All of this highlights its ready state as an institutional-level infrastructure.

Trusted neutral infrastructure: Ethereum is managed purely by transparent, auditable code-free from company interests, political pressures, or centralized personality. This credibility neutrality ensures fairness, predictability, and eliminates counterparty risk.

大规模去中心化: 以太坊的验证者集合全球分布,任何人只要有基本硬件和互联网连接即可访问。其安全性源于去中心化和多样性,而非中心化的数据中心或特权利益相关者。

无与伦比的市场份额: 以太坊生态系统承载了所有稳定币的60%³⁹和代币化真实世界资产(RWA)的82%40,包括代币化国债和信用工具。大多数基于区块链的金融活动已存在于以太坊上41。

高价值结算层: 以太坊目前在其生态系统中保护着超过7670亿美元42的总锁定价值(TVS)。随着全球金融越来越多地迁移到链上,预计这一数字将显著加速增长。

最安全的开发者工具: 以太坊虚拟机(EVM)在其在更广泛的加密生态系统中的受欢迎程度和采用率方面类似于JavaScript。它已被充分理解,并在过去十年中通过无数高价值的金融应用进行了实战测试。

透明度 : 完全开源的协议和代码,数据可公开审计。

可扩展性: 明确定义了性能增强和扩容解决方案的路线图,这将使以太坊能够处理真正全球规模的交易和使用。

定制环境: 模块化、隔离式解决方案,专为机构定制设计——包括隐私、KYC合规、定制燃气模型、数据可用性以及专业执行环境。

安全性: 强大的权益证明(Proof-of-Stake)共识机制,通过经济削减机制得到强化,并通过验证者客户端多样性得到巩固。

中立性 : 没有中心化的基金会或特权/补贴的验证者集合。以太坊既是全球性的,也是无需许可的,在基础设施层面消除了交易对手风险。

可编程性: 原生、高度可组合的智能合约功能,由最丰富、最久经考验的开发者和安全工具生态系统提供支持。

监管成熟度: 以太坊是全球机构实体和监管机构最广泛采用、法律上最被理解的区块链。

最小环保足迹: ETH的环保足迹接近于零(每笔交易约0.01千克二氧化碳)43。

以太坊不仅仅是一个去中心化的账本;它是一个机构级的公共基础设施。凭借其可信中立性、经证实的韧性、成熟的监管地位和长期路线图,它是唯一能够作为全球金融系统基础架构的区块链。

为什么以太坊正在进入它的复兴期

以太坊的根本优势长期以来一直被低估,其架构、去中心化和开发者生态系统默默地推动着加密领域的大部分有意义的创新。现在,经过多年的默默耕耘和专注开发,这个生态系统正经历一系列复合式利好,这些利好共同作用,有望将以太坊推向聚光灯下,并推动其快速普及。

对于ETH而言,这场复兴不仅仅是背景——它是一个催化剂。ETH的价值与以太坊的实力、使用量和机构信任度直接相关。随着以太坊变得性能更优、更直观、更深入地融入全球金融体系,对ETH作为燃料、抵押品和战略储备资产的需求将加速增长。

接下来将探讨定义以太坊复兴的结构性改进和生态系统转变——以及为什么它们将使ETH在未来数月和数年内迎来戏剧性的重估。

- 更具协调性和前瞻性的生态系统

以太坊诞生于一个充满监管不确定性的环境,创新常常面临阻力,知名度也伴随着风险。作为少数与比特币一样真正去中心化的区块链之一,以太坊有意地将中立性、安全性和抗审查性置于速度或积极推广之上。因此,多年来,以太坊基金会一直强调研发,而非市场营销和机构合作。

这种做法现在正在发生显著转变。 随着监管清晰度的提高,以太坊社区已采取了更具前瞻性的姿态。尽管没有单一实体管理以太坊,但以太坊基金会的新领导层——联席执行董事Tomasz Stanczak 和Hsiao-Wei Wang——正在明确并清晰地沟通协议的技术路线图。在他们周围,由经验丰富的构建者、知名基金和重要基础设施提供商组成的多样化联盟正在联合起来,积极提升以太坊的知名度和战略相关性。

