8% of Bitcoins are purchased by institutions who are holding huge amounts of Bitcoin

転載元: jinse

05/03/2025·16D

When it comes to the values of the crypto world, the concept of decentralization is the most well-known. Tracing the origin, the emergence of cryptocurrencies comes shortly after Lehman Brothers went bankrupt. In the context of the turbulent global currency crisis, Satoshi Nakamoto proposed the concept of decentralized currency, and Bitcoin emerged, laying the foundation for the value belief in the crypto world. In the next decade, around decentralization, the crypto ecosystem has been continuously expanded and expanded, and value beliefs and technological beliefs have gone from controversy to unification, and from unification to dispersion, and have developed in the theory of value and price. But no matter how controversial it is, Bitcoin is the most strong value pillar in the crypto world. From miners to mines, from capital to institutions, despite the constant changes surrounding the so-called "bankers" of Bitcoin, the market firmly believes that no one can own more than 51% of Bitcoin, and they also recognize it as a successful demonstration sample of decentralized currencies.

But in recent years, decentralized currencies seem to have returned to the centralized context. Starting from 2020, Wall Street institutions and listed companies have started the Bitcoin purchase craze. Last year, Bitcoin spot ETFs were listed, and now, the establishment of the US Bitcoin strategic reserves shows that institutional investors, listed companies, and even countries have begun to hold a large amount of Bitcoin. This move has both advantages and disadvantages. The advantage is the rise in prices. The injection of liquidity successfully pushed Bitcoin to $100,000, which not only left a strong mark in the history of cryptocurrency, but also truly gave the diamond hands glory. Compliance makes holders’ threshold higher, cryptocurrencies have entered the mainstream for the first time, speculators have also turned gorgeously into value investors, and by the way they have been labeled as emerging asset holders.

But the disadvantages are also obvious. Miners are moving behind the scenes, the linkage between the crypto market and the US stock market is becoming increasingly close, independent markets are difficult to find, and the macro economy is stimulating the fragile nerves of the market. The current market interprets this very well. Everyone's focus is either on the tariff war or discussing the US interest rate cut, or on the list of research on the inflows and outflows of ETFs, and the priority of technological progress is constantly recursive. Compliance and regulation have not made the crypto market shine brightly. Instead, they have let the president take the opportunity to cut the first leeks. The family MEME storm continues, and Defi and chain games must also be grasped.

Combining the above, questions are also emerging, who holds the most Bitcoin? Is the growing growth of institutional investors a good thing for Bitcoin? As more and more BTC is locked in cold wallets, Treasury bonds and ETFs, is on- chain data losing reliability? Regarding this issue, Bitcoin Magazine reporter Matt Crosby also conducted research, and translated his report here to explain whether Bitcoin’s decentralized spirit is truly at risk or is simply evolving.

New whale

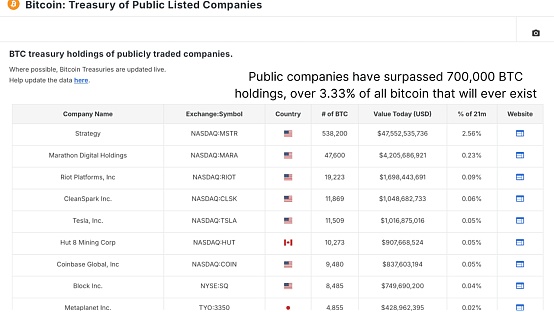

Let’s start with the financial data of listed companies . In terms of data, large listed companies including Strategy and MetaPlanet have accumulated more than 700,000 BTC in total. Strategy is a well-deserved leader among them. As of April 21, 2025, Strategy held 538,200 Bitcoins, with a total purchase cost of approximately US$36.47 billion and an average price of approximately US$67,766. In the past six months, it has acquired 379,800 BTC . Considering that the total supply of Bitcoin is 21 million, this accounts for about 3.33% of the total supply of BTC in the future. Although this supply cap cannot be reached in the current life of holders , it reflects obvious: listed companies are making long-term bets.