- 以太坊Layer 1正在扩容——不牺牲去中心化

历史上,以太坊的扩容策略主要侧重于Layer-2解决方案。如前所述,L2是旨在减少以太坊Layer 1流量、提高交易吞吐量并帮助将费用维持在合理水平的独立链。

之所以采用这种方法,是因为L1的直接扩容此前曾有损以太坊核心原则——即基础层的可信中立性和去中心化安全性。然而,最近的突破,例如生产级零知识虚拟机(zkVMs)以及像FOCIL这样的创新研究项目,已经开辟了新的可能性,使得Layer-1能够实现显著的性能提升,而不会损害去中心化或安全性。

以太坊现在正朝着两个方向同时进行扩容:L1的垂直扩容和L2的水平扩容。这些进展已经超越了理论阶段;L1的增强功能正在积极开发中,预计将于2025年部署。其结果将是

一个性能显著更高的基础层,作为经济活动的中心枢纽,并辅以继续扩展以太坊可扩展性和全球覆盖范围的L2网络。

- 以太坊L2比竞争性L1更快、更便宜、互联性更强

以太坊L2生态系统以非凡的速度扩张,形成了一个充满活力、模块化的高性能链网络,它们都锚定于以太坊的安全性与经济性。这种灵活的架构已经吸引了显著的机构采用,德意志银行(通过zkSync和Memento)、索尼(通过Soneium)、瑞银、Coinbase(通过最大的L2 Base)、Kraken(通过Ink)以及World Chain(由OpenAI的Sam Altman联合创立)等全球主要实体都在积极部署或开发定制化的L2解决方案。

最初的快速增长导致了碎片化,因为每个L2独立运行,给整个生态系统带来了摩擦。现在,这一挑战正在被果断解决。新一代的互操作性标准正在陆续推出,将这些Layer-2链重新连接成一个有凝聚力的以太坊体验。

结果将是一个统一、无缝的生态系统——它将保留以太坊Layer 1强大的安全保障,同时提供与竞争性Layer-1区块链相当或超越它们的性能和成本优势(因为L2使用以太坊来确保安全,而非从头开始重建)。随着互操作性协议和抽象化钱包体验的全面部署,以太坊将再次像一条单一、统一的链一样运行和感觉。

- 以太坊的用户体验正在进入其金融科技阶段

以太坊历史上最重要的变革之一并非纯粹技术性的——它是体验性的。在过去十年中的大部分时间里,与以太坊的交互涉及笨拙的界面、冗长的24个单词助记词,以及在摩擦和风险之间做出不舒服的权衡。那个时代正在迅速走向终结。

2025年5月,以太坊引入了原生账户抽象(Account Abstraction),这是其迄今为止最具雄心的用户体验全面改革。账户抽象解锁了重大增强功能,包括基于生物识别的交易(例如,面容ID)、与安全硬件飞地(例如,iPhone中内置的那些)的无缝集成以进行原生密钥管理,以及社交恢复等高级智能钱包功能。以太坊终于开始模仿现代互联网的无缝体验——直观、安全,对终端用户几乎隐形。

- 机构采用不再是假设,它正在加速

以太坊的架构——在基础层去中心化,在应用层可定制——是专为机构采用而构建的。这一设计已被证明具有先见之明。如今,以太坊已成为代币化资产的主要目的地44,吸引了绝大多数在以太坊Layer 2上构建的机构级区块链部署。

从资产管理公司代币化国债和信贷市场,到银行部署结算基础设施,以太坊已成为这些应用的 事实标准 。这种采用并非巧合;它是结构性的。以太坊独特地提供了在全球范围内运营的机构所需的 监管 中立性 、安全保证和可组合性 。领先的代币化倡议已明确选择以太坊作为其基础基础设施。45超过**102亿美元46(约占82%)**的所有非稳定币代币化资产,包括国债、信贷市场和附息基金,已由贝莱德、摩根大通、富兰克林邓普顿、富达、阿波罗、德意志银行、瑞银和索尼等全球领先机构在以太坊上发行。47Coinbase 和其他主要交易所正在积极部署直接集成到以太坊安全层和经济中的定制化Layer-2 区块链。

然而,这股机构浪潮仍处于早期阶段。以太坊的基础设施终于成熟,监管环境正在迅速演变,机构需求持续加速。以太坊正接近其“ChatGPT时刻”——主流机构突然普遍意识到,以太坊最适合为未来的数字基础设施提供动力。

- 监管 清晰度 即将到来

近十年来,以太坊一直处于持续的监管不确定性之下。在美国,在以太坊上进行开发所伴随的 声誉、财务和法律风险巨大 ,这 扼杀了创新并使机构资本却步 。以太坊代币(ETH)本身也一直处于监管模糊状态, 持续面临被归类为证券的风险 。因此,尽管以太坊拥有技术优势,但有意义的机构采用却被推迟了。

然而,监管格局正在转变。 美国政府在2018年 48 确认并将以太坊视为一种商品而非证券 ,并在 2024年重申了这一决定 。49 2024年5月,现货以太坊 ETF 获得批准 ,这使得ETH在传统金融机构眼中获得了合法地位。 2025年,美国政府表示打算实施一个明确的数字资产法律处理框架 ,这很可能进一步重申以太坊已获批准的监管地位,并增加机构使用区块链的信心。

机构的信心水平已经开始迅速提升,其证据是 越来越多的机构公开将其资产转移到链上 ,这表明他们不担心这样做会使他们站在监管机构的对立面。

- 逆向资本正在涌入——ETH 是被错误定价的核心资产

尽管以太坊的采用指标达到了新高,但ETH 本身仍然被严重低估和低配。在过去两年中,尽管有明确证据表明以太坊平台占据主导地位、机构信任度不断提高以及具有实质性的经济效用,但ETH 的表现却落后于比特币(BTC)。这种脱节提供了一个难得的投资机会。

精明的资本正开始注意到这一点。ETH 目前提供了不对称的上涨潜力:它是一种流动性高、可生息、机构级别的资产,却因散户叙事和传统估值框架而被错误定价。对于逆向投资者而言,ETH 代表了一个引人注目的、高确定性的价值重估机会——类似于2022 年的AI、2020 年的BTC,或是2009 年初的科技股。

ETH 是驱动数字经济的“数字石油”。随着以太坊机构采用的加速,ETH 的价值也将随之增长。市场尚未将这种快速的采用曲线计入价格,这为投资者提供了一个绝佳的入场点。

以太坊与人工智能:自主经济的引擎

前一节概述的市场驱动因素已经为以太坊——以及因此的ETH——在近期内实现突破做好了准备。然而,如果我们将时间范围再放远一些,有一个未来的催化剂,如果它能实现,将使ETH 成为全球最受欢迎的资产之一,甚至是最受欢迎的资产:人工智能和数字金融的融合。

当今流入人工智能的资本量堪比人类历史上最宏大的基础设施项目。以今天的美元计算,阿波罗登月计划耗资约2000 亿美元,美国州际公路系统耗资约6000 亿美元。相比之下,私营部门在人工智能领域的投资已经 达到万亿级别 ,并且正在加速。

仅在2024 年,英伟达(NVIDIA)就创造了1300 亿美元的收入。 ·

Meta 在2025 年为其Llama 模型分配了650 亿美元。

微软正在投资800 亿美元用于人工智能基础设施、训练和部署。

苹果公司宣布在四年内投入5000 亿美元,用于与人工智能相关的史无前例的投资

这种资本的涌入正在重塑电网、计算基础设施以及软件本身的能力。这场演变的核心是一个新范式: 自主 AI 代理的崛起 ——这些智能的、自我导向的软件实体能够与世界互动、执行复杂任务并与其他代理协调。

随着AI 代理变得越来越复杂,它们将需要可编程的货币、嵌入式金融服务和原生的数字所有权框架。它们将需要即时地在全球范围内进行交易、结算支付和执行合约,而无需依赖传统的人类中介。

以太坊:为自主代理构建的基础设施

以太坊在支持新兴的自主数字经济方面具有独特的优势,它提供了传统金融甚至其他区块链根本无法复制的能力:

最终性和执行保证 :以太坊的原子化、可组合的交易结构使AI 代理能够无缝执行复杂的金融交互,这是传统结算系统无法支持的。

全球 财产权 ,而非管辖权主张 :以太坊的智能合约通过代码而非法庭来强制执行财产权。AI 代理可以安全地跨境交易,没有管辖权的摩擦和复杂性。

无需许可的金融 :以太坊提供对稳定币、代币化资产、DeFi 协议、预言机服务、身份系统等的原生访问,所有这些都具有机构级的流动性和安全性。

可编程性和速度 :与以太坊交互的AI 代理可以即时部署、升级和触发复杂的金融逻辑,这模仿了人类的决策过程,但以计算的速度运行。

以太坊的工具链:Agent开发与协作平台

除了其金融功能之外,以太坊还提供了一个强大且成熟的工具链,完美地设计用于自主AI 代理的创建、部署和协调:

去中心化数据策展和治理 :用于管理数据集、治理和代理演进的透明、基于协议的系统。

代币化框架 :内置的机制,通过代币化模型和资产定义所有权、分配版税和筹集资金。

模型训练市场 :市场驱动的平台,将特定领域数据转化为高质量、精细调优的AI 模型。

代理托管市场 :简化代理部署和操作的基础设施市场,无需私有基础设施。

至关重要的是,基于以太坊的代理并非孤立存在。一旦部署,这些自主代理可以原生发现、相互通信和相互补偿,形成能够进行复杂实时协作的去中心化代理网络。这种自主代理网格将使各种应用成为可能,从自主物流和交易到个性化医疗保健、教育等——而ETH 将作为通用的交换和协调媒介。

看涨ETH的理由

以太坊有望成为支撑全球经济的基础设施。如果这一点得以实现,数万亿甚至数十万亿美元的资产最终将在以太坊的Layer-1 和Layer-2 网络上进行代币化,从而在全球范围内释放前所未有的效用、创新和金融可及性。

以太坊已经处于领先地位,并且随着其作为全球记录账本的角色日益巩固,其领先优势将继续扩大。以太坊对去中心化、安全性、可靠性和正常运行时间的战略性强调,使其能够稳步获得全球采用,刻意避免了“快速行动并打破常规”心态的陷阱。

ETH 本身代表了一种全新的资产类别。尽管石油因其全球经济效用和战略重要性而提供了最接近的经典类比,但即使这种比较也未能充分展现ETH 的全部潜力。

ETH 的供应通过发行上限进行程序化控制,并由一个全球性的去中心化网络进行保护。ETH 是一种理想的生产性价值储存资产。这些属性将不可避免地导致供应大幅紧缩,因为机构将竞相囤积ETH 作为国库级储备资产。

以太坊目前在机构区块链采用方面占据主导地位,但ETH 仍然是一种逆向投资。随着金融行业意识到以太坊无与伦比的机构吸引力,ETH 将迅速重新定价至其真实估值。

ETH 是数字石油,为全球金融系统和更广泛的数字经济提供动力。以太坊及其原生资产ETH 正在进入其复兴时期,为具有前瞻性思维的投资者创造了一个引人注目的机会。

introduction

1这个最大通胀率是针对当前供应量而言的;由于通胀是供应量的函数,因此随着供应量的增加或减少,该值会反向波动。

2数据来源ultrasound.money(更改时间范围以从合并时开始计算)。

3尽管质押ETH与活跃的验证者服务相结合可以产生收益——有时被描述为使ETH成为一种“生产性”的价值储存——但这种动态类似于黄金在被借出或作为抵押品时获得收益;在这两种情况下,并非底层商品本身具有固有的生产性,而是围绕该商品建立的外部服务活动。ETH的核心估值仍由其作为稀缺货币商品的作用驱动,而非通过折现现金流模型。

4数据来自(ETH in DeFi) andvalidatorqueue.com(ETH staked); Breakdown graphic + script

5数据来自api.llama.fi/tokenProtocols/ETH((链和桥接合约中的ETH 总量/ ETH 总供应量); Breakdown graphic +script

6数据来自defillama.com/fees/ethereum(从2021年8月6日至2025年5月9日,即销毁机制实施期间,总销毁量[123.88亿美元] 除以总费用[154.01亿美元])

7这个最大通胀率是针对当前供应量而言的;由于通胀是供应量的函数,因此随着供应量的增加或减少,该值会反向波动。

8L1 总锁定价值(TVS)来自defillama.com/bridged/ethereum;L2 总锁定价值(TVS)来自growthepie.xyz/fundamentals/total—value—secured(选择所有L2);L2 现实世界资产(RWA)来自app.rwa.xyz/networks(未计入其他数值),ETH 市值。