Figure 1: Listed companies have the highest BTC holdings

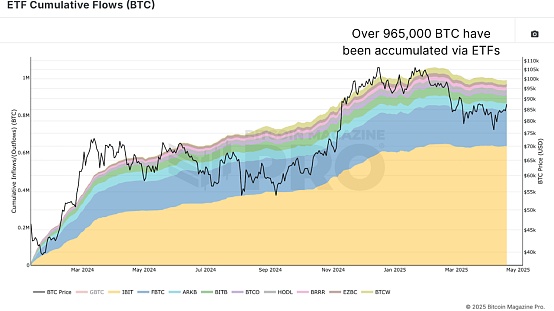

In addition to the Bitcoin directly held by enterprises, it can be seen from the EFT cumulative traffic (BTC) chart that ETFs also occupy a considerable share . As of this writing, the spot Bitcoin ETF holds approximately 965,000 BTC, slightly below 5% of the total supply. This digital fluctuation is relatively limited , but it is still the main force affecting daily market dynamics . Taking BlackRock as an example, according to BlackRock data, the IBIT fund was launched simultaneously with 10 other US spot Bitcoin ETFs in January 2024, and its current net assets are approximately US$53.77 billion. In the past 30 days, the fund's average daily trading volume reached 45.02 million shares. If corporate treasury bonds and ETF holdings are combined, the number will climb to more than 1.67 million BTC, accounting for about 8% of the total theoretical supply , but this data is still more than that.

Figure 2: ETFs stimulate institutions' interest in BTC

In addition to Wall Street and Silicon Valley, some regional and national governments are now widely active in the Bitcoin field. Through reserves such as sovereign purchases and strategic Bitcoin reserves, regions and countries hold a total of about 542,000 Bitcoins. Adding to previous institutional holdings, it can be concluded that institutions, ETFs and governments hold more than 2.2 million Bitcoins. On the surface, this accounts for about 10.14% of the total Bitcoin supply 21 million.

Forgotten Satoshi and the lost supply

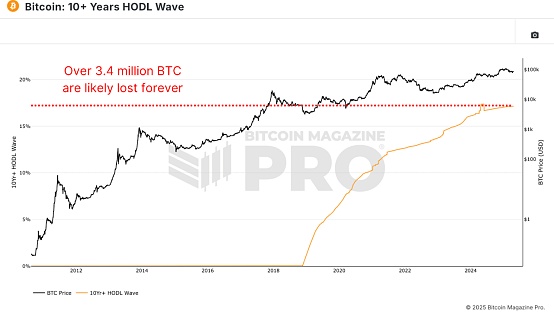

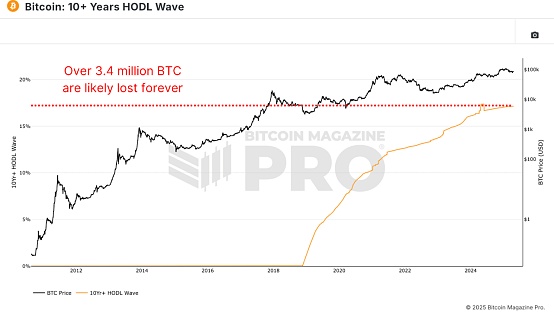

In fact, not all 21 million BTC can be accessed and tracked . According to estimates of the "10+ years of HODL Wave" data, which measures currencies that have not been moved in a decade, more than 3.4 million BTC may have been lost forever , including Satoshi's wallet, currency from the early mining era , forgotten passwords , and even USB drives in landfills .

Figure 3: The number of lost BTC can be imagined to exceed 3.4 million

Currently, there are about 19.8 million BTC in circulation , and about 17.15% of it is expected to be lost, so the actual supply is close to 16.45 million. This completely changed the current balance , and the proportion of BTC held by institutions rose to about 13.44% in terms of more practical supply . This means that about 1 of every 7.4 BTC on the market has been locked by institutions, ETFs or sovereign states.

In this context, are institutions sufficient to control Bitcoin?

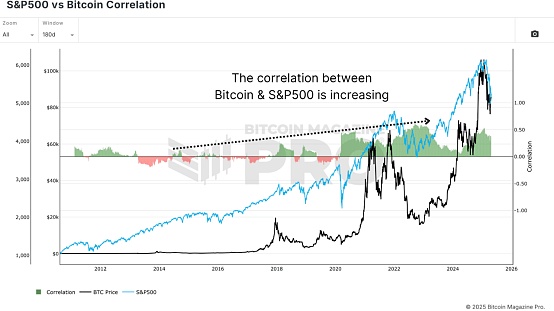

Fortunately, judging from the data, there is no such trend yet . But this does show that its influence is growing, especially in terms of price behavior . Judging from the correlation chart of the S&P 500 index and Bitcoin, the correlation between Bitcoin and traditional stock indices such as the S&P 500 index or the Nasdaq has been significantly enhanced. As these large entities enter the market, BTC is increasingly seen as a "risk-favorite" asset, meaning that its prices tend to fluctuate with changes in investor sentiment in traditional markets.

Figure 4: The increasing correlation between Bitcoin and the S&P 500 index

This will be relatively favorable in a bull market , and Bitcoin is now expected to attract larger inflows than ever when global liquidity expands and risky assets perform well, especially as pensions, hedge funds and sovereign wealth funds begin to allocate their portfolios, even if only a small percentage. But there is also a trade-off in this , and as institutions adopt further, Bitcoin’s sensitivity to macroeconomic conditions will increase. Central bank policies, bond yields and stock volatility are all starting to become more important than ever.

Despite these changes, more than 85% of Bitcoin still remain uninvested by institutional investors. Retail investors still hold the vast majority of Bitcoin supply. ETFs and corporate vaults may have stockpiled a lot of bitcoin in cold wallets, but the market remains highly decentralized. In this regard, some industry critics believe that the use of on-chain data is weakening. After all, if so much BTC is locked in ETFs or idle wallets, can we still draw accurate conclusions from wallet activities? Although this kind of worry is not groundless, it has not appeared recently.

New adaptation

Historically, most of Bitcoin’s trading activity has taken place off-chain, especially on centralized exchanges such as Coinbase, Binance and formerly FTX. These transactions rarely appear on the chain in meaningful ways, but still affect prices and market structure. Today, the market is facing a similar situation, but with better tools. ETF capital flows, company filings, and even state purchases are subject to information disclosure regulations. Unlike opaque exchanges, these institutional participants often have to disclose their positions, which provides analysts with a lot of tracking data.

In addition, on-chain analysis is not static. Tools like MVRV-Z ratings are constantly evolving. By narrowing the focus to the 2-year rolling average of MVRV Z scores instead of full historical data, current market dynamics can be better captured without being affected by long-term lost tokens or inactive supply.

Figure 5: More targeted 2-year rolling MVRV Z scores can better capture market dynamics

in conclusion

All in all, institutional investors' interest in Bitcoin has risen unprecedentedly. Bitcoin has over 2.2 million holdings between ETFs, corporate bonds and sovereign entities, and this number is growing . During a period of weak markets, this influx of funds undoubtedly played a role in stabilizing prices. However, this stability also brings some entanglement. Bitcoin is increasingly connected to the traditional financial system, and its correlation with stocks and broader economic sentiment is growing.

This does not mean that the era of Bitcoin’s decentralization or on-chain analytics is over. In fact, as more and more Bitcoins are held by recognizable institutions, the ability to track the flow of funds will become more accurate. Retail investors still dominate, and the analysis tools on and off- chain are becoming smarter and responding to market changes more sensitively. The spirit of Bitcoin’s decentralization is not threatened, it is just maturing. As long as the analysis framework and Bitcoin can keep pace with the times and develop together , it will inevitably be able to cope with the corresponding challenges in the future.

panewslab

panewslab