9数据来自defillama.com/yields(以太坊L1及排名前9的L2上使用ETH或ETH衍生品的总交易对)

10战略ETH储备https://www.strategicethreserve.xyz/BTCS Inc. https://www.btcs.com/wp—content/uploads/2025/05/Convertible—Note—May—14—2025—vF.pdf

来源:strategicethreserve.xyzbyFabrice Cheng

11数据来自validatorqueue.com,以ETH现货价值2,600美元计算。

12860,000,000 TH/s/500 TH/s= 1,720,000 台* $4791/台= $8.24亿美元

13数据来自ultrasound.money(更改时间范围以从合并时开始计算

14数据来自etherscan.io/chart/ethersupplygrowth

15这个最大通胀率是针对当前供应量而言的;由于通胀是供应量的函数,因此随着供应量的增加或减少,该值会反向波动。

16数据来自validatorqueue.com

17数据来自ultrasound.money

18数据来自ultrasound.money(更改时间范围以从合并时开始计算)

19数据来源于ultrasound.money(30天时间范围)

20数据来自defillama.com/fees/ethereum(总销毁量[$12.388B] 除以总费用s [$15.401B] 时间范围为2021年8月6日至2025年5月9日,即销毁机制实施期间)

21这个最大通胀率是针对当前供应量而言的;由于通胀是供应量的函数,因此随着供应量的增加或减少,该值会反向波动。

22数据来源etherscan.io/chart/ethersupplygrowth

23这个最大通胀率是针对当前供应量而言的;由于通胀是供应量的函数,因此随着供应量的增加或减少,该值会反向波动。

24数据来源ultrasound.money(30天时间范围)

25数据来源charts.bitbo.io/inflation

26ETH vs. BTC: 以太坊的卓越货币特性yyoutube.com/v/skcZbXitZxQ

27数据来源defillama.com/fees/ethereum总销毁量[12.388亿美元] 除以总费用[15.401亿美元] 时间范围为2021年8月6日至2025年5月9日,即销毁机制实施期间)

28需要运行一个以ETH作为抵押品的验证者节点;为网络提供验证服务可以类比为石油公司为石油行业提供服务。

29以太坊数据来自digiconomist.net/ethereum—energy—consumption

30比特币数据来自digiconomist.net/bitcoin—energy—consumption

31代币化资产主要存在于以太坊生态系统(占82%)rwa.xyz/networks

32储量数据来自worldometers.info/oil, 每桶价格来自marketwatch.com/investing/future/cl.1

33数据来自McKinsey

34储量数据来自worldometers.info/oil,每桶价格来自marketwatch.com/investing/future/cl.1

35数据来自companiesmarketcap.com/gold/marketcap

36数据来自techsciresearch.com/report/bond—market/27048.html

37数据来自streetstats.finance/liquidity/money

38数据来自app.rwa.xyz/networks(以太坊L1 + L2s)

39以太坊系统稳定币总量数据来自growthepie.xyz(选择“总生态系统”,选择“所有网络”,并选择“堆叠图表”),稳定币总量数据来自app.rwa.xyz/stablecoins

40数据来自app.rwa.xyz/networks(以太坊L1 + L2s)

41使用以太坊的高知名度实体ethereumadoption.com/built—on—ethereum/

42L1 TVS(总锁定价值)来自defillama.com/bridged/ethereum;L2 TVS 来自growthepie.xyz/fundamentals/total—value—secured(选择所有L2s);L2 RWAs数据来自app.rwa.xyz/networks(未计入其他值)

43数据来自https://digiconomist.net/ethereum—energy—consumption

44资产可在app.rwa.xyz/networks/ethereum上找到。

45app.rwa.xyz/networks

46数据来自app.rwa.xyz/networks(以太坊L1 + L2s)

47主要实体正在以太坊上进行建设,来自ethereumadoption.com

48SEC.gov | Digital Asset Transactions: When Howey Met Gary (Plastic)

49Federal Court Finds Ether Is a Commodity in CFTC Fraud Case |PracticalLaw

chaincatcher

chaincatcher